Budget 2016: Highlights

Total Revenue and Grants- Rs.2,047 billion Total Revenue and Grants- Rs.2,047 billion

Tax Revenue- Rs.2,032 billion

Non tax revenue – Rs.378 billion

Grants – Rs.15 billion

Total Expenditure Rs.2,787 billion

Recurrent -Rs.1928 billion

Public Investment – Rs.868 billion

Budget Deficit – Rs.740 billion

Total Foreign Financing - Rs.183 billion

Total Domestic Finacing - Rs.557 billion

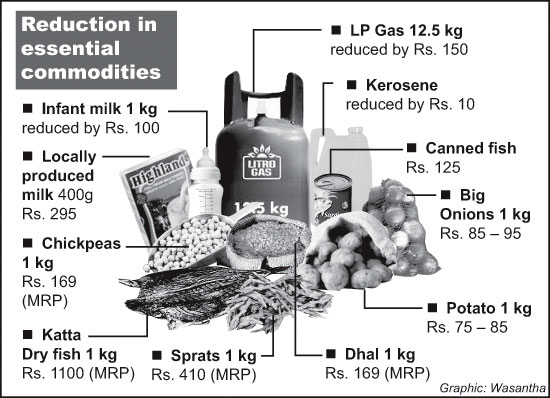

Prices of essential commodities reduced

Potato 1 kg Rs. 75 – 85, Big Onions 1 kg – Rs. 85 – 95, Locally

produced milk 400g – Rs. 295 Infant milk 1 kg – reduced by Rs. 100,

Canned fish – Rs. 125, “Katta Dry fish 1 kg – Rs. 1100 (MRP), Chickpeas

1 kg- Rs. 169 (MRP), LP Gas – reduced by Rs. 150”, Kerosene – reduced by

Rs. 10, Sprats 1 kg – Rs. 410 (MRP), Dhal 1 kg – Rs. 169 (MRP)Employees

PAYE tax ceiling to be increased from Rs.750,000/- to Rs.2.4 million.

The wholesale and retail trade will be excluded from VAT.

Reduce Excise duty to 2.5 percent for vehicles run on solar, hydrogen

or helium.

Vehicle Entitlement Certificate fee of Rs. 2,000 per Motor Cycle and

Three Wheeler, Rs.15,000/- for a Motor Car and Rs.10,000/- per vehicle

for all other vehicles.

Fee on Emission Test Certificate increased to Rs. 5,000.

Rs.1 million insurance for fishermen

Super games tax to be abolished.

Fifty licences to be issued for duty free gold importers.

Embarkation Levy increased from USD 25/- to USD 30/-.

Fee on one-day service of passports increased from Rs.7,500/- to

Rs.10,000/- per application. Fee on one-day service of passports increased from Rs.7,500/- to

Rs.10,000/- per application.

No imports of used washing machines, TVs and mobile phones.

Rs.10,000 fine for road accidents.

Colombo international financial centre – a specific zone in line with

Dubai financial centre to be constructed in D. R. Wijewardene Mawatha.

Casino centre of the previous administration to be converted to

Colombo international financial centre such as the Dubai financial

centre.

Withholding tax to be withdrawn from 2016 for loan securities.

Persons who issue dud cheques to be brought before the law under

Penal Code

Private sector employees will have five-day week.

Rs.15,000 million for road expansion including the construction of

Ruwanpura Expressway and extension of the Marine Drive upto Panadura.

National Digital Identification to be introduced countrywide with

effect from January 2016.

A new state- of- the- art convention centre to be constructed at a

cost Rs.3000 million.

Land lease taxes on feoreigners removed to promote investment.

An exhibition centre to be constructed near parliament.

Rs.1500 million to develop Kelani Valley Railway Line

New access road Kelaniya to Colombo Fort at an estimated cost of

Rs.4000 million

Domestic Airports to be built in Badulla, Digana and Puttalam.

Trincomalee and Hambanttota ports to be used for ship building,

reparing and bunkering purposes

Existing fertilizer subsidy to small scale paddy farmers; a cash

grant of Rs.25,000 covering a production year subject to a maximum

extent of one hectare.

The 15 per cent intereste rate offered to Senior Citizen to be

increased from Rs.1 million to Rs.1.5 million and to expand to this

benefit to citizen above 55. This facility will be granted through

licenced finance companies where an intereste subsidy of 1.5 per cent

will be granted by the government.

