Role of transport in accelerated development

By Dr. Lalithasiri Gunaruwan

Can the Transport Sector Continue to be a Driver of Economic Activity

in Sri Lanka ? Can the Transport Sector Continue to be a Driver of Economic Activity

in Sri Lanka ?

Transportation is a vital element of well-being and development of

any economy. It provides the required mobility for people and goods, and

enables access to places and markets. It serves as the medium through

which the resource endowment differences among localities and social

segments are smoothed out.

Being a country with a tradition of exchange with the rest of the

world, the role played by the transport sector in the economic

development of Sri Lanka has been significant throughout the history.

Studies also indicate significant contributions made by the transport

sector towards social development of post-independent Sri Lanka. The

operation of public bus services by the Ceylon Transport Board (CTB),

providing mobility to the public all over the country and enabling them

to access places and services, appears to have had a significant

influence over Sri Lanka’s outstanding performance in a number of social

development indices, which are generally considered to be direct results

of public expenditure on health and education sectors.

The challenge faced by the transport sector during the first few

decades since independence was basically in the provision of basic

services. The low levels of income received by people and the consequent

deficiency of effective demand in the market, together with long

pay-back periods of transport related investments and the welfare

oriented political ideology that prevailed since mid 1950s, made the

industry a service-oriented, non-profit seeking and essentially

State-funded sector in the economy . Thus, the focus was to expand the

capacity of transport infrastructure (such as road development), to

provide accessibility to regions and rural areas, and to ensure basic

mobility of people at affordable prices through State-owned transport

operators.

Given the low level of market competition, demand conditions

insisting less qualitative parameters (such as punctuality and

standards) and comparatively low values assigned for travel time,

transportation has been essentially supply driven, with insignificant

pressure to be cost conscious, efficient, competitive or to manage the

demand.

The role expected to be played by the transport sector has thus been

one of being a ‘supporter’ to the process of socio-economic development.

The evolution of the sector has essentially been pulled by the

pressures exerted from socio-economic development, including economic

growth, rise in per capita income and in trade, in addition to being

closely influenced also by political concerns. The sector therefore

evolved with a lag, resulting in the commonly observed ‘backwardness’

and capacity constraints in service provision. These fundamental

characteristics, particularly visible in public land transportation, do

not seem to have significantly changed, despite the economy reaching a

per capita income level of $ 2300. The evolution of the sector has essentially been pulled by the

pressures exerted from socio-economic development, including economic

growth, rise in per capita income and in trade, in addition to being

closely influenced also by political concerns. The sector therefore

evolved with a lag, resulting in the commonly observed ‘backwardness’

and capacity constraints in service provision. These fundamental

characteristics, particularly visible in public land transportation, do

not seem to have significantly changed, despite the economy reaching a

per capita income level of $ 2300.

It is with this background that the economy is intending to double

its per capita income through a phase of accelerated economic growth of

over 9% per year over the coming five years.

Could the transport sector successfully withstand the demand

pressures emanating from such a high economic growth rate and continue

to play its traditional role of ‘supporting’ the process of development?

What would be the implications of such rapid economic growth on

transportation and related activities? How best could any undesirable

eventualities be minimised? How should the transport sector be reformed

and geared to successfully take part in realising the intended high

growth scenario? The first two questions are on the opportunities and

pressure the transport sector and its stake-holders are likely to face

under the assumption that the growth projections are realistic, while

the second two questions call for policy and strategy oriented answers.

Macro-economic outlook and the role of Investment

The Sri Lankan economy is projected to have an annual real economic

growth rate of more than 9% in average over the next few years.

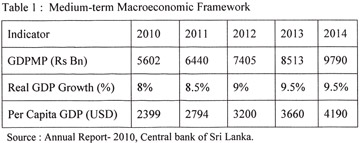

Table 1

What is the scale of the impact of this expected high growth scenario

on the country’s transport sector? Let us investigate the growth

projections and underlying parameters for a five year period from 2011

to 2015 in order to perceive the gravity. What is the scale of the impact of this expected high growth scenario

on the country’s transport sector? Let us investigate the growth

projections and underlying parameters for a five year period from 2011

to 2015 in order to perceive the gravity.

