|

Sri Lanka becomes a role model:

Global recognition for a well-managed economy

By Uditha KUMARASINGHE

*Eight percent target growth and stable

exchange rates

*President created greater awareness of our

achievements

*Favourable weather gods

*Improved power generation

|

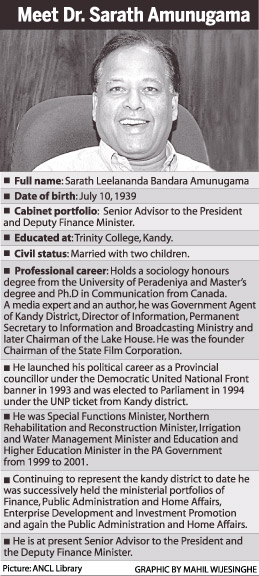

Dr. Sarath Amunugama speaks at the ‘Emerging Markets Summit’

organised by the Economist magazine in London recently. |

Senior Presidential Advisor and Deputy Finance Minister Dr. Sarath

Amunugama said Sri Lanka has become a model on how an economy should be

well managed. At present there is global recognition that the Sri Lankan

economy is well managed. Dr.Amunugama in an interview with the Sunday

Observer said President Mahinda Rajapaksa went to UN at a time when we

are getting credit for defeating terrorism and putting the economy on a

growth path.

Q: How does the 18th Amendment and other constitutional

changes ensure economic and political stability in the country?

A: Actually the 18th Amendment has its impact on the political

and the economic future of the country. These two are intertwined. We

need more investment in the public and private sector to achieve our

goal of 8 to 9 percent GDP growth. Investors are always interested in

the returns on their investments. People don't throw money around. They

look for stability in the country. Stability and predictability is very

necessary if we are to attract more investments. When there is a war,

investors tend to shun that country. That is true not only for Sri Lanka

but the world over. Now the war is over and the LTTE has been defeated.

Now we have to look at the stability in the country. Stability is judged

by the presence of democratic process. We are very fortunate in that Sri

Lanka is a democratic country. Investors prefer to invest in a

democratic country where there is the guarantee of continuity.

The 18th Amendment ensures sustainable development. The President can

now go for a third term, if he so wished. We had Provincial Council,

Parliamentary and Presidential Elections. In these three elections, we

presented to the country a common program. The voters overwhelmingly

endorsed the "Mahinda Chinthana Idiri Dekma" common program during these

elections.

If the President had only two tenures as earlier, the latter part of

the second term would have inevitably led to some degree of confusion.

Wherever there is this two term provision, the latter part of the

second term very often leads to some conflict or attempts by various

groups to pander to the candidate who is going to be the next President.

That was the situation in Sri Lanka and in many countries as well.

Q: Sri Lanka recently received another tranche of US$ 213

million from the IMF. Do you see this as an indication of the

international community's confidence in the Sri Lankan economy?

A: Yes definitely. The IMF gives that disbursement only after

making a comprehensive evaluation of our economic policies and the

success or failure of them. Before this tranche was approved by the

governing body of the IMF, a report had to be submitted by the IMF

officials in charge of the Sri Lanka stand by arrangements.

The approval was given only after it was tabled at the governing

council. It was not so easy as to secure the approval as first time.

There were some countries which abstained and voted against us. This

time we have had a clear passage. It means that we have been given a

clean bill of health judged by international standard of economic

management. Some people tend to forget the fact that the IMF conducts

surveys like this for every country. The IMF global report covers the

economic development of every country. Now Sri Lanka has become a model

for sound economic management. There are other factors too which justify

our management of the economy. There are global rating organisations. We

have Standard and Poor, Fitch Ratings and Moody's. These are the three

rating agencies.

All these three have upgraded Sri Lanka.

They have given B plus rating and also brought the definition upto

stable. This is something done quite independent of the IMF. That is the

second category. They have given B plus rating and also brought the definition upto

stable. This is something done quite independent of the IMF. That is the

second category.

In the third category, all the leading banks such as Bank of

Scotland, Standard Chartered and Deutche Bank have their very strong

research divisions. They do country analysis.

They also do their internal ratings. Even they have shown that Sri

Lanka is positive. When we look at our bond issues, they have all been

oversubscribed at the interest rates which are coming down more

competitively. All these show that there is global appreciation or

global recognition of the fact that the Sri Lankan economy is well

managed.

Q: The Colombo Stock Exchange recently surpassed the 7000 mark

for the first time. How do you view this achievement?

A: This is a very desirable trend. Sri Lanka must do two

things. We are too much engaged in private companies and therefore we

should encourage them to access the Stock Market.

