|

Focus: Human suffering

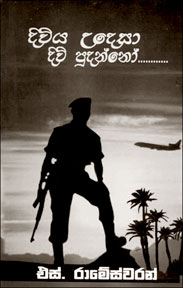

Diviya Udesa Divi Pudanno

Translated from Tamil into Sinhala by Sarath

Ananda

Published by S. Godage and Brothers

'Diviya Udesa Divi Pudanno' is a publication which consists of 11

short stories translated to Sinhala language by Sarath Ananda of

Tissamaharama and written by S. Rameswaran. As the name of the book

suggests, the author portrays with clarity the hardships faced by the

Tamil people during past three decades due to the ongoing war/conflict

in our country. While expounding on the expectations of the younger

generations the author explains the reasons behind unemployed youth

choosing the armed forces. 'Diviya Udesa Divi Pudanno' is a publication which consists of 11

short stories translated to Sinhala language by Sarath Ananda of

Tissamaharama and written by S. Rameswaran. As the name of the book

suggests, the author portrays with clarity the hardships faced by the

Tamil people during past three decades due to the ongoing war/conflict

in our country. While expounding on the expectations of the younger

generations the author explains the reasons behind unemployed youth

choosing the armed forces.

Through the short stories like 'Diviya Udesa Divi Pudanno', 'Mal

Wadamatada Suwanda Atha', 'Urumayada Me' and 'Neethiya Saha Dharmay' he

had been able to reveal perceptively the worries and difficulties faced

by the people in a conflict situation. 'Bhashawa' reveals how ones

ethnicity is harmed through war and conflict. He writes about what are

the shortcomings of human nature and their effects on families and the

society through the 'Nawa Niwasayedi' and 'Gatawara Viye Mathaka'

stories.

The novelty of the collection of short stories written in Tamil

language by the author and translated to the simple Sinhala language

helps the Sinhala readership understand the human suffering due to the

conflict.

Rameswaran who hails from Arthiyady, Point Pedro is attached to

Hector Kobbekaduwa Agrarian Research and Training Institute as

Information and Publication Officer. During 1974 to 1980 he worked as a

Sub Editor at Express Newspapers (Ceylon) Ltd.

- Nadika Damayanthi

Title: Advanced Level Poetry

Author: Hector and Nilusha Alahakoon

Keeping in mind that it is essential to study poetry with a good

understanding of the poet and his thoughts and feelings in the proper

context the authors of this book give a detailed and relevant

description of the poems, prescribed for the Advanced Level syllabus.

Authoritative book on insurance

Title: 'Situation Essays' on Insurance in Sri Lanka

Author: Dr. Wimal Wickramasinghe

Reviewed by Mahanama Prematilaka

On reading this newly published book on insurance in Sri Lanka, I was

amazed how Dr. Wimal Wickramasinghe could write such a comprehensive and

authoritative book on insurance with the details of many and diverse

aspects - a book for all those interested in insurance in Sri Lanka.

This is easily the only book available to the readership with the best

update, given both theoretically and practically.

One noticeable feature of this book is the expression of his candid

and personal views, observations and criticism without upsetting the

trends of thought and also without fear and favour. No other author

would dare to do so! Dr. Wickramasinghe's clout and standing in the

country holding many prestigious positions has given him not only

experience but also courage to air his views freely and forcefully. It

is a rare and bold act.

The subjects dealt with in the book are enormous with 23 chapters

except Introduction and Conclusion. Some of the important ones are

overall insurance, life and general insurance, insurance education,

governance in insurance, microinsurance, reinsurance of general

insurance, bancassurance, study of insurance law, reinsurance of general

insurance, etc. - all related to Sri Lanka but against a comparative

perspective.

The chapter on Takaful or Islamic Insurance in Sri Lanka given

against an international background with all the Islamic terms relevant

to insurance explained should be the only one of its kind, available in

Sri Lanka. A descriptive account given on the insurance business in

India is useful to both Sri Lankan and Indian readers - as author

himself says, it is not found anywhere else in one go.

This is not a book just to be read once and thrown out like a novel

or short story. It is in fact a reference book to be kept by the side of

an insurance practitioner. There are only three textbooks hitherto

available in the market written by two qualified and experienced

insurance experts and they are of course useful to insurance

practitioners and students. But they are limited in coverage and the

number of pages, with no recent developments about the insurance

industry in Sri Lanka given or analyzed. In comparison of the price

charged for these books, the price of the book under review is very

reasonable.