A real growth rate of over 9% during the next five years will mean

the Sri Lankan economy reaching a Gross Domestic Product of

approximately 12 trillion Sri Lankan Rupees at current market prices ,

reflecting a per capita GDP of around $ 4800, almost double the per

capita GDP of 2010. This would amount to an average per capita income

growth (at current market prices) of around 19% per annum over the

coming five years . Macro-economic relationships imply that such a

growth scenario would associate with corresponding re-alignment among

components of the resource balance.

Key to understanding the possible trends of such a re-alignment would

be to appraise the behaviour of investment. Thus, it is proposed that

this discussion be focused on this vital aspect, namely the behaviour of

investment, in appraising the challenges faced by the transport sector

in continuing to support economic development.

Growth – Investment Dynamics

Investment is the economic activity which is instrumental in building

up the capital stock of an economy (or a sector) to ensure future

productive capacity of that economy (or sector). Thus, investment

becomes an essential determinant of growth and development.

The degree of contribution to the national (or sectoral) value added

by the capital stock of the economy (or the sector) is determined by the

investment productivity, the inverse of which is indicated, at an

aggregate level, by the measure called Incremental Capital-Output Ratio

(or ICOR) . Higher the ICOR, lesser would be the marginal or incremental

productivity of capital, meaning that a larger increment to capital

stock (higher rate of investment) would be required to achieve a

targeted increment in GDP (or a targeted economic growth rate).

Sri Lanka’s ICOR currently figures around 4.5, meaning that an

addition of 4.5% of GDP to domestic investment is required to achieve an

incremental economic growth of 1%. Thus, the economy would require an

investment ratio of more than 40% of the Gross Domestic Product over the

period under consideration for it to sustain a growth rate of 9% per

annum. This would necessitate an increase of investment of over 200% by

the end of the coming five year period compared to its current values,

which translates into an average growth rate of investment of over 26%

per year sustained during the next five years, if an average of 9% real

GDP growth rate per year is to be achieved.

Economic implications of a high-growth scenario

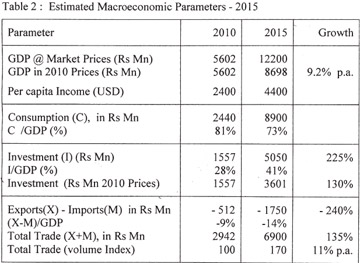

Increased investment requirement, together with the downward rigidity

of consumption ratio commonly observed in developing economies with

large share of low income earners, tend to widen the macroeconomic

resource gap. This needs to be bridged through net import of resources

to the economy. An estimate, based on a favourable inflation ratio of 7%

and an assumed consumption ratio of 73% over the period under

consideration, would indicate a widening of the net imports ratio to 14%

from current levels below 10%.

Table 2

Is this a pragmatic scenario? A Widened trade gap inevitably means

eating up of a larger proportion of factor income from abroad to finance

it, or increased foreign debt. Neither can be considered healthy in view

of economic as well as political independence of the nation. Is this a pragmatic scenario? A Widened trade gap inevitably means

eating up of a larger proportion of factor income from abroad to finance

it, or increased foreign debt. Neither can be considered healthy in view

of economic as well as political independence of the nation.

Growth implications within the Transport Sector

The accelerated growth would require economic sectors also to grow

fast. Accordingly, the service delivery capacity of the transport sector

will have to be augmented to meet the targeted value generation.

The Transport sector currently constitutes approximately 12% of the

country’s GDP. It has been observed that the transport sector’s share of

the country’s GDP increased with the per-capita income growth. Increased

affordability of the people to meet their mobility requirements, and

increased volumes of trade associated with economic growth, could be

behind this trend.

