Investing in Unit Trusts

Grow your wealth with Ravi Abeysuriya

(Part 2)

Types of Unit Trusts

Investors can get exposure to a variety of assets by investing in

unit trusts. You don’t have to worry about how to divide your exposure

to different asset classes - the fund manager does it for you.

Unit Trusts most common in Sri Lanka are:

Money Market Funds – Money market funds operate similar to bank

savings accounts, where you can take your money anytime without a

penalty. Money market funds invest in low risk money market instruments

that have maturities of less than 12 months, i.e. promissory notes,

commercial paper, short-term bank deposits, of corporate or financial

institutions that have an investment grade rating. Money market funds

are ideal for corporate and individual investors looking for higher

returns with minimum risk.

|

WWW.FORUMS.MARVELHEROES.COM |

Fixed Income Funds – These funds invest mainly in Sri Lanka

Government Securities, corporate debt instruments such as debentures,

and fixed deposits that can have maturities of less than and more than

12 months.

The objective of a fixed income (or bond) funds is usually to provide

regular income, with less emphasis on producing capital growth for

investors. It is possible, however, for fixed income funds to generate

both capital gains and losses during a period where market interest

rates are volatile. Fixed income funds that invest only in Government

Treasury Bills and Bonds are called Gilt-edged Funds.

Equity Funds – Usually called Growth Funds, a major portion of the

assets of these funds are generally held in diversified portfolio of

equities listed in the Colombo Stock Exchange.

The performance of the units is, therefore, linked to the performance

of the CSE. A rising market will normally give rise to an increase in

the value of the unit and vice-versa.

Growth funds are generally considered medium to long-term

investments. Investors in these funds should be willing to accept a high

level of risk and should have the ?nancial resources to stay invested in

them for a reasonable period to gain the full bene?ts.

For this reason, you should have adequate financial resources so that

you won’t have to liquidate your funds during a market downturn if you

need the money at short notice.

Balanced Funds – Some investors may wish to have an investment in all

the major asset classes to reduce the risk of investing in a single

asset class. A balanced unit trust fund generally has a portfolio

comprising equities, fixed income securities, and cash.

Index Funds – An index fund is a type of Unit Trust with a portfolio

constructed to match or track the components of a market index, such as

the ASPI or S&P 20, and hence does not involve active fund management.

An index fund can provide broad market exposure, low operating expenses

and low portfolio turnover.

Shariah Funds – The main objective of Shariah funds is to provide an

alternative avenue for investors sensitive to socially responsible

investing which does not morally or socially harm society. Shariah funds

exclude companies involved in activities such as charging interest and

products or services related to gambling, alcohol and tobacco.

Advantages of Unit Trusts

1.Your money is in safe hands.

Unit Trust funds are well regulated and are managed by professional

fund managers, qualified and experienced in investment management. They

decide what assets to buy or sell based on the investment objective of

the fund and monitor your investments on a daily basis, and make

decisions based on research and analytical tools that you as an investor

may not have access to.

By handing over your money to a professional fund manager you get

financial discipline to protect your money from your own irrational

investor behaviour when trying to manage your own funds. i.e. buying

stocks during market bubbles and selling during market downturns

2. Investment risk is usually lower

By investing in a unit trust, you are pooling your money with that of

other investors. You benefit from diversification or spreading your

risks because funds in a unit trust are invested in a wide range of

companies (SEC limits the maximum exposure to a company or a group),

this reduces the overall risk of the portfolio.

This means that if one investment doesn’t work out, you won’t lose

all your savings as was the case when investors put all their money in

one finance company. Poor performance of any one company would have only

a minimal impact on the portfolio as a whole.

3. Unit trusts are easy to sell

Units can be easily sold and converted to cash within a day if you

need your money in an emergency. Unit trust management companies quote

the buying and selling prices once a day for their units for open-ended

unit trusts. Close-ended listed unit trusts can be sold through the

Colombo Stock Exchange. Units can be easily sold and converted to cash within a day if you

need your money in an emergency. Unit trust management companies quote

the buying and selling prices once a day for their units for open-ended

unit trusts. Close-ended listed unit trusts can be sold through the

Colombo Stock Exchange.

The price of each unit is based on the fund’s NAV divided by the

number of units outstanding.

The NAV of a fund is the market value of the fund’s net assets

(investments, cash and other assets minus expenses, payables and other

liabilities). The NAV is usually computed daily to reflect changes in

the prices of the investments held by the fund.

4. The performance of your investments can be tracked

You can keep track of how your unit trust is doing in several ways.

Your fund manager also provides a monthly update through fact sheets,

daily NAVs, unit trust buying and selling prices can be found in the

website of your unit trust provider and the daily newspapers.

The fact sheets provide quick summaries of how your investment is

doing, what are the underling investments your unit trust management

company has bought and the risks associated with the fund.

5. You don’t need large sums to invest

Unit trusts are designed for ordinary income earners, also called

retail investors. It provide access to assets or markets which may be

difficult or expensive for you to invest directly. You can begin

investing with Rs.1,000 in most unit trusts in Sri Lanka as a lump sum

or on a monthly basis. Monthly investing makes it possible to build a

large amount slowly on a limited income.

