Global financial crisis - no direct impact on Lanka

By Lalin FERNANDOPULLE

[email protected]

The global financial crisis will not have a direct impact on Sri

Lanka's economy since the country has less involvement with financial

institutions which have been hit by the crisis, said Director, Merchant

Bank of Sri Lanka PLC, Dr. Ranjith Bandara.

He was addressing a seminar on the 'Global Credit Crisis' organised

by the Merchant Bank of Sri Lanka recently.

Dr. Bandara said due to the global nature of the current crisis Sri

Lanka will not be able to fully avoid the impact of the crisis.

The tourism industry and key export sectors such as textiles, tea and

rubber will be affected by the global economic slow down.

The US and Euro Zone economic downturn will have a negative impact on

the textile and garment exports.

Around 50 per cent of the country's garments were exported to the US

and 40 per cent to the European Union last year.

Rising interest rates and inflationary pressure, the appreciation of

the US dollar, the high public expenditure and a war budget will worsen

the situation on Sri Lanka. Foreign investors will be compelled to

withdraw investments if the crisis worsens.

"Sri Lanka's economy has been resilient to various external shocks

but if there are no balanced policies and prudent management the global

recession will have adverse consequences on the country", he said.

The loss of the global financial crisis is estimated at US$ 945

billion of which US$ 225 billion is due to outstanding loans and US$ 720

billion due to losses on securities.The world GDP growth projected by

the IMF will slow down by 2 per pent or more and as a result the GDP per

capita is expected to fall.

Dr. Bandara said though Asia is resilient to the crisis, trade

expansion will reduce due to the decline in commodity prices and there

will be a drop in export volumes to the US and Europe.

Developing rural industries and small and medium enterprises will

help gain economic stability and face the global challenges. Rural

industries make a significant contribution to the GDP of the country.

Assistance for the SME sector will have a positive impact on the

economy.

"With steps being taken by the government to strengthen the economy,

bridge the regional disparity and strategic partnership with donor

countries such as Iran the impact of the credit crunch could be low", he

said.

Partner, PricewaterhouseCoopers Chartered Accountants, Sujeewa

Muddalige said the premium on emerging market debt over the US Treasury

has widened in the recent weeks, and a host of currencies has fallen

against a resurgent US dollar.

Foreigners have sold more Asian stocks than they have bought this

year, according to the Standard Chartered Bank. They have pulled out US$

31 billion from South Korea, US$ 10 billion from Taiwan, US$ 8 billion

from India and nearly US$ 4 billion from Thailand.

The cumulative fall in major stock markets since the crisis erupted

in July this year is over 10 per cent which has erased a staggering US $

4.5 trillion from global stock markets in four weeks.

Policy makers should identify the early warning of a future financial

crisis, the critical gaps in the international regulatory and accounting

architecture and rate complex securities that will provide information

on risk to investors.

The global liquidity crisis is the prolonged economic expansion and

abundance of leveraging in the western world.

George Soros, a leading investor said the current financial crisis is

a result of 60 years of good time.

Muddalige said when the economies were doing well no one questioned.

The people indulged in high consumerism with credit debts running into

alarming amounts. A US citizen uses around 10-15 credit cards and the

total debt increased four times since 1995-2005.

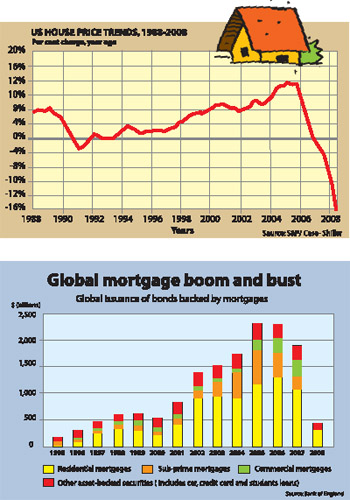

The global crisis is the manifestation of the collapse of the US

credit and housing bubbles. Lending to poor quality (subprime) credit

risks to finance home purchases has been stretched to the maximum

compared to other segments of the credit markets. US housing prices

increased by 52 per cent from 1992 to 2006. |