The secret to financial success

This series of articles will provide sound financial advice that

stands the test of time on how to protect and grow your wealth in simple

language for anyone to understand and reach financial freedom and

security. This series of articles will provide sound financial advice that

stands the test of time on how to protect and grow your wealth in simple

language for anyone to understand and reach financial freedom and

security.

|

Ravi Abeysuriya |

Banks and finance companies can go bankrupt, stock markets can go up

as well as down but the strategies explained in the articles will give

financial literacy for you to take control of your finances away from

institutions.

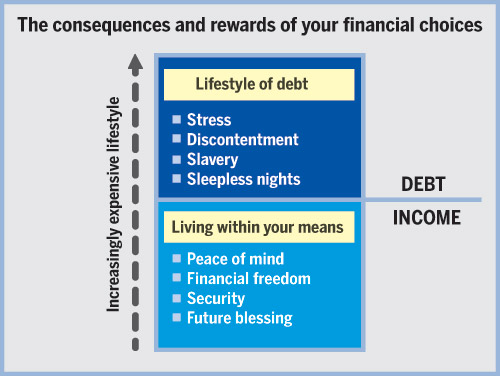

The secret to financial success lies in how much money you spend and

how much money you save and prudently invest during your working years.

If you budget properly and live within your actual means, you will see a

positive cash flow that will allow you to determine what you can afford

so that you don't reach too high and fall.

If you earn more than you spend you have everything you need to build

your wealth so that you can live comfortably later on. The most

important thing that determines whether you will be financially

successful is controlling your cash flow.

How you build your wealth will be a function of what your current

lifestyle needs are, and putting a little bit away for the future to

grow which will be a function of your investment goals and a function of

your risk tolerance, (both of which will be discussed in the future

articles in the series).

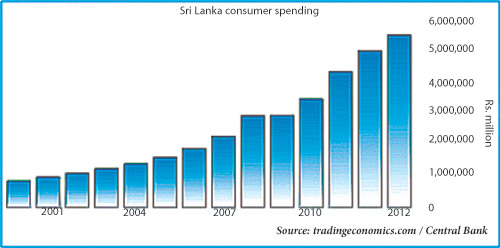

Consumer credit

In other words, whether you live within your means, not buying what

you want but what you need and can afford within your income level. No

matter how wealthy you are, you have to monitor your spending and have

an idea of how much you are spending compared to your income. In other words, whether you live within your means, not buying what

you want but what you need and can afford within your income level. No

matter how wealthy you are, you have to monitor your spending and have

an idea of how much you are spending compared to your income.

If you are an executive earning Rs. 100,000 or a driver earning Rs.

25,000 a month if you are spending more than you get, you are bound to

get into difficulties. One of the main causes in today's context is

consumer credit that coaxes you to spend more than you can afford and

ultimately devastates your financial future.

There is constant pressure on you to buy cars on lease, finance your

vacations, or sign up for credit cards and get you into debt with

installment payments even at zero interest.

This relentless pressure to spend money you do not have never

ceases.You may vehemently deny that you are trying to keep up with the

Joneses, but unconsciously it is happening due to the consumerising

society we live in. You may be already suffering crushing financial

stress with your stomach doing somersaults from the anxiety to make ends

meet.What is truly required is minimalist lifestyle and to do away with

inner Jones to live within your means with strict financial discipline.

Make sure that you spend money on what is important and meaningful

for you and simplify your lifestyle. Purchase what you need without

using consumer credit. Which means you will have to really think whether

it makes sense before you purchase and wait longer to buy things. Make sure that you spend money on what is important and meaningful

for you and simplify your lifestyle. Purchase what you need without

using consumer credit. Which means you will have to really think whether

it makes sense before you purchase and wait longer to buy things.

Financial literacy

Too much debt makes it harder to reach your investment goals. Having

monthly loan obligations means that the money needed to service those

loans can't be used for something else, something that increases your

wealth. Being financially literate does matter, but the deciding factor

is whether your thoughts are living in the past, present or future,

which will make the difference in your financial behaviour.

People who live in the past may be more cautious (which can cost them

money in the stock market if they fear risk) but also less likely to

default on debt. People who live in the present tend to focus more on

the moment and less on changing their financial situation.

People who live in the future may be more financially literate but

also feel that they can predict the future, which could lead to taking

on too much debt or making bad investments. None of the time

perspectives is a perfect scenario, just like everything else in life,

each perspective has its pros and cons...but the optimal scenario is to

strike a balance among all three. Creating a balance between present

desires and future goals will ensure happiness now and in the future.

People sometimes ask me for help after they realise that things have

got out of control. All these people have one thing in common, not

necessarily age, or occupation, or lifestyle choices. People sometimes ask me for help after they realise that things have

got out of control. All these people have one thing in common, not

necessarily age, or occupation, or lifestyle choices.

The trait that they all share is that they are unhappy. Here's where

the 'buy now, pay later', instant gratification mentality sweeps under

the carpet: There is a price to pay for your spending decisions, and the

price can be steep.

People who choose to live beyond their means while they are working

are likely to pay a hefty price during their golden years for their

spendthrift ways.

By foregoing smart financial planning during the working years, when

you have both time and resources on your side, many are going to be in

for a rude awakening when you realise that you are staring at retirement

with depleted savings.

What was supposed to be a time of leisure suddenly looks pretty

bleak, with few decades of retirement ahead and little to draw on.

Look out for the next article on how to get started.

The writer is the Group Director and CEO, Candor Group and can be

reached at

[email protected] |