|

Capital Gains Tax to be introduced:

Move to resolve looming crisis

By Rukshana Rizwie and Isuri Kaviratne

A proposal for the introduction of Capital Gains Tax (CGT) and tax on

commodities was approved by the Cabinet Committee on Economic Management

(CEM) at a meeting last week.

The

measures are aimed at resolving a revenue crisis to meet the growing

expenditure of the country. The

measures are aimed at resolving a revenue crisis to meet the growing

expenditure of the country.

The CEM had proposed to increase the direct tax from 10 to 20 percent

and the income tax and company tax from 15 to 17.5 percent. Minister of

International Trade Sujeewa Senasinghe said the current tax revenue is

10 percent of the GDP whereas the tax owed to the government is 20

percent.

“Doubling the tax revenue would help the government to develop better

infrastructure and grant concessions for the needy.” He cautioned that

benefit systems, such as the pension schemes will be curtailed gradually

as people will be encouraged to save for their retirement.

Sri Lanka’s economy is growing at six percent. Hence it is envisioned

that with new tax reforms, the rate could go up to three times the

current rate. “With the support of the IMF team who is due in late March

or early April, we will start fund-supported development projects such

as the setting up of vehicle manufacturing factories and the removal of

the EU fishing ban, strengthening tea and rubber exports.”

Economist Executive Director at the Institute of Policy Studies Dr.

Saman Kelegama said the government is on the right track.

“At present, the tax revenue of the government is not at a

satisfactory level – around 11.8 percent of the GDP,” he said. “We need

to enhance this to about at least by 1.7 percent of the GDP quite soon

to make it around 13.5percent to meet the growing expenditure of the

economy.”

He explained that our income taxes amount to 2.7 percent of the GDP

when most developing countries reap around 4 to 5 percent of the GDP

revenue from income taxes. “Hence a CGT will certainly enhance the

income tax revenue.”

He referred to the 2010 Presidential Taxation Commission

recommendations to increase tax revenue citing that Sri Lanka has become

highly indebted due to excessive borrowing by successive governments. A

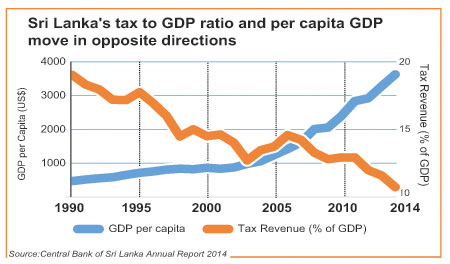

Verité Research suggests the tax rate in a country should increase

parallel to the GDP: though Sri Lanka’s per capita GDP has increased

over seven times since 1990, tax revenue has halved. ‘Therefore, the

government needs to improve its tax revenue for development projects and

not to run into budget deficits.’

Chief Economist at the Ceylon Chamber of Commerce Anushka Wijesinha

was taking a wait-and-watch approach to the revenue crisis. “These are

not tax reforms, they are piecemeal tax changes by a government

responding to an urgent revenue need,” he said. “The revenue crisis the

country is facing is a result of years of postponing more comprehensive

tax and expenditure reforms.”

Referring to the economic climate, he said there is an “issue of

inconsistency and uncertainty with regard to tax policy which is

undoubtedly affecting business.”

“If we want to continue public spending on sectors such as education

and health, then tax revenue is a huge part of that equation,” he said.

“But the country has to decide whether we are going to pay higher taxes

to fund those sectors of spending or to reduce public spending and pay

less tax.”

The Treasury and the Ministry of Finance were not available for

comment. |