They should issue shares and the public should be contribute. This

will help in two ways. Firstly they will get greater capital once they

have shares which are appreciative. Secondly, there is a greater

accountability. Shareholders will want greater accountability on the

part of the people who are trading their shares.

That is the first step and we will find more and more companies. You

would have seen so many IPOs coming into the stock exchange. That is a

very good trend. Other companies should also try to come into this. When

the Stock Market is booming that is an incentive for these companies

which are outside the Stock Market to come and test the value of their

company in the Stock Exchange. That is one favourable development.

Secondly it attracts other capital as well. Now there are two

factors. One is the speculative factor. The people know that the economy

is growing.

There is an appetite for more and more stocks. Due to the defeat of

terrorism and good management of the economy, people know that their

money will bring more returns.

They come to the Stock Exchange in larger numbers than before as they

see a brighter future; Most of the big foreign investors are also coming

in. Some of them left during the economic downturn. At the beginning of

our foreign exchange crisis, I believe US$ 600 million were pulled out.

Now such assets are coming back because basically there is confidence in

the economy. It is rising. Investors have the faith that the economy

will prosper further and it will be well managed. There is a long term

horizon in that. So they can put their money into this.

Q: What are the benefits to Sri Lanka from the President's

UN/US visit from an economic and investment angle?

A: The President went to the UN at a time when we were getting

the credit for ending the war and putting the economy on a growth path.

We are proud of that we had these significant achievements to our

credit. The President has created greater awareness of our achievements.

When the President addressed the United Nations, the premier world body

he was heard throughout the world.

The UN General Assembly is the world forum where each country express

its views on the global situation and their country situation. The

President's address to the august assembly has generated a lot of

interest among the world community.

We also attended the meeting on the Millennium Development Goals (MDG).

Sri Lanka can be proud of its achievements in the MDG fields. I am not

wrong in saying that of all the countries in the developing world, we

are right on top when it comes to things like universal literacy, gender

differentiation, low infant mortality rates, higher life expectancy and

higher nutrition levels. Of course, we can improve these areas. We are a

very good example of being well on our way to achieve the MDG goals.

When the President addressed the UN General Assembly (UNGA), he

highlighted our achievements particularly in the social welfare areas.

In the MDG meeting, the President reiterated our great successes in the

social welfare field.

At the UNGA, he also highlighted the defeat of terrorism, our growth

path and shifted in our approach and emphasised that we are friends of

everybody. Sri Lanka is a country which is friendly to everybody. We are

open to dialogue with every country. While we stand on our principles,

we continue to be an open society.

Q: Standard and Poor, Moody's and Fitch Ratings have upgraded

their ratings on Sri Lanka, giving a very positive image to the country.

What are your views on this development?

A: As I mentioned earlier this is a very difficult analysis of

an economy. Decisions in relation other business enterprises such as

insurance, freight and tourism are made globally on the basis of these

ratings. During the ethnic conflict, we got negative ratings. That had a

bad effect particularly on our manufacturing and tourism sectors. Now

they have made a very tough assessment and found that we are

progressing.

They have upgraded our ratings. This is a very good signal to

businessmen, shipping, insurance and to those interested in investing

here. All of them now see that things are improving. They don't just say

this is A, B or C. It is not a carom game! They do a thorough study and

give their considered ratings. People treat them as basis for their

decision making. The three companies have given a very good report. I

should congratulate the Central Bank because they got down the three

companies to analyse the situation. We are very happy as they have come

up with the same finding that the economy is improving.

Q: Sri Lanka's US$ 1 billion 10 year sovereign bonds have been

oversubscribed six times. Do you think global investors are so keen on

Sri Lanka?

A: They buy these bonds for two reasons. One, whether their

money is safe. Once they invest their money, sovereign bonds means

sovereign guarantee. The Government is banking that and putting its

value behind it. That is a very strong thing. Secondly we are giving

attractive interest rates. At present the interest rates have come down.

When it is oversubscribed it shows that the people are willing to invest

their money even at low interest rates. It is a very good sign.

Q: All these positive developments have taken place just one

year after the defeat of terrorism. How do you think the economy will

perform in the next few years?

A: The economy has to perform much better. We have targeted

eight percent growth and stable exchange rates. A low interest rates

regime is also taking place. We want to have a rapid growth in

agriculture, manufacturing and service sectors which are now in

progress. We can further improve these sectors. We should try hard to go

beyond. We are on a very good trajectory and there is always room for

improvement.

