Developing countries share in EU imports increase

by Sapumali GALAGODA

‘The EU market for home textiles has been hit by the global economic

crisis, showing a significant decline in consumption. Production in the

EU decreased even more, as a result of strong competition in the market,

which led to manufacturers outsourcing their production to low cost

countries’, states The Exporter - a publication by the National Chamber

of Exporters.

Developing Countries (DCs) saw their share in EU imports increase as

they have a comparative advantage in labour costs.

However, DCs become competitors to each other. Especially China and

Pakistan which dominate DC supplies to the EU could form a threat to

other DCs mostly in terms of the low price they can offer. However, DCs become competitors to each other. Especially China and

Pakistan which dominate DC supplies to the EU could form a threat to

other DCs mostly in terms of the low price they can offer.

Opportunities can be found in both West and Eastern Europe. Large

markets can be found in Western Europe (Germany, France, Italy, UK and

Spain) and growth markets in Eastern Europe (especially in Poland and

Romania).

Furthermore, the Netherlands and Belgium are major traders of home

textiles in the EU.

Although East-European countries could form a threat to DC suppliers

on the West-European market (in terms of production costs in combination

with short and cheap transportation) the region itself is certainly a

promising market, showing strong growth in imports from DCs in the

period 2005-2009.

Opportunities can be found in all product groups (bed linen, table

linen, bath and kitchen linen, blankets and rugs). DC exporters should

also look into the market niches within these product groups, such as

the market for organic or fair trade home textiles.

The UK is of specific interest regarding these market niches. The use

of natural materials also offers opportunities, since it also addresses

the trend.

The EU home textiles market declined by 3.5 percent annually on

average between 2005 and 2009 due to the economic crisis which hit the

market as from the beginning of 2008.

The decline was witnessed between 2008 and 2009 when consumption

declined by 8.7 percent due to the crisis as people tend to focus more

on the functionality of their home textiles than fashion aspects and

replace their products only when necessary.

However, prospects are positive since sales are expected to increase

again after the crisis; small signs of recovery were witnessed at the

German Heimtextil trade fair in the beginning of 2010. Home textile

sales are not as strongly related to the housing market as furnishing

textiles.

When people move house they could for example buy new bath and

kitchen linen that fits their new home in terms of colour and design but

this is more so the case for furnishing textiles.

In 2009 total EU consumption of home textiles amounted to Euro 3.9

billion or 747 thousand tonnes. The market consisted of 54 percent for

bed linen, 26 percent for bath and kitchen linen, 11 percent for

blankets and rugs and for the remaining share, of table linen. All

product groups showed a decline in consumption during the review period,

states The Exporter.

The largest EU market is Germany, accounting for 23 percent followed

by France 19 percent, Italy 16 percent, UK 15 percent and Spain 8.0

percent. These countries all showed a decline in consumption during the

review period.

In general, growth markets can be found in Eastern Europe and the

Baltic states as well as in Finland and Greece. Poland which showed a

strong growth in consumption between 2006 and 2008 is also (temporarily)

affected by the crisis.

Regional variations in climate influence consumer preferences for

home textiles in the EU. In northern Europe the climate is colder,

leading to a higher need for blankets and bed linen suitable for thick

quilts. In southern countries the climate is warmer. Resulting in a

lower demand for warm bedding.

A growing niche market is the market for organic home textiles. The

UK and Germany are important markets for these products, but also

West-European countries. In the UK for example, sales of organic

textiles (including estimated market value of Euro 126 million in 2008,

after which it remained stable due to the crisis.

Cotton is the major material used for organic textiles, accounting

for around 90 percent of the British market. The UK represents around 10

percent of the global economic cotton market and is the largest market

for Fair Trade Cotton.

In 2009 total EU production of home textiles to Europe 1.7

billion/171 thousand tonnes; a steady decline of 12 percent annually on

average compared to 2005.

Production consisted of 56 percent for bed linen, 19 percent for bath

and kitchen linen, 13% for blankets and rugs and for remaining share of

table linen. Production of all product groups declined. Due to the

strong competition on the home textile market, EU manufactures are

increasingly outsourcing.

In 2009 the EU imported Euro 4.6 billion or 856 tonnes of home

textile; an average annual increase of 0.9% in value terms compared to

2005.

However between 2007 and 2009 imports declined by 2.7 percent

annually on average, due to the economic crisis.