A conservative projection would be that the transport sector would

have to contribute approximately 12.5% of the country’s GDP.

For this to happen, the sector would have to grow by an average of

over 17% per year in nominal terms, or over 10% in real terms.

In practice, where does this necessity to grow stem from ?

Firstly, it would be from the transport and logistics demand that

would be generated by the rapid growth in international trade associated

with the above described resource gap. Having to increase imports at a

rate greater than that of the exports growth inevitably leads to an

expansion of Sri Lanka’s overall international trade (imports plus

exports of goods and non-factor services) by about 135% in current

market prices over the next five years. This would be an annual growth

of 11% in volumes of international trade. In terms of physical units,

this would correspond to the ports of Sri Lanka having to handle, within

a year, almost one million TEUs of import and export cargo alone

annually by 2015, compared to little over 500,000 TEUs of containerised

import and export cargo currently handled.

Sri Lanka has never experienced such a high growth rate of foreign

trade in volumes. For example, the growth of import and export volumes

during 1997-2007 has just been 5% and 4% per annum respectively. What is

to be faced within the coming five years would be more than twice that.

Next, the growth of other economic sectors with high transport and

logistics intensity would add significant demand pressure on the sector.

Tourism and Fishing are two such sub-sectors expected to grow fast over

the next few years.

Tourism, for example, displays high transport intensity with almost

one-third of the expenditure made in the economy by a tourist would be

on transport and tour-related services.

This would be even up to 60% if the expenditure on international air

travel is spent on a Sri Lankan source. With tourist arrivals targeted

to exceed 2 million by 2016, the transport sector should be prepared to

produce value exceeding $ 1 billion per year on tourism alone by five

years from now.

Last, but not least, the demand for mobility would stem from

increased affordability of people as a result of high per capita income

growth. In Sri Lanka, the average income elasticity of travel demand

during the last five years between 2005 and 2010, for example, has been

0.7 for all modes. Private modes indicated a higher income elasticity of

1.3, while public transport modes showed a lower elasticity of 0.43.

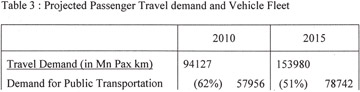

Projections made for the coming five year period based on the above

elasticity estimates would indicate alarming trends. Passenger travel

demand would experience an increase of more than 60% during this period,

indicating an average annual growth rate of 10%, compared to 7% annual

growth observed during the previous five year period.

Table 3

Our economy, and particularly her road network, thus will have to be

capable of shouldering the cost and load of almost 40% more private

vehicles and approximately 25% more buses by 2015. These requirements

will be even higher if the Sri Lanka Railway fails to maintain by then

its current market share of approximately 5%, and the private vehicles

do not achieve an average loading of three passengers per vehicle. Our economy, and particularly her road network, thus will have to be

capable of shouldering the cost and load of almost 40% more private

vehicles and approximately 25% more buses by 2015. These requirements

will be even higher if the Sri Lanka Railway fails to maintain by then

its current market share of approximately 5%, and the private vehicles

do not achieve an average loading of three passengers per vehicle.

Implications would be many. Investment requirement on fleet

augmentation itself would be enormous. The State and private bus

operators, for example, would have to add more than 6000 buses to their

fleets anew for this fleet augmentation within the next five years, in

addition to what is required to replenish depreciated stock.

This alone would mean a capital expenditure requirement of around Rs.

24 Bn. A 40% augmentation of the private vehicular fleet would mean much

greater scale of capital expenditure requirement on fleet expansion.

This capital expenditure burden would reflect entirely on the external

account of our economy as almost all new capital additions on motor

vehicles have to be imported. All these will put additional pressure on

already congested urban and sub-urban roads, causing the requirement to

expand the carrying capacity of the country’s road network. Needless to

emphasise the scale of financial and other challenges the sector and the

economy are bound to face in having to meet such a road capacity

expansion within a short period of five years.

To be continued...

|