US financial crisis; global recession deepens

The financial crisis in the United States which started with the

crisis in the sub prime lending market, nearly a year ago deepened last

week.

On Monday, the financial crisis toppled the giant US investment bank

Lehman Brothers threatening the survival of the world’s biggest

insurance company AIG.

After US Federal Reserve Bank pumped $85 billion to rescue the AIG,

the risk of the worldwide recession deepened and by Wednesday

selling-off spread to Asian markets. Panic-stricken investors started to

sell shares and buy bonds, gold, oil and other commodities.

“It’s panic, investors were running for cash and assets such as

Treasuries that they thought would be safe. Markets in Asia were pricing

in “pretty extreme scenarios” that matched the crash of October 1987.

|

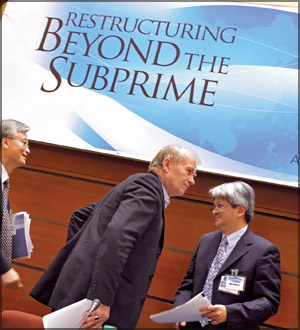

Financial experts (from L) Yoon Je Cho of South Korea’s Sogang

University, Charles Adams of the National University of

Singapore and former International Monetary Fund (IMF) official

and Chee Sung Lee, IMF Asia-Pacific regional director arrive at

the Asian Development Bank (ADB) forum in Manila on Thursday to

discuss the current turmoil in the international financial

markets. Experts warned that Asia could get hit hard by the US

financial crisis despite limited direct exposure to instruments

linked to sub-prime mortgages. AFP |

“That’s within the memory [of many people in the market]. If it’s out

of memory, then there are no guideposts,” according to the Financial

Times quoting Malcom Wood, Asia-Pacific equity strategist for Morgan

Stanley in Hong Kong.

Market analysts said that the $85 billion Fed injection to rescue AIG

failed to curb the surge in risk aversion and markets were hit by a

fresh wave of anxiety.

One cause for fear came when shares in a supposedly safe money market

mutual fund fell below par value.

All thought that profit was abandoned as traders piled into the

safety of short-term Treasuries, with the yield on three-month bills

falling as low as 0.02 per cent - rates that characterised the “lost

decade” in Japan.

The last time US Treasuries were this low was in January 1941.

(Financial Times UK )

The crisis has already hit the world’s largest companies. Share

values of Morgan Stanley and Goldman Sachs, the two largest independent

US investment banks fell 24 per cent and 14 per cent as the cost of

insuring their debt soared, threatening their ability to finance

themselves.

HBOS, a leading UK mortgage lender pressed into sales talks by the

government after its share price halved this week, agreed to a £12bn

takeover by Lloyds TSB.

The Federal Reserve, working with central banks in Europe, Canada and

Asia, pumped as much as $180 billion into money markets on Thursday to

combat a seizing up of lending between banks that is intensifying the

global financial crisis.In a statement, the Fed said it had authorised

the expansion of swap lines, or reciprocal currency arrangements, with

other central banks, including amounts up to $110 billion by the ECB and

up to $27 million by the Swiss National Bank.

The Fed also said new swap facilities had been authorised with the

Bank of Japan for as much as $60 billion; $40 billion for the Bank of

England and $10 billion for the Bank of Canada.

The Fed action increased lines of cash to central banks by $180

billion to $247 billion.

It was the latest chapter in the worst financial upheaval since the

Great Depression. For more than a year, investors around the world have

watched with growing alarm as the US economy, the world’s largest, has

struggled to correct itself before being tipped over the edge by massive

foreclosures, shrinking consumer spending and rising inflation.

GW |