Corporate news

BoC goes for Rs. 3 billion debenture issue

by Gamini WARUSHAMANA

[email protected]

The Bank of Ceylon (BoC), the premier State owned bank will issue

debentures to the public to the value of Rs. 3 billion. This will be

raised to Rs. 5 billion in the event of over subscription. The

debentures will be opened on October 23 and closed on November 13.

The Chief Financial Officer of BoC Saliya Rajakaruna said that the

objective of the issue goes beyond the bank's capital requirements. This

is the first BoC public offering in its nearly 70-year history and while

it provides our capital requirement, this would also help to improve the

secondary credit market in the country, he said.

Rajakaruna said that the BoC sees the new investment opportunities in

the Eastern province and probably in the North in the future. The

debenture will enhance the capital adequacy ratio and the single

borrower limit of the bank.

The BoC has also planned to capitalise its London branch as a

subsidiary operating under the direct supervision of the Financial

Service Authority in the UK, he said.

There are three unsecured subordinated redeemable five-year debenture

products of Rs. 100 each and are categorised as type A,B and C to match

with the investor requirements. The minimum investment is Rs. 10,000 and

the BoC targets mainly small and medium investors.

Type A product has a fixed 19% interest paid annually.

The type B has a floating rate equal to the six-month gross treasury

bill rate plus 75 basis points, interest paid annually.

The type C is a zero coupon and redeemable at Rs. 225 each bearing a

17.61% interest rate and the interest will paid after maturity.

Investors can invest in all three types of debentures. Joint

investments are accepted but those who apply jointly cannot forward

single applications.

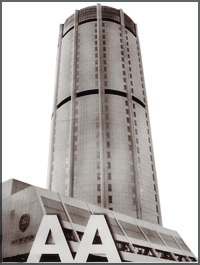

The debenture listed on the main board of the Colombo Stock Exchange

has been rated AA- by Fitch Ratings and managed by the Merchant Bank of

Sri Lanka, a majority owned listed subsidiary of BoC.

Rajakaruna said that the debenture gives the highest return and

offers high interest rates at a time the interest rates are declining as

the Central Banks are cutting rates to face the global financial crisis.

The security of the investment is guaranteed with the strong position

of the BoC governed under tight regulations from the inception of the

bank as the first Sri Lankan commercial bank.

The BoC counts the largest asset base amounting to Rs. 438 billion,

25% of the total assets are held by the commercial banks in the country.

The BoC holds the largest capital base of any commercial bank (Rs.21

billion), 20% market share of domestic deposits (Rs. 202 billion), 15%

of advances (Rs. 265 billion), 30% of foreign currency deposits (Rs. 106

billion) and seven million customer accounts. The BoC has been rated AA

by Fitch Ratings and is a fully State owned bank.

CSE launches TV program CSE launches TV program

The Colombo Stock Exchange (CSE) has launched a TV program to educate

the public, prospective investors and students as part of it strategy to

improve levels of awareness about the Stock Market among Sri Lankan

society as a whole.

This is the first time that the CSE has undertaken such an endeavour.

'The Stock Market - Kotas weladepola jayaganna denaganna' is a 30

minute program telecast in Sinhala every Sunday from 10.00 p.m. on

Swarnavahini.

The program will take the viewers through a step by step process on

equity investing and will discuss concepts such as investing options,

the relationship between risk and return, primary market, secondary

market and access points for investors.

These concepts will be presented through the use of graphics,

animations and informative interviews, making it simple and interesting.

Seminar on 'Security in an era of terrorism'

The Industrial Security Foundation (Sri Lanka) Inc., (ISF) which has

conducted several successful national and international seminars on

security related subjects will hold another seminar and exhibition on

October, 21 and 22 at the Galle Face Hotel.

The theme on the seminar 'Security in an era of terrorism' provides

the platform for indepth analysis of a number of threats that exist and

are likely to occur with harmful consequences to day to day life and

economic activities.

New Chairman and CEO (Designate) at Sampath Bank

|

I. W. Senanayake |

Harris Premaratne |

I.W. Senanayake has been appointed Chairman while Harris Premaratne

has been appointed Chief Executive Officer (Designate) at Sampath Bank

PLC.

Indulakshin Wickramasinghe (Arthur) Senanayake was a founder director

of Sampath Bank and was subsequently appointed Deputy Chairman since

1998. He is the fifth Chairman of Sampath Bank since its inception in

1986.

Harris Premaratne was formerly Senior Deputy General Manager of

Commercial Bank, responsible for Corporate and Off-Shore Banking,

Corporate Finance, Trade Services and Correspondent Relations, Overseas

Lending and Recoveries.

He has nearly 40 years' experience in the banking industry and is an

Associate of the Institute of Bankers - London. |