6. Tax benefits

Based on the taxation laws at the time of writing the article,

dividends on units and all gains arising from sale of units are not

liable for income tax, hence no income tax is payable by individuals or

corporates on their investments in unit trusts. The unit trust funds pay

income tax at 10%.

Disadvantages of Unit Trusts

Fees and charges: You would have to pay a one-time front-end fee

(typically in equity or growth funds) when you buy a unit trust, and

this fee ranges from 1.5% to 3% of your investment depending on the

fund.

There will be also trustee fees, management fees usually 0.5% to 2%

and sometimes a redemption fee (fees charged when you sell your units in

the fund when there is no front-end fee). Fees can reduce the returns

from your unit trusts. Fees are usually payable, regardless of how well

or poorly the fund performs.

No control over individual investments purchased by the fund: By

investing in a unit trust, you give up control over the choice of

individual shares, debt instruments and other assets that go into the

fund, as the fund manager will make these decisions for you.

Not all money managers are able to produce good returns for their

investors. Therefore, you have to choose fund managers who have industry

experience as well as a good track record and have proven ethical

standards in handling investor’s money.

Risks

Like any other investment, there is an element of risk investing in

unit trusts. Although investing in unit trusts helps to diversify some

of your risks, it does not eliminate all risks entirely. As such, be

prepared for ?uctuations in the market price of your unit trust.

Key questions to ask before buying a unit trust fund: Unit Trusts

differ in terms of investment objectives, strategies, risks and costs.

When choosing a fund, consider the following:

1. Your needs and goals/objectives, personal circumstances and risk

profile

Your risk pro?le is determined by how much risk you are willing to

bear. It will differ depending on your age, ?nancial situation and

investment objective. Think about whether you want the fund to provide

regular income or for your initial capital to grow.

2. Find out more about the unit trust you are considering investing

in. You should be comfortable that the fund manager has the resources,

experience and skills to manage your investment.

Check that the firm and the individuals managing the fund have a

credible performance track record in managing the fund which you hope to

invest in. Make it a point to speak to someone you know who has already

invested in the unit trust offered to you. However, do note that past

performance is not necessarily an indication of future performance.

Find out about alternative unit trusts and compare their risk-return

profile and features with the unit trust introduced to you

Unit trusts di?er in the type of assets they invest in and the

strategies used by the fund manager. Some unit trusts aim to deliver

higher returns but this is almost always accompanied by higher risks.

Choose a unit trust that meets your investment objective and risk pro?le.

The Sharpe ratio measures a fund’s historical risk-adjusted

performance. Generally, the higher the Sharpe ratio, the higher the

return the manager generateS per unit of risk taken.

In other words, when comparing two funds that are benchmarked against

an index, the fund with the higher Sharpe ratio gives a better return

for the same level of risk. Comparable performance reports of all unit

trusts for the month are available at Unit Trust Association of Sri

Lanka website utasl.lk/performance-reports/ around the 20th of each

month.

4. Select a fund based on the amount of risk you are willing to bear

and can afford to take.

Higher volatility of historical returns implies higher risk.Watch out

for how the fund performs compared to its benchmarks. A fund is said to

have outperformed its benchmark index if the return is higher than

benchmark. Conversely, if the return is lower than the benchmark index,

the fund has underperformed.

An actively-managed fund is generally expected, over a reasonable

time horizon, to outperform its benchmark index. For passive or index

funds, you can compare the fund’s performance against its benchmark

index to see how closely the fund replicates the index’s returns.

5. Fees and Charges

Check what you need to pay and compare them with similar unit trust

funds.

The Unit trust performance should be disclosed net of all fees and

expenses per annum. There are many unit trust funds to choose from. You

can select a fund or a combination of funds to cater to your specific

investment objectives and risk tolerance.

For example, if you are nearing retirement and have a low tolerance

for risk, you may consider funds whose objectives are capital

preservation and income generation. On the other hand, if you are

looking for capital appreciation and willing to accept higher risks,

there are also funds that focus more on growing your capital rather than

generating income.

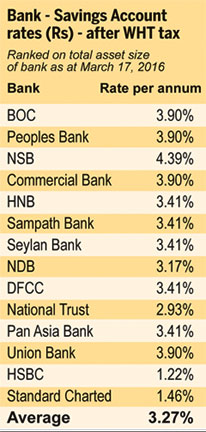

Investing in unit trusts is a great way to kick off a wealth building

strategy. Probably the safest bet for an investor who is new to unit

trusts with limited income is to invest in a money market fund that

provides a return of around 9.5% p.a. after tax and management fees

(takes only 7 ½ years to double your money) at present compared to

average return of a bank savings account 3.27% after withholding tax

(takes 22 years to double your money).

(Concluded)

Look out for the next article in the series - ‘Real Estate Investment

Trusts’.

Ravi Abeysuriya is the Group Director/CEO of the Candor Group and can be

reached at ayojana.upades @gmail.com |