|

Sharp drop in vehicle imports in recent past:

Tax reduction will have positive impact on revenue

By Manjula FERNANDO

Vehicle importers are elated about the masive tariff reduction on

imported vehicles and certain electronic goods effected by the

Government from June 1, in a bid to fasttrack the country's development

via tourism revival. Vehicle importers are elated about the masive tariff reduction on

imported vehicles and certain electronic goods effected by the

Government from June 1, in a bid to fasttrack the country's development

via tourism revival.

While the initiative that would help different segments of society in

various ways was welcomed, there seems to be doubt as to how soon this

benefit would trickle down to the customer.

The Government has spelt out the major tariff reductions covering

imported vehicles from cars to trishaws and motor cycles. This would

undoubtedly have a significant impact on its annual revenue. Vehicle

importers were unsure how this would affect the overall reduction in the

market price.

The Treasury emphasised the 50 per cent cut on import tariff will be

reflected by about a 25 per cent reduction in the market price, an

opinion which was unfortunately not echoed by vehicle importers.

They were somewhat reluctant to admit that there would be a drastic

fall in the market price of imported used and brand new vehicles.

Importers however welcomed the initiative as a simplified tariff

system.

The tariff revisions announced by the Government is as above.

Earlier Now

Cars Petrol

1000 cc 187% 90%

1000 cc less than 1600 cc 217% 115%

1600 cc less than 3000 cc 299% 150%

3000 cc less 299% 180%

Cars Diesel

1600 cc 412% 179%

1600 cc less than 2000 cc 510% 185%

2000 cc less than 2500 cc 524% 271%

2500 cc less 524% 290%

Motor cars electric 144% 66%

Auto Trishaws

Diesel 68% 40%

Petrol 47% 40%

LP Gas 43% 40%

Electric 50% 40%

Vans

13 less than 17 persons (Petrol) 187% 121%

13 less than 17 persons (Diesel) 281% 152%

Double Cabs 366% 152%

Luxury vehicles

10 less than 13 persons (Petrol) 299% 191%

10 less than 13 persons (Diesel) 524% 290%

Motor cycles 68% 61%

Source: The Finance Ministry |

The 15% surcharge and 10% cess imposed earlier on all above items

have been removed.

The present import tariff includes Customs Duty, Value Added Tax,

Port and Airport Development Levy, Social Responsibility Levy, Excise

Duty, Regional Infrastructure Development Levy (RIDL) and Nation

Building Tax.

Electric motor cars and auto trishaws are exempted from RIDL and

Excise Duty.

A cross section of vehicle users welcomed the initiative by the

Government to revise the duty while some voiced concern about the rising

cost of living.

They pointed out the necessity for action to bring down the prices of

essential commodities as much as they welcomed this unexpected boon.

"We most certainly welcome this initiative. But I hope the Government

would do something soon about the rising cost of living", A.

Wickremanayake a public servant nearing retirement age who uses his own

car to work said.

Nandana, a trishaw driver operating in the vicinity of Attidiyasaid

the tariff reduction should also be extended to vehicle parts as well,

so that the prices of these items would also be slashed.

He pointed out that if the Government was targeting tourism revival,

the transport service sector of which trishaws play a major role, needs

to be given a boost.

Electronic goods

Tariff reductions on refrigerators and freezers are down from 139% to

100%, dish washing machines from 109 % to 81%, washing machines from

139% to 100%.

A bigger tariff reduction was effected for the items listed below:

Air-conditioners from 139% to 8.5%, Vacuum cleaners from 123% to 8.5%,

Telephone sets from 71% to 8.5%, TV and radios from 123% to 8.5%,

Monitors and Projectors from 84% to 8.5% Parts for above items from 91%

to 8.5%.

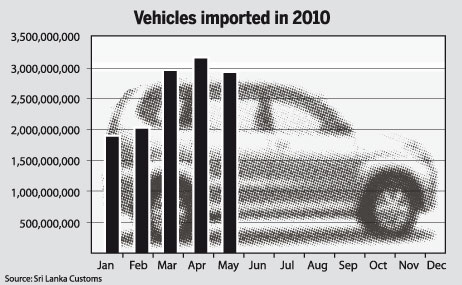

A senior customs official said it was imperative that a reduction in

the vehicle import tariff was made since the Department has seen a

drastic drop in the number of vehicles imported to the country in the

past few years due to the gradual introduction of new and high taxes by

the Government.

"This may rekindle the import sector and have a positive impact on

our revenue," he said.

Breakdown of income generated by way of customs duty on vehicle

imports since 2007: Rs. 44 billion in 2007, 39.4 billion in 2008, 15.8

billion in 2009 and 12.5 billion up to May 2010.

Almost Rs. 400 billion was collected as revenue last year.

The Customs Department accounts for a big share of the national

income with vehicle imports taking priority.

During the first five months of this year customs has cleared 114,741

vehicles. The breakdown is as follows.

|