|

observer |

|

|

|

|

|

OTHER LINKS |

|

|

|

Campaign to take CIF unit trust to masses, overseas investorsCeylon Asset Management (CAM) which manages the only index fund in Sri Lanka, The Ceylon Index Fund (CIF) began a campaign last week, to take this unit trust to the local masses and also to the overseas investor. CAM comes under the Bartleet group, while the campaign is termed `Invest in Sri Lanka - an undiscovered gem.'

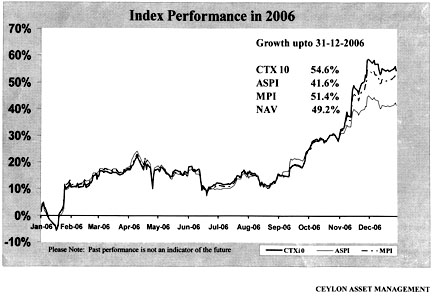

While past performance is not an indicator of future achievement, the issue price of the units on January 2, 2006 was Rs 22.98, redeem price end-November was Rs 33.13 and growth for the period was 44.2 percent. You can also expect an annual dividend from the fund, the fund's CEO, Ms Sharmini Ratwatte said. The Top 10 make up Dialog Telecom (telecommunications) market capital 196,191,025,195; John Keells Holdings (diversified holdings) 89,709,888,840; Sri Lanka Telecom (telecommunications) 50,084,865,000; Distilleries Co (beverages food and tobacco); Commercial Bank (banks finance and insurance); NDB (same); Lanka IOC (power and energy); Hemas Holdings (diversified); Asian Hotels and Properties (hotels and travels); Hayleys Ltd (diversified, with a market capital of Rs 452,720,257,325. The CTX 10 accounts for over 50 percent of the CSE capitalisation, while over 250 companies are listed on the stock exchange. CAM chairman Eraj Wijesinghe is the former chairman of CSE. Wijesinghe, said that CSE should perform favourably in the imminent future backed by the momentum of regional markets across South Asia. The Sri Lankan market offers much better value at a Price to Earnings ratio of 13.95, compared to a PE of 21.26 in India. The S&O NIFT Index also experienced an investment boom recording a 40 percent gain in 2006, Wijesinghe told the media. Wijesinghe said that Sri Lanka's economy is forecast to grow over 7 per cent for 2006 while in the past 20 years the growth was 4.5 to 5 percent. While the civil war continued, the sector outside the north and east, being outside the war theatre contributes 80 percent of GDP. The western province where development is clustered was generating most of the GDP, pointing to a vibrant public sector. But, a negligible number of Sri Lankans participate in equity markets, not knowing how. Wijesinghe said that the CTX 10 could provide the answer to the negatives weighing down the economy; growing by over 50 percent and outperforming all other indices. He said with inflation at 19.3 percent and savings interest at 5 percent, citizens should have some hedge. He spelled out rising defence expenditure, high price of oil, depression in currency, climbing borrowing rates, among negatives. The positives such as: 20 percent growth in foreign remittances each year, increase in supply of services, large infrastructure programs to be undertaken this year, high value of land and buildings, sale of apartments, the resilience of the economy, with the stock market not crashing with negative news levelled at it from the international media. CIF's minimum investment is Rs 10,000. The trustees of the fund is HSBC and SEC will regulate fund activities. CAM's director economic advisor, Michael Preiss, is a director and research fellow, Asian Bond Market Forum, a Hong Kong, based non-profit think-tank, besides holding other international positions. Preiss said that for foreign investors, the value of investing in Sri Lanka is high, due to high potential, while foreign markets are saturated. But, few outside Sri Lanka knew about the investment potential, here. Preiss, advocated the disclosure of the local equity culture through diverse means. He argued that it was only last year that the Chinese equity market grew. Also that India could override the Chinese economy, if there was broader participation of Indians in Indian stocks. "Without innovation, nothing can happen." Foreign investors may invest in the Ceylon Index Fund through HSBC Custodian Services. Directors: Eraj Wijesinghe - Chairman Bartleet group, Michael Preiss, director and economic advisor CAM, Mangala Boyagoda MD, CEO Wealth Lanka Management, Ravi Abeysuriya CEO Amba Research, Angelo Ranasinghe, manager, Business Development, Bartleet Mallory Stock Brokers and Ms Sharmini Ratwatte CEO CAM. |

The CAM boast is that during 2006, using the Colombo Top 10 Index (CTX

10) or the top ten companies, its return was 47.9 percent, outperforming

the Colombo Stock Exchange (CSE) ASPI (All Share Price Index) by 6.3

percent.

The CAM boast is that during 2006, using the Colombo Top 10 Index (CTX

10) or the top ten companies, its return was 47.9 percent, outperforming

the Colombo Stock Exchange (CSE) ASPI (All Share Price Index) by 6.3

percent.