|

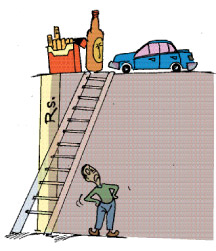

Increase in taxes and duties on cigarettes and

liquor:

Tax revision to net Rs. 3 billion

The Government has projected an additional revenue of Rs.3 billion to

the coffers through the increase of taxes and duties on cigarettes and

liquor announced yesterday, the Finance Ministry said.

According to the revision, the tax for a litre of imported beer has

been increased by Rs. 50 and for local beer by Rs. 5. Taxes for hard

liquor have been increased by Rs. 60 for a litre. According to the revision, the tax for a litre of imported beer has

been increased by Rs. 50 and for local beer by Rs. 5. Taxes for hard

liquor have been increased by Rs. 60 for a litre.

All brands of cigarettes will cost one rupee more per cigarette.

In another measure aimed at reducing import expenditure, road

congestion and fuel consumption, the Government has raised production

taxes on motor vehicles, three wheelers and motorcycles.

The Finance Ministry said in a statement that all vehicle imports,

including cars, motorcycles and three wheelers, rose 147 percent in 2011

compared to 2010. The increase from 2009 to 2010 was 121 percent.

In 2011, Sri Lanka imported 54,285 cars, up 46 percent compared to

37,134 in 2010.

The ministry said, vehicle imports have been rising rapidly since

2009 along with a corresponding rise in fuel imports and road

congestion. The new tax measures are aimed at discouraging imports of

passenger cars and reducing import expenditure.

A salient feature of the tax increases disclosed yesterday is that

duties on small-engine capacity hybrid and electric vehicles have

increased only marginally, thereby encouraging more consumers to opt for

these fuel efficient, environment friendly vehicles.

Accordingly, total taxes on a hybrid car (a petrol engine car with an

electric motor) with an engine capacity lower than 2000 cc will be 60

percent from the current 51. For capacities between 2000 cc to 3000 cc,

the total tax will be 100 percent from the current 75 percent and over

3000 cc, it will be 125 percent from the current 100.

Taxes on petrol-driven three wheeler vehicles have been raised from

51 percent to 100 percent, diesel three wheelers from 61 percent to 100

percent and electric three wheelers from 27 percent to 50 percent. This

is likely to discourage the import of three wheelers which has reached

saturation point.

There will be no change on taxes and duties imposed on buses,

lorries, trucks and agricultural vehicles including tractors.

Cumulative taxes on all petrol engine cars with an engine capacity

less than 2000 cc has been raised to 200 percent, while taxes on cars

with 2000 cc-3000 cc engines will amount to 250 percent. For petrol cars

having engines exceeding 3000 cc capacity, the new taxes will total 275

percent.

Total taxes on diesel cars with small engines (1600 cc or less) will

be 250 percent while at the other end of the scale, diesel cars and

jeeps having bigger engines (2500 cc and above) will attract total taxes

amounting to 350 percent of the vehicle value.

Taxes on petrol vans have been raised from the current 103 to 172

percent range to 125 to 200 percent. Taxes on diesel vans have been

raised from the current 112 to 291 percent to 125 to 350 percent.

Reconditioned vans will see a higher tax rate than brand new vans to

discourage the import of vans used abroad.

All motorcycles will be taxed 100 percent, from the current 61

percent.

|