Legend of largesse, yet unassuming

by Rosanne Koelmeyer Anderson

|

Prof Muhammad Yunus, Nobel Laureate 2006 |

A vibrant persona, clad in typical Bangladeshi Grameen checked fothua,

bubbling with energy, was a legend of economics and developer of the

concept of micro-credit, founder of the Grameen Bank and cynosure of all

eyes, Prof Muhammad Yunus, Nobel Laureate 2006, whom I had the pleasure

of interviewing last Saturday at a distinguished reception held at the

Bangladeshi High Commission at Gregory's Road Colombo 7.

Colombo came alive on August 21 when the legend addressed the Sixth

South Asian Free Media Conference which was well attended by the

country's most distinguished personalities with electronic media

epitomizing the icon's arrival to Sri Lanka by frequently inserting

excerpts of his speech, keeping the public well informed.

The vibrant personality was honoured for his great contribution; the

concept of micro-credit which gives would be entrepreneurs much needed

financing who are too poor to qualify for traditional bank loans.

The concept of micro-credit is to give out very small sums to very

poor people to start up their own enterprise, which has paved the way

for upliftment of millions of poor Bangladeshis, many of them women,

without any financial security by a legend, a leader whose success to

translate visions into practical action has benefited millions of people

,not only in Bangaladesh but also in many other countries.

|

Prof Yunus in a conversation with Media Minister Anura

Priyadharshana Yapa at the Bangaladesh High Commission

Bengali music and entertainment |

It has today become a reality, a role model and a success story of

poverty elevation. Prof. Mohammad Yunus was born to a well-to-do family

in Chittagong, a business center in Bangladesh, in 1940. His father was

a successful goldsmith who always encouraged his sons to seek higher

education. But his biggest influence was his mother, Sofia Khatun, who

always helped any poor person who knocked at their door.

This inspired Prof Yunus to commit himself towards eradication of

poverty and inculcate in him far-sighted thoughts which took him to

greater heights to where he stands today, indomitable, with universal

recognition.

The sprightly figure in his interview, full of zeal, vehemently

stressed that poverty is something that should not be there. It is

artificial, it is a denial by a system that creates poverty.

This has to be fixed up; which necessarily means going back to grass

root level, to society itself. Nobody should remain poor. Breaking these

walls is the crux of the matter of any system and the country should be

geared to do it, he went on to explain.

His vision is to reduce world poverty by half by 2015 and zero it by

2030 he quipped smiling; triumph and achievement towards his endeavour

to make his dream concept a reality. Prof. Yunus is a contended man.

Unassumingly candid in his perceptions he reiterated that he would be

glad to extend his services and advise to anyone who sought it for the

betterment of a society at large. What matters after all is that

people's lives are uplifted as much as possible, devoid of poverty.

Achieving fame and receiving Nobel Laureate 2006 is no surprise.

After all, Yunus was an outstanding student who won a Fullbright

Fellowship to do PhD at Vanderbilt University in Nashville, Tennessee in

1965 and thereafter returned home in 1972 to become the Head of the

Economics Department at the Chittagong University where he found the

situation in newly independent Bangladesh worsening day by day.

It was the terrible famine of 1974 in Bangladesh that changed his

life forever. He despised the thought that while people were dying of

hunger on the streets, he was teaching elegant theories of economics.

He felt the inadequacies of elegant theories of economics and finally

decided to make the poor his teachers and embarked on studying them and

questioning them about their lives. One fine day, interviewing a woman

who made bamboo stools, he learnt that, because she had no capital of

her own, she had to give more than 93% of her proceeds to the middleman.

Prof. Yunus identified the problem as one of structure ,lack of

credit to the poor which attributed to the thought that people are poor

today because of the failure of the financial institutions to support

them in the past. Thus, the idea of micro-credit was born by this

revolutionary who was bent on uplifting the economic and social status

of the poorest of the poor,and thus began his journey of commitment to

eradicate poverty and establish a better tomorrow .

The Grameen Bank (in Bengali, Grameen means rural) which Prof. Yunus

has built over the last 22 years, is today the largest rural bank in

Bangladesh. It has over 2 million borrowers and works in 35000 villages

in a country of 68000 villages. 94 % of its borrowers are women.

The bank is based on simple, sensible rules, meticulous organization,

imagination and peer pressure among borrowers. The break that Grameen

Bank offers is a collateral-free loan, sometimes equivalent to just a

few U.S. dollars and rarely more than $100.

In rural areas, it makes things happen. 98% of its loans are honoured.

Thus he has turned into reality a philosophy that the poorest of the

poor are the most deserving in the land and that given the opportunity

they can lift themselves out of the mire of poverty. His ideas combine

capitalism with social responsibility.

|

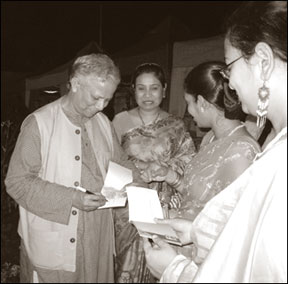

Prof Yunus signing autographs |

Micro-credit concept is now being practised in 58 countries. In the

US, it is a success even with the shifting poor of Chicago's toughest

districts. The United States alone has over 500 Grameen spin-offs.

Bill Clinton said in his election campaign that Yunus deserved a

Nobel Peace Prize and cited the experiment of Prof. Yunus as a model for

rebuilding the inner cities of America. Pilot projects have also begun

in Britain. The methods are adopted to suit local conditions, but the

principle of empowering individuals with their own capital is the same.

Prof Yunus and Grameen Bank were subsequently chosen in 2006 for the

prestigious award from among 191 candidates, including 168 individuals

and 23 organisations. Prof Yunus is the first Bangladeshi and also the

third Bengali after poet Rabindranath Tagore and economist Amartya Sen

to win the Nobel Prize.

"Good luck in all your future endeavours Prof. Yunus", I wished him

as I walked out of the High Commission as the Bengali music and singing

faded away into the night .

[email protected]

|