Budget 2016: Impressive, confusing and stupefying

by Prof. Sirimal Abeyratne

Budget 2016 is peculiar, because you would find all in one basket: At

a glance it will impress you, perusing its proposals one-by-one can

confuse you; stupefy you; and its delivery in the year to come will

remain the biggest question. Budget 2016 is peculiar, because you would find all in one basket: At

a glance it will impress you, perusing its proposals one-by-one can

confuse you; stupefy you; and its delivery in the year to come will

remain the biggest question.

When we glance at the overall Budget, it may look 'market-oriented'.

At last after spending a long time wastefully, there is some light in

the right 'direction'. The revised Budget for 2015 was seen as moving

the country in the reverse direction, while it no doubt frightened

investors too. Over the past few months, we were unable to see any

policy direction.

The government was busy with petty economic matters such as the

administered price of hoppers or special duties on onions - sometimes we

were wondering if we were back to the 1960s and 1970s. The government

even confused many other nations which are close to us. It told 'yes' to

India, 'no' to Japan and 'hold on' to China.

Budget 2016 has brought about far-reaching tax reforms, trade

liberalization and policy measures that placed greater emphasis on the

role of the private sector. With these tax reforms, Sri Lanka can be

considered as one of the few countries with the lowest tax regimes.

Therefore, the country has overnight become a highly competitive

investment destination in the region. Whether the investors looking for

long-term policy stability, would suddenly become overwhelmed by it or

not is a different matter.

Contradictory proposals

Someone who is interested in reading and assessing tax proposals and

expenditure proposals is, however, likely to end up confused. While

showing an overall market-oriented policy direction on the one hand, you

may find that there are inconsistencies, trade-offs, ad-hoc moves, and

even things that are hard to explain with economic rationale.

While the overall Budget is in the direction of market-orientation,

its positive outcome appears to be, however, nullified by other

contradictory proposals. Doing business is eased in some reforms, but

made difficult in other reforms. Some proposals are hard to explain even

with common sense.

The Budget also hints at the public not to do banking if you have big

money, keep them in an off-shore bank or somewhere else.

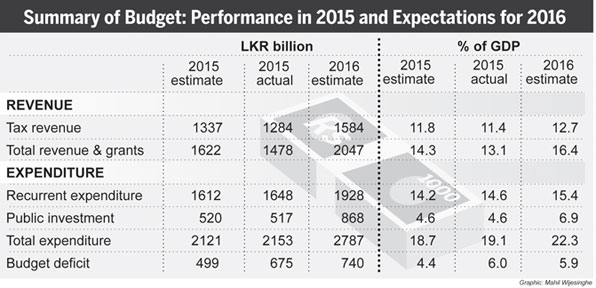

The estimates of budgetary numbers for 2016, compared with the

achievements for 2015, show some extraordinary expectations. While

direct and indirect tax shares have changed into those of a more

'under-developed' country, the anticipated increase in total revenue and

grants by over half a billion rupees and tax revenue by Rs. 300 million

looks substantial.

Similarly, there is also a significant increase in estimated

recurrent expenditure and capital investment. Although there will be a

moderate budget deficit, the estimates show a revenue surplus of Rs. 104

million for the first time in many years. There is much hope in

budgetary numbers as they show nothing but the healthy fiscal position

of the government, provided that the Budget is looked at in isolation. Similarly, there is also a significant increase in estimated

recurrent expenditure and capital investment. Although there will be a

moderate budget deficit, the estimates show a revenue surplus of Rs. 104

million for the first time in many years. There is much hope in

budgetary numbers as they show nothing but the healthy fiscal position

of the government, provided that the Budget is looked at in isolation.

Astonishing

There is, however, a problem, and it is a big one; does Sri Lanka

have room for such a comfortable Budget, especially if we look at the

budget in the context of the current state of the economy? Let me take a

few numbers, which we do not explicitly see in our budgetary estimates.

According to the Central Bank's latest publication (2015: p.85),

Recent Economic Developments: Highlights of 2015 and Prospects for 2016,

debt service for 2015 amounts to Rs. 1,265 billion, which should be paid

from tax revenue, while the total tax revenue of the year amounts to Rs.

1,284 billion. This implies that the country should borrow more to cover

budget expenditure; if tax money is for budget expenditure, then the

country should borrow to repay debt and cover the remaining Budget

deficit. We have been borrowing this year too and our debt service is

due to rise further.

Conditional Budget

However, Budget 2016 does not indicate at all that we need to be

careful about fiscal consolidation. If you consider the rising foreign

debt service, sluggish export growth, meagre foreign investment flow,

and over 250 either loss-making or unproductive State enterprises and

that fiscal consolidation is a necessary condition, though not

sufficient. This issue leads to a second important question: how

effective would be the delivery of the Budget within the next 12 months?

This is where conditions apply. Even if the Budget proposals remain as

they are without any change, its delivery in terms of revenue and

expenditure depends on a number of key parameters - private investment

(domestic and foreign), reform process, and finally the overall growth

performance of the economy.

The fundamental issue is that we have placed a short-term budgetary

performance on medium-term economic progress and competitiveness in

these areas is yet to be seen.

|