Q: Our economy has proved to be resilient, but what are the

challenges and external shocks facing the economy? Are there any

safeguards?

A: During the last three years, we went through a very

difficult time due to terrorism and increasing oil prices. Again food

prices went up and the global economy collapsed. So it was a very

difficult time. Even during that time, we managed to achieve 3 to 4

percent growth. That shows our economy is resilient. We are on a growth

path. Naturally for any economy, there are risks. We have to mitigate

the risks.

The first risk is what are called the shocks that come from outside.

One is that the oil prices should remain stable as it is now. We hope it

will remain like that. For example if it doubles, again our plans have

to be completely changed. The second thing is we are assuming that the

global environment is improving. It is so. But the global scene shows

signing of a downturn due to variety of factors. Third one is the

weather.

So far the Government has been very lucky because the weather gods

have been very favourable! Fourthly our power generation is improving.

We have many hydro power schemes.

If the weather continues to be favourable, we can switch into hydro

power which is the cheapest. Otherwise we have to depend on more oil

imports. All those factors have been controlled so far. As long as they

are controlled, we can go on.

Q: How is the economy coping with the loss of the GSP Plus

facility?

A: The GSP Plus is usually given to low income countries, that

is least developed countries (LDCs). Anyway Sri Lanka is not a LDC. Now

we are a middle income country and we would become middle- middle income

country very soon.

So many concessions that are given will have to be revived. For

example, we can't get very low interest credit which is given to LDCs.

In Africa and certain part of Asia, there is debt forgiveness. The

lending countries have written off their debts. But we can't get that

benefit as we are not a LDC. Sri Lanka has a very good record in paying

back its debts. But we are a middle income country now based on certain

things. Even in future, it would have affected the GSP Plus. We can't

deny that. Earlier it helped us in securing markets.

Now we have to cope it up. When we do business, we have to always

face challenges. Our garment industry and other production areas are

also affected by this. But the garment industry is coping as much as

possible.

The people who have well managed with good capital can survive and go

on. Those who are in the margin have to collapse. That is a normal

phenomenon. So far we hope that at least our earnings from the garment

sector can contribute to the country.

Q: The rupee is appreciating against the Dollar and some other

major currencies. Will this be a significant long term trend? If the

Rupee appreciates, how does the Government allay the fears of the local

exporters?

A: Central Bank manages the exchange rates. That is one of the

primary functions of the Central Bank. Strengthening of the Dollar means

our foreign reserves are very good and we are strong. As an

import-export country, we have to balance it and keep the exchange rates

at a point which is good enough for the exporters as an export

incentive.

We have to balance it always. There are certain advantages. When we

pay back our debts, when importers import machinery, we have to pay

less. On the other hand, tourism industry will get less of incentives if

the Rupee appreciates.

There will also be less of incentives to tea exporters and garment

exporters. I don't think we will allow it to appreciate to such extent.

So we will try to keep it stable.

Q: What does the Government's massive majority for the 18th

Amendment mean in terms of economic and political stability?

A: The country needs stability for economic growth. But we

have something even more. We have stability with democracy. In other

countries, they have not been so concerned about democracy and they have

been going for stability. If we take Singapore, they were not bothered

about democracy.

They had a stable regime. Lee Kuwan Yew regime has continued for such

a long time. A certain amount of stability was there in other countries

when there was a rapid economic growth. We are very proud that we have

stability and democracy. That is a model that we must preserve.

Q: Will the Government be able to bring down the cost of

living in the short or medium term?

A: Yes, when the inflation is low,it means the cost of living

is contained. Now everybody is talking about the cost of living. But

nobody is talking about the drop in rice prices.

They are complaining that tomatoes and fish prices have gone up. They

always talk about the cost of living when it comes to vegetables. But

those are remediable things. When they talk about cost of living, they

must look at the inflation rate as well.

When inflation increase, the public sector scream that the cost of

living has gone up. When the inflation is low, they keep quiet. When

vegetable price go up,it should help the farmer. When rice prices come

to a stable position, that benefit should go to the paddy farmer.

The Government has to balance the production side and the people who

really do the work have to be paid well. The office wallahs also have to

be paid but not at the expense of the people who are producing rice or

vegetables.

Others are just coming to office with a big bag and expect the

Government to give them a big salary. We have too much of people who are

sitting down and pushing papers here and there by blocking everything.

Bureaucracy is too large.

Those in the paddy fields and vegetable fields are too little. We

should increase the number of people in factories, paddy fields,

vegetable growing areas and reduce the number of those in offices. That

is how it should be. |