When I saw the first part of the title of the book, 'Situation

Essays' within quotes, I was a bit puzzled but the author has said in

the text that any lively subject like insurance keeps on changing almost

every day and therefore, it is an analysis of insurance as at end

October 2007. But its value from both historical and analytical

standpoints does not diminish at all as it seems to be the only book

that examines a plethora of important subjects of insurance not hitherto

examined by any other author.

The book begins with a comprehensive evaluation of insurance business

against an international perspective followed by life and general

insurance in Sri Lanka and insurance business in India. The role and

functions of many insurance practitioners in the context of Sri Lanka

and elsewhere are sufficiently examined in the text: insurance agents,

insurance companies, brokers, actuaries, marketers, chief executive

officers and directors. Up to now, insurance education has been a

neglected subject but its recent developments towards a university

course, in addition to the one at Wayamba University, are assessed

objectively, giving the author's suggestions for consideration by the

Insurance Board of Sri Lanka.

The most useful feature of the text has been the critical analysis of

the role and functions of the Insurance Board of Sri Lanka, making a

series of proposals for amendment of the Insurance Act as no single

amendment to the Act has been made since its enforcement in 2001. The

author suggests that the amending process should not be done on a

piecemeal basis, as is now proposed by the Insurance Board. There should

be an overhaul of the Act considering the recent changes witnessed in

both Sri Lanka and elsewhere.

Insurance industry is now fully privatized except a part of

compulsory reinsurance of insurance business being recently assigned to

a government body called National Insurance Trust Fund. The critical

views expressed by the author on the sorry state of affairs of the

National Insurance Trust Fund should receive the attention of its

hierarchy and the government.

The reader will notice how fierce insurance competition is,

especially among big wigs. In a way there is no harm in it as it bestows

an array of facilities and benefits to the insured - a welcome sign.

Nevertheless, my personal suggestion is that it should not be allowed to

unethical proportions by the Insurance Board as all advertisements in

both print and electronic media should be referred to the Insurance

Board for prior approval. It is the duty of Chief Executive Officer of

each insurance company to do so, as per a directive given by the

Insurance Board.

The plight into which small insurance companies are placed is

critically examined by the author. To add insult to injury, the

Insurance Board has suggested to the government an increase of paid up

capital of insurance companies to Rs. 500 million for each class of

insurance business as against Re 25 million for life insurance and Rs 50

million for general insurance.

The other proposal the author resists is the proposal for

dispensation of composite insurance business by a single insurance

company, requiring every existing insurance company that does both life

and general insurance business under one roof to segregate one from the

other, resulting in almost doubling of the number of insurance

companies, much cost to the company and the insured.

This seems to be built following of the Indian example, a country

with 1.2 billion population as against 2 million in Sri Lanka and a

country 60 times bigger than Sri Lanka in size. To my knowledge, no

other insurance practitioner or author has argued against these

proposals due to many reasons given by the author. His objection to this

issue is based on the following: there is no insurance company that is

(a) faced with bankruptcy, (b) not reported to be refusing claims on any

noticeable scale, and (c) bolstered in terms of capital by resort to

reinsurance facility of reputed international insurance companies that

assume a larger part of risks. Above all, Sri Lanka is a small country.

It is no doubt a bold exposition of views in a scientific manner.

Issue of corporate governance is a crucial one in business

management. How it is applied to insurance sector is vividly analyzed in

the book against the recent worldwide literature on governance and the

Companies Act of 2007.

Microinsurance is another subject that has amply received attention

in the text with more material from the international scene, a popular

insurance instrument for the poor. His innovative proposals to be

followed by the Insurance Board are worthy of its immediate

consideration. Bancassurance (issue of insurance policies by banks on

behalf of insurance companies) is a fascinating subject that has become

popular on the international insurance scene. This is also gathering

momentum in Sri Lanka with the proposal of allowing corporate entities

too to act as insurance agents - now restricted to individuals only.

This subject is treated comprehensively in four chapters in the book

with definitions, salient features, role of insurance companies, banks

and insurance agents amply explained. There are many other important

subjects dealt with in the book but I shall finally concentrate on the

proposal made by the author for study of insurance law in Sri Lanka, one

of the most fascinating topics treated both comprehensively and

scientifically. As it is, no one has treated this subject. This book is

an update on insurance in Sri Lanka against a theoretical and

comparative background - a book well worth for every insurance

practitioner. It is a worthy reference book, written with a lot of

labour and pain, using new material from the website.

As the author himself says, this book is recommended for all*:*

legislators, insurance administrators, insurance ombudsman, chief

executive officers, actuaries, underwriters, insurance brokers,

marketing and sales force personnel, finance managers and accountants,

all other insurance practitioners and university and other students. |