|

Taxes: a speed-hump for your car

By Pramod de Silva

Vehicle imports and sales have plunged in the wake of steep duty and

tax hikes imposed on several segments of vehicles through the last

budget and several subsequent occasions, industry sources told the

Sunday Observer. During the first four months of 2016, motor vehicle

imports had fallen 23 percent, with cars falling 43 percent, buses 52.7

percent and trishaws by 62.6 percent, according to industry data.

"Imports have gone down drastically. There has been some recovery in

certain vehicle categories, but the overall picture is not healthy at

all. This is a very serious issue, with a large number of cars stuck at

the Port since no one wants to pay 100 percent or more, extra for a

vehicle they have ordered," says Gihan Pilapitiya, outgoing Chairman,

Ceylon Motor Traders' Association (CMTA), the leading industry body.

Difficult environment

"The only silver lining is that we have received an assurance from

the Finance Minister that there will be no further changes, at least for

the next two years. We do not however, see an immediate resolution of

the present situation," he told the Sunday Observer.

Pilapitiya said, it is an 'extremely difficult environment' for brand

new car importers who have to order vehicles 4-5 months ahead. With

ad-hoc and unforeseen changes to the tax system, there is a lot of

instability in the industry. On the other hand, used car importers from

Japan and elsewhere have more flexibility with the tax and duty regimes

because they buy cars off the shelf and ship them within two weeks.

Incoming

CMTA Chairman Reeza Rauff echoed these views. "Once a policy is

implemented we generally work on that. This [kind of ad-hoc changes]

puts us in a very embarrassing situation in the eyes of our principals.

As brand new vehicle import agents we invest a lot of money in terms of

maintaining showrooms and after sales, spare part backups. It is not

just selling cars, it is an industry on the whole. Unfortunately, the

policymakers do not see that. It is basically creating a total imbalance

in the market," he said. Industry sources believe that with very high

taxes imposed on cars above 1,500 CC, there could be a bigger shift to

used cars from Japan, which are below 1,500 CC and which have not been

affected by the recent tax changes. Incoming

CMTA Chairman Reeza Rauff echoed these views. "Once a policy is

implemented we generally work on that. This [kind of ad-hoc changes]

puts us in a very embarrassing situation in the eyes of our principals.

As brand new vehicle import agents we invest a lot of money in terms of

maintaining showrooms and after sales, spare part backups. It is not

just selling cars, it is an industry on the whole. Unfortunately, the

policymakers do not see that. It is basically creating a total imbalance

in the market," he said. Industry sources believe that with very high

taxes imposed on cars above 1,500 CC, there could be a bigger shift to

used cars from Japan, which are below 1,500 CC and which have not been

affected by the recent tax changes.

However, reports from Japan indicated that even used Japanese

automobiles to Sri Lanka could fall by roughly half, in unit terms

because of import duty hikes implemented since October 2015 and due to

the appreciation of the Yen. Importers are looking forward to the

reactivation of the duty concessionary permit schemes to reactivate the

market.

Sri Lanka was the biggest importer of used Japanese cars by value in

2015, ranking sixth overall in unit terms. According to statistics

released by the Japanese Ministry of Finance in January 2016, Sri Lanka

became the No. 1 destination by value for used passenger cars exported

from Japan last year, up from third place in 2014. But it took in just

1,066 used Japanese vehicles this May -- down 70% from a year earlier.

Most of the cars imported from Japan by "car sales" are hybrids less

than one year old including Toyota Prius (now in its fourth generation),

Axio and Aqua (also sold by the official agent as the Prius C), the

Honda Fit, Grace and Vezel (also sold as the HR-V by the official

agent), Suzuki's Wagon-R (sold by the agent in a non-hybrid version) and

Hustler and Nissan's X-Trail. They are all hybrid models, with the only

non-hybrid models finding favour among reconditioned car buyers being

the Toyota Allion and Premio which are now available in the latest 2016

versions.

Midsize hybrids have been taking the brunt of the stiffer tariffs.

Duties roughly doubled in May for the Toyota Prius and the Nissan

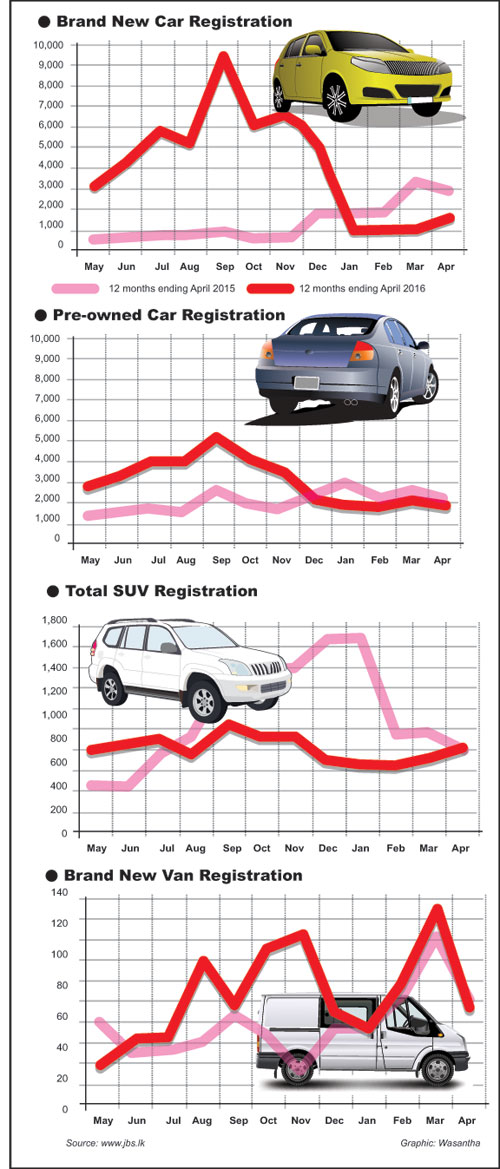

X-Trail Hybrid. However, RMV data shows a slight recovery of vehicle

registrations in some categories.

