IMF on protectionism: Stymies goods exports

|

Cross country comparison suggests Sri Lanka has effectively

gone backwards on trade protection - defying both regional

and global trends in policies and performance.

|

Creeping protectionism in the form of high import tariffs has led to

a decline in Sri Lanka's share of world trade in recent years, with

goods exports losing badly while, notably, the services sector, not

burdened with tariff and non-tariff barriers, has done much better, an

analysis by the International Monetary Fund has revealed.

Protection

While statutory Customs tariffs are relatively low, use of para-tariffs

and other trade taxes make the effective rate of protection considerably

higher, according to the IMF Staff Report released after the approval of

the US$1.5 billion IMF loan. This partly reflects the revenue problem,

as progressive use of border taxes somewhat compensated for weak VAT and

income tax, it said. Trade taxes currently in use are the Cess Levy,

Special Commodity Levy, and Port and Airport Development Levy, which

amounted to 1.4 percent of GDP in 2015 while import duties were 1.2

percent of GDP.

"Reviving Sri Lanka's outward orientation will also be essential to

achieving growth and other macroeconomic objectives," the IMF said.

"Sri Lanka's share in world trade has declined over the years."

War

While some of this was likely linked to increasing isolation and

lower productivity during the war, a second component seems to have been

a policy of "creeping protectionism and import substitution," it said.

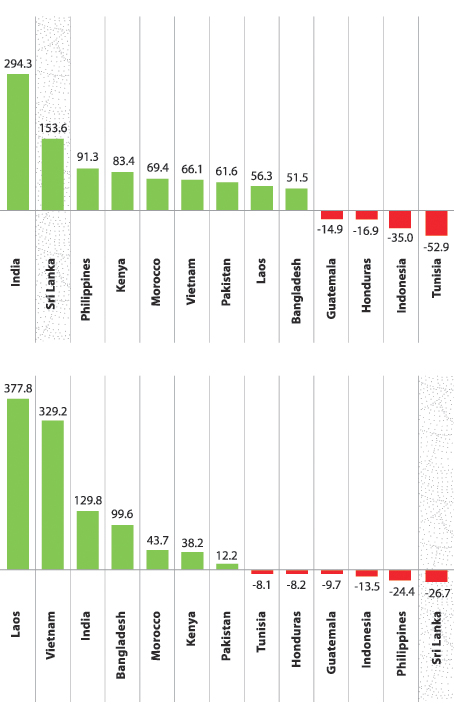

Several of Sri Lanka's neighbours have performed more strongly in

this regard - managing to boost their share of global exports between

2000 and 2015.

"Notably, the services sector (which has been largely immune from

para tariffs, excises, and other forms of non-tariff barriers) has

performed much more strongly than goods exports in recent years,

mirroring the rise of services in the economy as a whole, and more than

keeping up with other lower middle income economies," the IMF said. – CJ

IMF report on SL trade

While statutory customs tariffs are relatively low, use of para-tariffs

and other trade taxes make the effective rate of protection considerably

higher. This partly reflects the revenue problem, as progressive use of

border taxes somewhat compensated for weak VAT and income tax.

Trade taxes currently in use are the Cess Levy, Special Commodity

Levy, and Port and Airport Development Levy, which amounted to 1.4

percent of GDP in 2015 while import duties were 1.2 percent of GDP.

World Bank estimates suggested that the average total nominal

protection rate as of 2011 was about 24 percent, with para-tariffs

amounting to 12 percent.

The imposition of these para-tariffs and other trade taxes are often

considered as complex and unpredictable, reducing transparency. Cross

country comparison suggests Sri Lanka has effectively gone backwards on

trade protection - defying both regional and global trends in policies

and performance.

Sri Lanka’s weaker trade performance points to the need of reforms.

Growth has not been driven by expanding exports and shifting to more

processed goods, but by domestic demand fueled by government spending

and inward remittances.

This reflects in Sri Lanka’s trade performance – both exports and

total trade as a share of world market declined over the 2000s and

stagnated in recent years (albeit with fluctuations). Lack of

integration and continued protection will only limit Sri Lanka’s growth

potential and undermine increased diversification and resilience to

external shocks.

Reviving Sri Lanka’s outward orientation will also be essential to

achieving growth and other macroeconomic objectives.

As noted above, Sri Lanka’s share in world trade has declined over

the years.

Some of this was likely linked to increasing isolation and lower

productivity during the civil war, but a second component seems to have

been a policy of creeping protectionism and import substitution.

Several of Sri Lanka’s neighbours have performed more strongly in

this regard - managing to boost their share of global exports between

2000 and 2015.

Notably, the services sector (which has been largely immune from para

tariffs, excises, and other forms of non-tariff barriers) has performed

much more strongly than goods exports in recent years, mirroring the

rise of services in the economy as a whole, and more than keeping up

with other lower middle income economies.

FDI remains relatively low, however, highlighting the cost of policy

uncertainty. |