|

Top experts say:

Capital Gains Tax deters FDI

by Lalin Fernandopulle

Tax experts said the country is grappling with the challenge as to

what is the ideal combination of taxes to promote businesses and trade

endeavours and for it to be a preferred destination for Foreign Direct

Investments (FDIs).

N.R. Gajendran |

Vajira Kulathilake |

Ravi Abeysuriya |

Tax Consultant and Partner, Gajma and Company, N.R. Gajendran said

the policy statement of Prime Minister Ranil Wickremesinghe provided an

overall direction as to how taxation should be directed as we approach

2020. The salutatory thought was articulated by the Premier that the

ratio of direct tax to indirect tax should move up to 40:60 compared to

the current 20:80.

This is in line with the traditional and accepted thought in fiscal

policy where income tax which is considered a progressive form of tax,

should generate a greater proportion of revenue compared to indirect

tax.

The indirect tax being a consumption tax has a greater adverse impact

on the poorer segment of society. This clearly shows that the

government’s policy is not to impose greater hardship on the

less-privileged people as its objective is to generate a greater

proportion of revenue from the affluent segment. The policy of the

government is that the tax to GDP ratio which is at an abysmal level of

11.7 percent in 2015 to progress to 18 percent by 2020. The dual fiscal

aim is to achieve 18 percent tax to GDP ratio and the direct to indirect

ratio to be 4:6 by 2020. This will be the first step for fiscal

consolidation, Gajendran said.

In achieving these objectives, there has been aberrations in the

fiscal policy making and inconsistencies and uncertainties have emerged

for many reasons such as to achieve the objectives in 2020, ensure the

less-privileged segmental is not burdened which is vital to avoid social

unrest and manage debt and the exchange rate which is a major challenge

faced by the government, he said.

Debt is being rolled over so that the country moves away from the

high cost of debt finance to a manageable level of debt servicing cost.

In this regard, the country will have to face the demands of

multilateral agencies which are prepared to fund at a lower cost. Debt

management is vital because the interest cost for 2016 has been

projected at half a trillion rupees which in absolute and relative terms

has become the significant expenditure for the government.

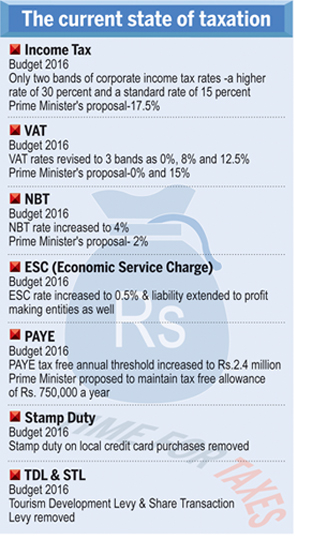

The current state of taxes is receiving mixed reactions as the State

has to face a conflicting and contradictory fiscal and monetary state of

affairs, Gajendran said.

With regard to the Capital Gains Tax (CGT), he said CGT is a

progressive form of tax.

It is a tax on the realised gain on a capital transaction and a part

of direct tax. One would pay only if a capital gain is realised. If

there is a capital loss in line with the normal principles it should be

allowed against the capital gains. This is in line with the principle of

capacity to pay. The capital market is not doing well currently even

without the CGT.

On RAMIS (Revenue Administration Management Information System),

Gajendran said it is an ambitious program using technology for revenue

administration. It is not the first time such as program was tried. Many

attempts to modernise and revamp the system has come a cropper.

RAMIS is not a panacea for all ills. It will link 26 government

institutions. If RAMIS is implemented the way it is spoken of then it

will yield good results such as minimising tax evasion, scaling down

corruption and improving efficiency. RAMIS is not a panacea for all ills. It will link 26 government

institutions. If RAMIS is implemented the way it is spoken of then it

will yield good results such as minimising tax evasion, scaling down

corruption and improving efficiency.

President, Colombo Stock Brokers Association and CEO/Director, Candor

Group of Companies Ravi Abeysuriya said the CGT was completely abolished

from August 26, 1992 to promote share trading. The market has advanced a

lot and one can argue for a case to introduce the CGT. But this is not

the time for it, due a number of reasons.

Sri Lanka is faced with the necessity to attract FDIs for development

and economic growth. International investors care a lot about a

country’s international standing in terms of credit worthiness and

market-friendly policies.

Now the credit has been downgraded which will undoubtedly negatively

affect our ability to attract FDIs and portfolio investments. The

increase in the CG tax will be viewed negatively by investors because it

will reduce their returns.

This could result in a decline in share prices. A strong share market

enhances the international standing and investor attraction. Hence, in

the aftermath of a credit downgrade, introducing a CG tax will further

affect the country’s international investment standing and this is

counter-productive to the Government’s vision to attract international

investments for development.

The purpose of the CG tax is to increase government revenue and

thereby reduce the Budget deficit, particularly in the very short-term,

to put the fiscal house in order. But we are in an environment, both

domestically and globally, where share markets have declined (CSE about

20% down).

The short-to-medium term outlook is not very positive either. So,

effectively the government will not be able to collect CG taxes, if

there are no capital gains.

The CG tax could result in further net foreign outflows which will

lead to worsening of the foreign reserves and thereby putting more

downward pressure on the rupee. So, you are actually exacerbating the

existing forex and currency problems.

The CG tax, particularly in a weak or declining market, has the

potential to discourage trading activity, thereby, reducing the

liquidity in the share market. That will also increase the bid-ask

spreads and transactions costs to market players.

The Government has earned Rs.38 billion over the past 10 years

through the 0.3% Share Transaction Levy (STL) without any effort

whatsoever from Inland Revenue officials to collect revenue.

Further, over Rs.1.5 billion was earned in 2015, a year when share

trading activities were comparatively very low. Capital losses will have

to be offset against capital gains, resulting in further revenue losses

to the government. This might not in fact give the government the

increased revenue they desire.

The bottom line is that this is not the proper time to introduce the

CG tax. It can be considered when the capital markets are vibrant and

rising. In fact, this will be counterproductive to the need to preserve

a good international standing and attract foreign investors.

The government should and can reduce the budget deficit in many other

ways that will be less detrimental in terms of macro-financial

implications. The Government has to be smart about it.

Tax experts said a capital gains tax on quoted share dealings will

result in a drop in daily turnover, exit of local and foreign investors

from the market, lower volumes of turnover tax based on Bourse turnover,

drastic drops in indices, the absence of bonus and rights issues, a drop

in market capitalisation, holding back of expansion drives due to lack

of fresh capital, delistings from the market and inability to create

more private sector jobs, flow of foreign institutional funds to

overseas markets with no capital gains tax and lower transaction costs

and net foreign outflows from the market burdening the rupee further.

Instead heavy fines for all illegal offences at airports and sea

ports and also for acts such as human and drug trafficking and motor

traffic offences. It will force the public to desist from carrying out

such acts.

Chairman, Colombo Stock Exchange, Vajira Kulatilaka said the CGT will

impede trading in the Capital Market which is in a stage where liquidity

is low. Hence Capital Gains would lower the liquidity further.

This will also adversely impact foreign inflow of capital as most

probably foreigners will also be subject to Capital Gains Tax. Some

foreigners may pay Capital Gains in Sri Lanka as well as in their own

country thus subjecting themselves to double taxation.

Overall, there was a method to tax the listed market through the

Share Transaction Levy and it was functioning smoothly. Collectability

was assured as the CSE collected the levy and transferred it to the

Inland Revenue Department.

The Capital Gains on listed securities will have an adverse impact on

attracting capital and it will also diminish the market liquidity. |