Imports of blankets and bed linen increased during this period while

table, bath and kitchen linen faced a decline. The leading EU importers

are Germany (22 percent of total EU imports), France (15 percent) and

the UK (14 percent).

Countries with a strong growth in imports are Poland (19 percent

annually), Slovakia (22 percent), Romania (13 percent) and Lithuania (27

percent).

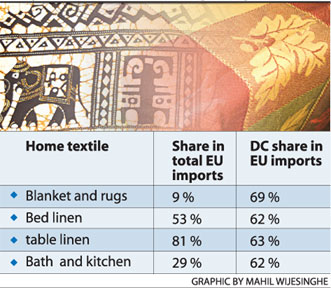

DCs play an increasingly large role in the EU home textiles trade.

Their share in EU imports increased from 58 percent in 2005 to 63

percent in 2009, and is equally large for each product group.

Imports from DCs increased on average by 2.7 percent per year in

production, and the sector is characterised by consolidation and

specialisation.

The largest EU producer of home textiles is Italy, accounting for 29

percent of total EU production in 2008, followed by Portugal (15

percent), Germany (14 percent), France (13 percent), and Spain (10

percent). all these countries witnessed a major decline in production

between 2005 and 2009.

Since EU production is not sufficient to cover the home textile

market, the EU is dependent on imports. Moreover production is declining

significantly.

Home textiles are increasingly imported from DCs and EU manufacturers

outsource production, mainly to Asia. The home textiles market is very

competitive, and highly labour intensive.

DCs can produce at lower costs than West-European countries; they

have a comparative advantage with regard to labour costs,Value and by

3.9 percent in volume, while intra-EU trade declined.

The two leading suppliers to the EU. China and Pakistan saw an annual

average growth of 8.9 percent and 8.4 percent respectively in the review

period, while imports from Turkey decreased by 5.7 percent. Emerging

suppliers were Bangladesh (15 percent annual growth in supplies),

Netherlands (12 percent, re-export) and Spain (13 percent) Germany is

the largest EU importer of home textiles from DCs, accounting for 25

percent of EU home textiles imports from DCs in 2009, followed by UK (19

percent) and France (11 percent).

However DCs accounted for the highest share in home textile imports

by UK (83 percent), the Netherlands (73 percent), Sweden (73 percent)

and Italy (73 percent), East-European countries, like Poland and

Romania, showed a strong growth in imports from DCs.

There are fact sheets on the most promising product-country

combinations. The selected fact sheet for the home textiles sectors

are,Bed linen- Italy and the Netherlands,Bath and kitchen linen- Italy,

the Netherlands and Poland,Blankets and rugs- Germany, Spain and

Romania, Table linen- France, Belgium and Poland,

For each product group, one Northern country, one Southern country

and if applicable,one growth market (in Eastern-Europe) has been

selected.

At first sight, bed linen seems the most interesting product, since

it is by far the biggest product group in the EU home textile market.

However it is also the home textile product most produced in the EU, the

market being dominated by large players and characterised by low margins

and high competition.

Therefore, other product groups are equally interesting for DCs.

Italy and the Netherlands are interesting bed linen markets since

they increasingly source in DCs to replace domestic production, Italy

and the Netherlands are also interesting markets for bath and kitchen

linen.

Italian production of this product is declining as well, which is

compensated for by the imports. The Dutch bath and kitchen market grew,

despite the economic crisis, and the share of DCs imports increased.

Poland is a growth market for this product group, and showed a strong

increase in imports from DCs during the review period.

Blankets and rugs are increasingly sourced in DCs. Germany is the

largest EU importer of this product group, and DCs saw their share in

German imports increase considerably during the review period. Spain

also imported a large part of the blankets from DCs, and this share

increased further during the review period.

Romania is an interesting growth market, and had the highest share of

blankets imported from DCs in the EU in 2009 while DCs lost the share in

table linen imports by the EU on average, their share increased in

imports by France and especially Belgium.

Moreover, both countries saw their production decline during the

review period. An interesting growth market is Poland, which was one of

the few EU countries showing (strong) growth in table linen imports

between 2005 and 2009.

Although importer, the UK was not selected as one of the most

promising markets.

This is mostly because there are few growth opportunities for DCs in

supplying the UK, as they already account for 83 percent of British

imports. Moreover DC supplies to the UK are most of the time dominated

by one supplier. However the UK can still be interesting for niche

markets, like organic and Fair Trade home textiles.

|