Training facilities for youth keen to join the hospitality industry

in collaboration with the private sector. 3000 youth to be trained in

every quarter. 50 per cent of the course fee subject to a maximum of

Rs.15,000 will be borne by the government. Training facilities for youth keen to join the hospitality industry

in collaboration with the private sector. 3000 youth to be trained in

every quarter. 50 per cent of the course fee subject to a maximum of

Rs.15,000 will be borne by the government.

New tax structure to make a ‘shopping paradise’ on several items

including electronic that will have lower import duties.

Mahapaola university to be set up in Malabe. Rs.3000 million. will be

allocated for

An Engineering Faculty in Kilinochchi and Agricultural faculty in

Vavuniya will also to be set up.

Laptops to be provided to the university students on an intereste

free loan for three years.

All schools will be provided with proper sanitary facilities. A sum

of Rs.4000 million to be set apart for this purpose.

All schools will be provided with electricity through national grid

or through solar power at a cost of Rs.2000 million.

Twenty five plantation sector schools to be upgraded to the secondary

level.

Printed books, magazines and journals to be excempted from import

duty.

HDFC Bank and State Mortgage and Investment Bank to be merged to

create National Housing Bank.

Lanka Putra Development Bank to be merged with Regional Development

Bank to create Lanka Enterprice Development Bank.

Sri Lanka Savings BaNew tax structure to make a ‘shopping paradise’

on several items that will have lower import dutiesnk to be merged with

National Savings Bank.

Financial Instituition Restructuring Agency FIRA will be established

to help failing finance companies.

A ceiling on intereste rates offered by the finance companies to

prevent undue concentration of deposits in the non-bank finance sector.

A child savings account for every child attending schools by

depositing minimum of Rs.250 per year.

The Bankers Association has come forward to assist the government in

this endeavour.

Colombo International Finacial Centre to be set up at D.R.

Wijewardena Mawatha, Colombo.

Lubricant and bitument market to be liberalised.

The securities investment account through which foreign investors

have been requested to channel their investments to be abolished.

Instead, investors will be allowed to bring in money to Sri Lanka

through any bank account existing in the formal banking system.

Three Cancer Hospitals to be build in nallur, Kandy and Matara.

Kideny hospital to be built in Minneriya.

Anuradhapura, Kurunegala and Jaffna hospitals to be modernised.

Ten district based Stroke Centres to be set up.

Sri Jayawardenapura hospital to be refurbished and expanded to

compete with private sector.

The government is to compelled all insurance companies to issue

medical insurance cover all the citizen upto the age of 75.

All citizen above age of 65 will be able to enjoy public transport

free of charge when the national digital indetity is issued.

The National Child Protection Authority will be mandated to create a

governing regulatory framework to safeguard the needs of families and

children.

The SriLankan Airline to be restructured with professional management

inclusive of local and foreign experts. SriLankan Airline will in the

future will focuss on profitable destination as a regional leader.

Central Expressway to be expanded to connect Dambulla, Polonnaruwa,

Mullaitivu and Jaffna.

Agent fee per worker collected by the Sri Lanka Foreign Employment

Bureau to be increased to Rs.15,000 per person.

Mansion tax will continue to be applicable except for condomonium

units.

Stamp duty levied for local purchases using credit cards to be

removed. However, Stamp Duty for foreign purchases to be increased tNew

tax structure to make a ‘shopping paradise’ on several items that will

have lower import dutieso 2.5 per cent.

Rs.4000 million to be allocated to reduce the human elephant

conflict.

Issuing of duty free vehicle permits including for the

parliamentarians to abolished

A lumpsum payment of Rs.250,000 to July strikers

Withholding tax on deposits to be removed.

Compliance and enforcement:

key to revenue generation

This is an overview of the budget proposals presented to the House

which may change at the time of legislation.

With a view of achieving sustainable economic growth in our country,

this year’s budget presented by the newly elected parliament sees a

strategic turnaround in the taxation and budget allocation proposals

covering key areas of the economy. The Government tax revenue to GDP

ratio had fallen drastically from 19% achieved in 1990 to 10.2% by 2014.

