Government debt to fall below 80 percent - Verité Research

Recorded government debt has dropped over the last six years

resulting in major improvement in the economic outlook of Sri Lanka.

Recent projections show debt falling below 80 percent of the GDP in

the next few years.

However, there is a flaw in the calculation of debt and this remains

unaddressed.

The Civil Service Pension Scheme applicable to public servants is an

unfunded debt obligation that has remained unaccounted for in the

presentation of debt in the National Accounts. Between 2009 and 2010,

the recorded government debt fell from 86.2 percent of the GDP to 81.9

percent.

However, the calculation of government debt fails to account for the

unfunded Civil Service pension payments which previous budgets have

inaccurately categorised as welfare payments. Pension payments to civil

servants constitute a legally binding debt obligation on the government

and as all other debts, it is a claim on future taxes. However, the calculation of government debt fails to account for the

unfunded Civil Service pension payments which previous budgets have

inaccurately categorised as welfare payments. Pension payments to civil

servants constitute a legally binding debt obligation on the government

and as all other debts, it is a claim on future taxes.

Omitting the present discounted value of the future pension payments

from the assessment of government debt obligations is a serious

technical failing in evaluating the true macroeconomic position.

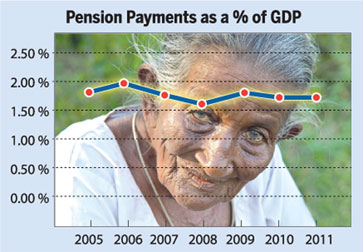

The average annual pension payments per year between 2005 and 2010

are 1.8 percent of the GDP.

The demographic ageing in Sri Lanka results in the pension burden

growing because of:

Regular inflation and growth-related upward adjustment to payment.

(b) Increase in number of pensioners

(c) Increase in the longevity of pensioners.

The number of pensioners are 485,000; and the total estimated pension

payouts in 2011 is Rs. 99 b more than 10 times the total payout for the

Samurdhi Welfare Scheme.

The recent trend shows the nominal pension payments alternatively

growing faster and slower than the nominal GDP. Between 2010 and 2011

nominal pension payment grew at almost the same rate as nominal GDP

growth.

The accumulated outstanding pension debt can be calculated as the

future stream of payments that are due to current pensioners as well as

those employed and qualifying for pensions in the future.

Verité Research has estimated the existing discounted value of the

outstanding pension debt obligation. If pension obligations are limited

only to current employees and all new employees are not pensionable, to

be in the range of 90 percent of the GDP. This means that the

substantively accurate reading of fiscal debt is 171.9 percent of the

GDP as opposed to the recorded figure of 81.9 percent of GDP.

Future policy and estimates with regard to pensions and fiscal debt

would benefit from taking into account, this otherwise hidden debt

obligation created by longstanding unfunded civil service pension scheme

in Sri Lanka.

|