Adjustments to tax system to make Lanka a financial hub - Tax expert

Minor adjustments in the tax structure will help Sri Lanka to be a

global financial hub spinning money for development, said Tax Consultant

and Chartered Accountant, Gajma and Co., N. R. Gajendran.

He said the country’s tax structure should be simplified and made tax

friendly to enhance revenue for infrastructure development.

The tax base has to be broadened by bringing in professional to the

tax net and scaling down tax concessions,” he said. Gajendran said

headline taxes at point of sales which include Withholding Tax, VAT,

Economic Service Charge should be scaled down.

“The Tax Laws in Sri Lanka could be considered the best in the world

yet there should be an effective tax administration to increase

revenue,” he said.

The vehicle import levy could be slashed down by around 50 percent.

The current tax on imported automobiles range from 150-500 percent

which has made price of vehicles skyrocket.

Automobile agents said sales dropped by 80 percent last year making

businesses face a huge challenge.

Senok Automobile sources said that sales slumped by around 45 per

cent due to the high import cost. Owning vehicles is no more a luxury

but a prerequisite for mobility.

“The poor public transportation has compelled people to purchase a

vehicle” Gajendran said. The vehicle import levy could be slashed since

the country’s foreign reserves have surpassed US$ 6 billion.

The number of vehicles imported dropped to 3,000 last year from

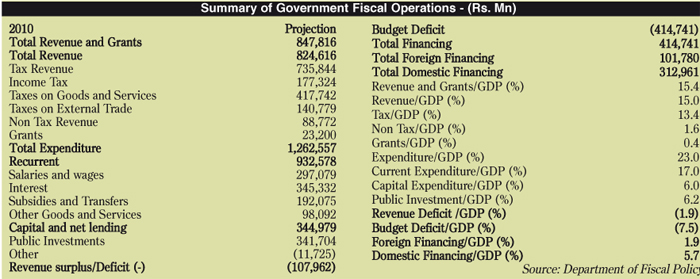

around 20,000 in 2008. According to the Ministry of finance revenue for

this year is estimated to be Rs. 825 billion with tax revenue of Rs. 735

billion and non tax revenue of Rs. 89 billion.(LF)

|