Incentive for foreign investors on land ownership

The Land (Restrictions on Alienation) Act No.38 of 2014 prohibited

the outright purchase of land by foreign investors. Under this Act, the

foreign investors were permitted to hold land in Sri Lanka only by way

of a lease, subject to a land lease tax of either 7.5% or 15%. This

restriction discouraged foreign investments. It has been proposed to not

only remove this restriction on foreign ownership for identified

investments but to remove the land lease tax imposed under this Act.

This can be viewed as positive step towards attracting foreign inward

investment.

Streamlining of direct tax for companies

The corporate tax structure comprises of the standard rate of 28% and

several concessionary rates across a range of sectors. It has been

proposed to streamline this structure to only two levels. More

specifically, companies in the sectors of betting and gaming, liquor,

tobacco, banking/finance/leasing, trading (excluding manufactures and

service providers) will be subjected to a higher rate of 30%.

The lower rate of 15% is to apply to all other sectors. While this is

considered as a good measure towards streamlining corporate tax, the

practical consideration of how it would assist to increase the

government tax revenue is questionable. If the envisaged objective is to

be achieved, the government will have to ensure the establishment of a

sound tax compliance and enforcement mechanism.

ESC for profit-making companies

ESC operates as a minimum tax, which was payable only by loss-making

companies and companies enjoying a tax holiday. The objective was to

reduce the tax burden on 23 tax liable companies. Profit- making

companies paying income tax were not subjected to ESC.

As a measure of increasing the Government tax revenue, it has been

proposed to remove the ESC exclusion granted to profit-making companies.

The profit-making companies will have to pay ESC in addition to any

income tax liability. Further, it has been proposed to double the ESC

rate to 0.5% from the existing 0.25%. This measure defeats the purpose

of ESC as a minimum tax and the proposal imposes an additional burden in

the tax compliance process for tax-paying companies.

Concession for Individuals

A notable tax concession is proposed for individuals to remove the

current progressive income tax rates and increase the annual tax free

allowance from Rs.500, 000 to Rs. 2.4 million, applying only a flat rate

of 15% on the balance income in excess of Rs. 2.4 million.

Further, the minimum WHT of 2.5% imposed on interest for individuals

is to be removed. While this is a positive measure towards reducing the

tax burden of individuals as to whether the government will achieve its

objective of increase in government tax revenue, is questionable. Since

only individuals in the high income slab will be made liable for taxes,

the government should establish a sound tax compliance and enforcement

mechanism to ensure collection of such tax from all liable persons.

Restructuring of Indirect taxes

The VAT and NBT registration thresholds have been reversed to the

previously existing threshold of Rs. 12 million per annum from the

increased threshold of Rs. 15million per annum, which was made effective

last year.

Another reversal proposed is the exemption of wholesale and retail

trade from the purview of VAT. In 2005, though 41% of the total tax

revenue was collected from VAT, its contribution to the tax revenue had

decreased significantly to 26% by 2014. In this light, while it has been

proposed to increase the VAT rate from 11% to 12.5% for service

providers a reduced rate of 8% is proposed for manufacturers and

importers of goods.

Some 24 companies engaged in the sectors of telecommunication

services, supply of electricity and lubricants are brought under the

ambit of NBT. It has been proposed to double the NBT rate to 4% from the

existing rate of 2%.

Revision on import taxes

The maximum customs duty rate is proposed to be increased to 30% from

the existing 25%. Further items such as tiles, ceramic and sanitary

ware, the import of which is restricted are to be removed for the

negative list. Another increase is the PAL rate to 7.5% from the

existing rate of 5%.

However, plant and machinery used for construction, dairy and

agricultural industries is to be exempted from PAL.

Tourism industry

As a measure to boost the country’s foreign income through tourism,

the PAL on certain electronic and electrical items is to be reduced from

5% to 2.5%. Further, the present Tourism Development Levy of 1% charged

on the tourism industry is to be removed.

Stamp duty considerations

While the stamp duty of 1.5% imposed on local credit card

transactions is proposed to be removed, the stamp duty of foreign

purchases is to be increased to 2.5%. Further exemption has been

proposed for stamp duty imposed on share certificates. However, the

government’s objectives of the stamp duty proposals are unclear.

Analyzing the above, while certain proposals can be considered as a

positive measure towards achieving the government’s objective, as to

whether the envisaged revenue target will be achieved and how it will

achieved should be given due consideration in light of the tax

compliance and enforcement mechanism in Sri Lanka.

-SJMS Associates |