Edible oil imports and tariff structure

Status, issues and possible impact:

By I. M. S. K. Idirisinghe

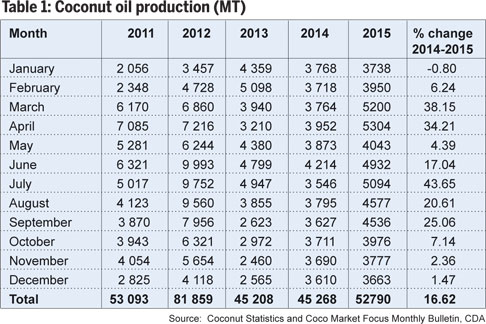

A consumer survey by the Department of Census and Statistics reveals

that per-capita edible oil consumption in Sri Lanka is around 4.31 kg

per year. This shows that the quantity of edible oil needed for national

consumption is 90,440 MT. Half of this demand is met by locally produced

coconut oil and the balance supplemented with imported edible oils

(Tables1 and 2). A consumer survey by the Department of Census and Statistics reveals

that per-capita edible oil consumption in Sri Lanka is around 4.31 kg

per year. This shows that the quantity of edible oil needed for national

consumption is 90,440 MT. Half of this demand is met by locally produced

coconut oil and the balance supplemented with imported edible oils

(Tables1 and 2).

When considering the total demand from other industries, the demand

for oil is around 80,000-90,000 MT but according to Sri Lanka Customs

records, the quantity of edible oil imported last year was 184,102 MT,

which is equal to the total oil needs of the of the country.

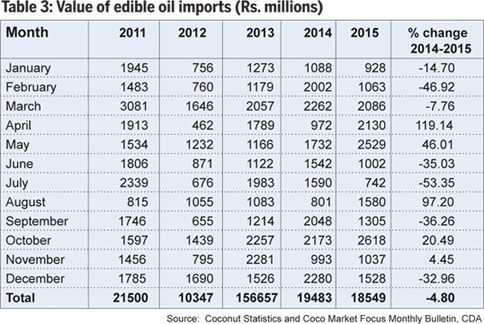

These un-controlled imports have inhibited coconut oil production and

the country has spent Rs. 18,549 million to import edible oils last

year.

This is 45% of the total foreign earnings from coconut kernel

products last year (Rs. 41,667 million) (Table 3). Although locally

produced palm oil has been added to the local market, it has still not

been taken into account in the policy making process. The tariff on

imported coconut oil and other edible oils was changed into a Special

Commodity Levy with effect from January 13, 2012. It has been continued

this year as well.

Virgin coconut oil and other substitute oils such as soya bean, palm

oil, sun flower seed, safflower, cotton seed were included under Special

Commodity Levy. The levy was amended in Budget 2012 to Rs 80 and Rs 110

per kilogram for crude and refined oils respectively. This was effective

from January 1, 2013. Coconut oil and palm kernel oil were not included

under this levy earlier, but those were also included into special

commodity levy from January 1, 2013. Virgin coconut oil and other substitute oils such as soya bean, palm

oil, sun flower seed, safflower, cotton seed were included under Special

Commodity Levy. The levy was amended in Budget 2012 to Rs 80 and Rs 110

per kilogram for crude and refined oils respectively. This was effective

from January 1, 2013. Coconut oil and palm kernel oil were not included

under this levy earlier, but those were also included into special

commodity levy from January 1, 2013.

This tariff structure was amended in the 2014 Budget and increased

the crude oil tax to the level of Rs. 90 per kg, palm oil Rs. 110 and

other Rs. 110 per kg. The next revision was in June 18, 2015 and the

revised tariff level for crude palm oil was increased from Rs. 90 to Rs.

110 per kg, palm kernel and refined oil tariff to Rs. 130 per kg.

Present tariff levels

Tariff levels for crude palm oil and palm kernel oils were revised on

May 13, 2016. This revised tariff is applied for crude or refined soya

bean oil, palm oil, sunflower oil, ground nut oil, coconut oil, palm

kernel oil, margarine and others.

With this revision, crude palm oil tariff was increased to Rs. 130

and for the refined product to Rs. 150. Tariff change has been a

positive influence on changing the market price of coconut oil, palm oil

price and copra prices.

According to market information, palm oil average prices have gone up

to Rs. 270-275. Since palm oil prices have gone up, coconut oil prices

also have increased to Rs. 165, while allowing coconut oil to compete

with the imported palm oil. This will also prevent the mixing of palm

oil with coconut oil. However, it is necessary to note that it is

essential to maintain the price gap between palm oil and coconut oil

since it prevents the mixing of the two oils. Even though tariff changes

have benefited some industries, farm-gate prices yet remain at Rs. 22 to

Rs. 24. One reason is that middlemen enjoy the advantage of prices

changes. The second reason is that palm oil suppliers pump the refined

oils which were imported at lesser tariff levels. The third is that even

though the demand for coconut oil has increased, coconut oil producers

and copra processors need time to start their production as most of the

production units were not in operation for a long period. According to market information, palm oil average prices have gone up

to Rs. 270-275. Since palm oil prices have gone up, coconut oil prices

also have increased to Rs. 165, while allowing coconut oil to compete

with the imported palm oil. This will also prevent the mixing of palm

oil with coconut oil. However, it is necessary to note that it is

essential to maintain the price gap between palm oil and coconut oil

since it prevents the mixing of the two oils. Even though tariff changes

have benefited some industries, farm-gate prices yet remain at Rs. 22 to

Rs. 24. One reason is that middlemen enjoy the advantage of prices

changes. The second reason is that palm oil suppliers pump the refined

oils which were imported at lesser tariff levels. The third is that even

though the demand for coconut oil has increased, coconut oil producers

and copra processors need time to start their production as most of the

production units were not in operation for a long period.

Unrefined low quality palm oil

If importers have continued this process over the years, it is a very

critical factor for the coconut industry as well as for the health of

the people. Therefore, the Coconut Research Institute proposes policies

to prevent these illegal activities. To adopt these policy

recommendations the following information has to be obtained: What is

the type of oil they have imported and harmonization code they use to

import these oils to the country?

What is the tariff level applied for these imports? What is the

purpose of importing these oils?

Who are the importers? Who are the importers?

To whom they have sold these oils and for what purpose?

How long this process has continued?

If these imports are under BOI projects, whether they have been

re-exported?

Whether importers have retail sales and if they do, the type of oil

that they sell

Steps needed to check the quality of oils available in the market.

The Coconut Research Institute is in the process of analyzing the

effect of tariff change on prices of coconut, and on other industries as

well as if tariff changes stimulate one industry and absorb more nuts

what will be the effect on other industries. Analyse available data to

decide the gap which should be maintained between the prices of imported

edible oil prices and coconut oil prices for the proper functioning of

the coconut oil industry, as the gap will help to prevent the mixing of

palm oil with coconut oil.

The writer is the Head, Agricultural Economics and Agribusiness

Management Division, CRI. |