|

EPF equity investments bring low returns:

ETF on a better footing

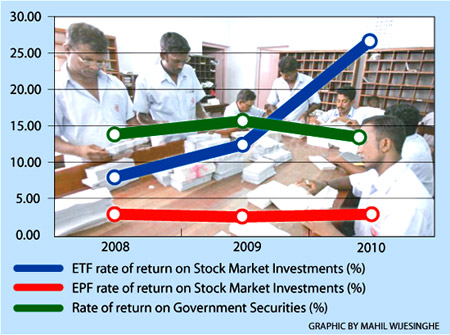

ETF has made a return of 26 percent on equity investments while EPF

returns stand below 4 percent an Analysis by Verité Research shows that

Employee’s Provident Fund’s (EPF)management of equity investments have

made low returns in comparison to stock market growth for the

corresponding period and in comparison to returns made by the Employees

Trust Fund (ETF).

EPF’s investments in the stock exchange has underperformed the All

Share Price Index (ASPI), and earned only one-fourth of what it would

have earned if the same investment had been placed with the usual

no-risk-low-return government securities, where 95percent of the EPF

funds are placed.

The investment of the EPF funds is under the supervision of the

Monetary Board of the Central Bank.

Historically, the main investments by the Fund have been in

Government Securities. This is not without its problems as the EPF has

been used as a cheap source of borrowing for the government, at the

expense of reasonable returns for the workers.

A study by the Institute of Policy Studies titled “Designing

Retirement-Income-Security Arrangements:

Theory, Issues and Applications to Sri Lanka” (de Mel, 2000)showed

that the EPF returns had been negative in real terms over a workers

career.In 2009, the Monetary Board invested 97.1 percent of the EPF Fund

in Government Securities, with a return of 15.70percent, while in 2010,

it invested 94.1percent with a return of 14.60 percent. At the same time

there was a move to increase the investment in the stock exchange.

In 2009, only 1.3% of the Fund (Rs.9.8 billion), was invested in

equities; but in 2010, there was a four-fold increase with 5% of the

fund (Rs.43.7 billion) being invested in equities.

The Central Bank has explained this increased investment in equities

on the basis that there was a need to diversify investments as returns

to government securities were on the decline. The explanation, however,

is contradicted by the outcome: the return to the EPF’s investment in

equities in 2009 was 3.53percent and in 2010 it was 3.81percent.

If the same investments had been kept in short and long term

government securities at the average yield, the EPF would have earned

almost 4 times as much it did by investing in equities. In 2009 post

civil war, the Sri Lankan stock exchange boomed, and in 2010 it became

the best performing stock exchange in the world. The percentage increase

of the ASPI in these two years was 125percent and96percent. In that

light, how the EPF managed to garner returns of just 3.53percent and

3.81 percentis puzzling in the extreme, and should require a public

accounting.

The Employees Trust Fund (ETF), which is managed by the Commissioner

of Labour, has also made investments in equities. In contrast to the

EPF’s return of 3.81percent the ETF made a return of 26percent on their

investment in 2010.The loss to workers as a result of mismanagement of

the fund’s investments in equities can be calculated at Rs. 71.2 billion

in 2010 alone. More than the absolute amount, the scale of loss is a

cause of concern. Where the quantum of investment had an expected market

return 73.9 billion based on the ASPI of the stock exchange in 2010, the

EPF earned only 1.7 billion: an adverse ratio of 43:1 (that is, if EPF

had simply distributed its investment proportionately across all shares

in the stock market without any thought or analysis, it would have

earned 43 times more than it actually earned with its expert investment

decisions).

The stock market is what economists call a “constant sum game”.

That is,the total long term benefits available from the stock market

are equal to the actual increase in dividends fromthe underlying stocks.

All deviations from this underlying increase in value are “zero sum”:

that is, one person’s loss is another person’s gain. Therefore, the huge

underperformance of the EFP investment is not without beneficiaries. |