Samantha Rajapaksa, CEO, Associated Motorways Limited, sole agents

for Renault and Nissan in Sri Lanka, told the Sunday Observer that

earlier reports of "cheaper Indian cars" after tax changes are

absolutely wrong. "In fact, the opposite has happened due to the way

taxes are calculated under the new scheme. The Suzuki Alto which we were

selling for around Rs 1.795 million now costs a little over Rs.2

million. Mid-range cars above 1,500 CC fare even worse, with the X-Trail

hybrid now going for around Rs.13.5 million, a steep hike from Rs 9.5

million."

AMW and several other brand new car importers have found a measure of

success with smaller cars even with high taxes coming in. "The newly

introduced Renault Kwid is doing very well. It is an entirely new car to

the market released in limited numbers and even though it would take

years for factors such as resale values to come into play, the sales

patterns at the moment are encouraging," the AMW CEO added.

Challenging time

Kapila Gunatilaka, Assistant General Manager (New Vehicle Sales) of

United Motors Lanka Limited also expressed the view that despite the

difficult environment, sales of smaller cars such as Perodua Axia were

quite satisfactory, although there has been a decline of interest in

bigger SUVs and cars across the board due to massive duty changes. Among

the other most popular brand new small cars are the Micro (Geely) Panda,

Tata Nano Gen-X, Hyundai EON and the Kia Picanto. "It is a challenging

time and importers have to be innovative to differentiate their products

to appeal to customers."

Yasendra Amerasinghe, Director/CEO of Car Mart Limited said despite

the overall slowdown in imports and registrations, customers were

responding positively to quality and value, as exemplified by the two

brands they represent - Peugeot and Mazda. "It is a competitive market

and we are mindful of the market conditions. But, as brand new car

importers, we cannot compromise on quality. Nevertheless, we have taken

cognizance of the shift towards smaller, more fuel efficient engines,

such as Peugeot's 1.2 litre turbo engine which is identical to the

previous 1.6 litre in performance."

Paradoxically, the luxury category seems to have been largely

oblivious to the tax hikes, with some importers claiming record sales of

their flagship models that cost at least Rs.20 million, before options.

In the premium stakes, the leadership position varies between Mercedes

Benz and BMW, with Audi, Land Rover, Jaguar, Lexus and Porsche trailing

behind. Less than 100 luxury cars and SUVs from all brands are

registered each month. The permit system also created a huge imbalance

in the luxury car market, enabling one to buy a BMW 520D for around Rs.8

million (at 2010 exchange rates), whereas a duty paid Japanese

non-hybrid car cost almost Rs 6 million.

High-end luxury sales have also received a boost with the value

increase in the MP's permit to US$ 62,500, from US$ 45,000. Under this

permit, one can import vehicles such as Toyota Prado Sahara, Nissan

Patrol Y62, Jeep Grand Cherokee Limited, the Range Rover Sport, and the

Mercedes Benz S-Class. It is no secret that MPs' permits change hands

for millions of rupees, with the buyers still saving on the applicable

duties and taxes when purchasing these luxury cars.

Vehicle sales

But the less affluent who now find a car out of their reach, are

gravitating towards two-wheelers and even three-wheelers according to

latest statistics. Motor cycle registrations rebounded in May while

small cars also recovered. According to JB Securities which regularly

tracks vehicle registration data, motorcycle registrations recovered to

32,244 in May (the latest month for which complete data is available)

after falling to 21,000 in January and February. Car registrations which

fell from 7,181 in December to 2,888 in January recovered to 3,657.

Three-wheeler registrations increased to 5,732 in May from 3,268 in

January despite higher taxes on three-wheelers announced recently. This

is still a far cry from the 10,000 to 12,000 three-wheelers registered a

month with people such as craftsmen buying them for private transport.

Three-wheelers could be on the way out if Bajaj introduces its new

quadricycle Qute to the Sri Lankan market as reported recently.

Vehicle registrations totalled 46,486 in May. With a slight recovery

now on, importers are optimistic that people will eventually get used to

the higher prices and vehicle sales will reach higher levels, if not the

spectacular limits witnessed last year when a total of 668,907 new

vehicles were registered bringing the total number of vehicles in the

country to 6.3 million as at December 31, 2015. The country's vehicle

imports in the first eight months of 2015 increased 90% from a year

earlier to a staggering US$ 905m and vehicle imports accounted for 7.2%

of total imports in 2015 up from 4.6% in 2014, leading to calls to the

Government to curb vehicle imports. |