Biz Briefs

Singer debentures oversubscribed

Singer PLC's issue of 10 million listed, rated, senior, unsecured,

redeemable debenture was oversubscribed, the company said in a Stock

Exchange filling. Singer PLC's issue of 10 million listed, rated, senior, unsecured,

redeemable debenture was oversubscribed, the company said in a Stock

Exchange filling.

Singer issued the debenture at an issue price of Rs. 100 each with an

option to issue a further five million of the debentures in the event of

oversubscription.

The company said it has received applications of an aggregated value

of over Rs. 1.5 billion and accordingly the initial issue has been

oversubscribed.

The subscription closed on December 17 and the basis of allotment

will be notified to the Colombo Stock Exchange in due course, company

sources said.

CASL introduces code of ethics

The Institute of Chartered Accountants of Sri Lanka (CASL) recently

launched the 2014 edition of the Code of Ethics for Professional

Accountants in its continuing efforts to ensure that Chartered

Accountants complied with the highest standards of professional ethics. The Institute of Chartered Accountants of Sri Lanka (CASL) recently

launched the 2014 edition of the Code of Ethics for Professional

Accountants in its continuing efforts to ensure that Chartered

Accountants complied with the highest standards of professional ethics.

The revised publication was developed considering the relevant

developments to ethical practices worldwide and emerging matters

specific to Sri Lanka.

Dr. Harsha Cabral, PC, commended Chartered Accountants for being one

of the few professionals who understood the importance of ethics, while

also congratulating CASL for ensuring that its professionals maintained

standards while in practice.

"This is one profession in particular which maintains discipline, and

you have to be congratulated for this. Most other professions don't even

have a document like this to look at," he said.

Siyapatha Finance debentures oversubscribed

The listed debenture issue of Siyapatha Finance Limited was

oversubscribed on Thursday, the opening day, according to financial

market sources. The listed debenture issue of Siyapatha Finance Limited was

oversubscribed on Thursday, the opening day, according to financial

market sources.

The company issued 5,000,000 rated, unsecured, subordinated,

redeemable debentures at a face value of Rs.100 each with a green shoe

option to issue up to 5,000,000 of the said debenture, totalling Rs. 1

billion.

The five-year debentures were rated A- (lka) by Fitch Ratings Lanka

Limited.

NDB Investment Bank acted as the financial advisers and managers to

the issue.

Fed delays parts of Volcker rule until 2017

The US Federal Reserve has given Wall Street banks even more time to

comply with parts of the Volcker Rule, a key provision of the 2010

Dodd-Frank financial reform bill. The US Federal Reserve has given Wall Street banks even more time to

comply with parts of the Volcker Rule, a key provision of the 2010

Dodd-Frank financial reform bill.

The rule prevents federally-insured banks from using their money when

investing in certain risky assets.

The Fed had already informed that banks would have until 2017 to deal

with one type of trading product.

It will now grant an extension to other types of funds.

Initially, the Fed had said banks would have until July 21, 2017 to

stop trading in collateralised loan obligations, which essentially move

the risk of investments in loans off their balance sheet.

|

Mrs Anusha Nanayakkara, a shopper at Arpico Supercentre Hyde

Park Corner (third left) is joined by (from left) Assistant

Marketing Manager, Richard Pieris Distributors Ltd, Peshala

Wijewardana, Assistant Manager, Supercentre, Asitha

Welarathne and Head of Marketing, Richard Pieris

Distributors Ltd, Minodh de Sylva at the lighting up of the

giant Christmas tree. |

|

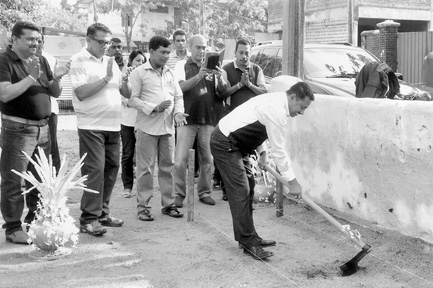

Construction work of Trillium Colombo 7 was launched

recently at Torrington Avenue, Colombo recently. Here

Chairman, Trillium Property Management, Janaka Ratnayake

cuts the first sod at the ground-breaking ceremony. Staff of

the organisation look on. The 20-unit luxury apartment

project is due to be completed by June 2016. -SJ |

|