Clear-cut tax policy, a must for vehicle imports

by Lalin Fernandopulle

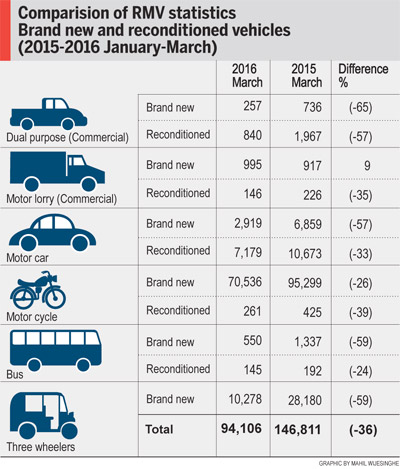

The unstable tax policy is not only a hit on the motor trade but also

a loss to government revenue and a failure to address the growing

congestion on city roads, motor trade and transportation experts said.

They said there has to be a clear cut policy on taxation for motor

imports which is constantly fluctuating, creating uncertainty in the

industry that has been adversely affected once again with the tax

revision and poor monetary policy measures triggering a 36 percent drop

in registration in the first three months this year compared to last

year. They said there has to be a clear cut policy on taxation for motor

imports which is constantly fluctuating, creating uncertainty in the

industry that has been adversely affected once again with the tax

revision and poor monetary policy measures triggering a 36 percent drop

in registration in the first three months this year compared to last

year.

The dual purpose brand new sector was the worst affected with a 65

percent drop in registration during the period under review.

Registration of dual purpose brand new vehicles slumped from 736 during

the first three months last year to 257 in the corresponding period this

year.

Fickle tax policy

Dual purpose commercial vehicles dropped 57 percent, motor cars brand

new 57 percent, buses brand new 59 percent and three-wheelers slumped by

59 percent this year. New lorries recorded a marginal decline of nine

percent this year.

Past Chairman, Ceylon Motor Traders Association, Tilak Gunasekera

said the fickle tax policy in not helping the motor industry to grow and

neither is it helping to boost revenue to the government coffers. This

has created a waite and see attitude among importers who have put on

hold orders as customers are not keen to purchase at exorbitantly high

prices. Sri Lanka had the highest tax rates for motor vehicles in the

world which was nearly two hundred percent making purchasing of a

vehicle impossible to many.

|

Murtaza Jafferjee |

|

Tilak Gunasekera |

|

Samantha Rajapaksa |

The sharp depreciation of the Sri Lankan rupee against the US Dollar

which is currently around 146, the Loan to Value ratio (LTV) currently

at 70 percent and rise in interest rates for leasing from 10 to 15

percent have impacted vehicle sales negatively.

The rupee dipped by around 11 percent during the last 12 months from

129.98 in April of 2015. The rupee reached an all-time high of 149.20 in

March of 2016 and a record low of 95.60 in December 2003. The LTV which

was 70 percent in September last year was increased to 90 percent in

October and again brought down to 70 percent in December last year. The

LTV was 100 percent financed by finance and leasing companies.

Motor industry experts said the current vehicle valuation system done

by the Finance Ministry and not by the Customs is time consuming and as

a result companies have to pay demurrage. The government introduced a

unit rate of excise duty for the vehicles on the basis of cubic

centimeters (cc) that generate Rs. 20 billion to the government. The

electric vehicle sector has not grown despite the hype about it due to

the inadequate number of charging centres in the country and the

distance a vehicle could travel when it has been recharged. Motor

traders said a recharged car could run only up to around 70-80

kilometres and the time taken to recharge is not viable.

Hybrid vehicles are the future due to the eco friendly and cost

effective factors, traders said.

Managing Director, Associated Motorways (AMW) Samantha Rajapaksa said

the increase in duty on vehicles in the last budget, the high LTV and

the depreciation of the rupee have hampered the motor trade industry

severely.

Senior Professor, Department of Transportation and Logistics

Management, University of Moratuwa, Prof. Amal Kumarage said the country

has not worked out a transportation policy to manage public space and

provide greater mobility to people.

He said we should move away from one off taxes on imports and

registrations to user base taxes. The focus should be on users of

vehicles and not ownership. It is not fair to tax users of vehicles in

rural areas where there is adequate space for movement. Taxes should be

collected in a way that efficiency and mobility in transportation is

enhanced. Singapore and many Western countries provide incentives and

subsidies for public transport at congested times and places. Vehicles

should be taxed for occupying limited public space and not as a personal

asset. Our transportation policy should be to provide a safe, cost

effective and convenient transportation system, Dr. Kumarage said.

Managing Director, JB Securities, Murtaza Jafferjee said income

should be taxed and not consumption behaviour. Taxes on vehicles should

be similar to durable goods. Excessive taxing of vehicles when the

remedy lies elsewhere is not a viable solution. Corrective taxation to

manage demand is vital. Vehicles should be priced in a way that makes

regular usage expensive and would discourage people from putting a

vehicle on congested paths. It is vehicle usage and not ownership that

should be taxed.

He said the Bus Rapid Transit System (BRTS) followed in Gujarat,

India has helped improve quality of transport and ease congestion and

delay in cities. Dedicated lanes for buses have smoothened vehicular

movement. This is also a cost effective way to address the growing

vehicle congestion in cities. Mobility provides greater economic

opportunities. Creating greater mobility is vital for inclusive

development, Jafferjee said. Sri Lanka's tax to GDP is currently around

12 percent. The target of the government is to raise it to around 18

percent. However, tax experts said the poor tax policy and compliance

will not help achieve the target of reaching a tax to the GDP ratio of

18 percent. |