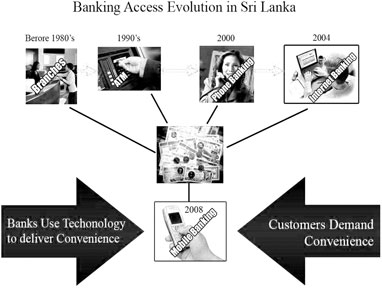

Technology

Branches at village boutiques :

Banking via mobile phones

by Gamini WARUSHAMANA

Thilaksha Kodituwakku, a young entrepreneur has developed a banking

solution which can deliver financial services through mobile phones.

|

|

Thilaksha Kodituwakku |

The solution which can be used by commercial banks has been tested

for security and confidentiality, said Kodituwakku

Responding to a recent article based on an interview with the Head of

Technology and Chief Software Architect of ICTA Sanjaya Karunasena on

service delivery through mobile phones, Kodituwakku said that he has

developed a complete banking solution for commercial banks to support

the delivery of financial services through mobile phones.

Managing director of Ekhash Lanka (Pvt) Ltd., Thilaksha Kodituwakku,

a former bank manager and professional marketeer said that he is trying

to convince the authorities and bankers on the advantages of this system

to the country.

The former Director, Bank Supervision of the Central Bank the late

Dr. Uthum Herath commended the viability of this solution.

Central Bank Governor Ajith Nivard Cabraal has positively responded

to a request and has given me an opportunity to present the solution to

Central Bank officials next week, he said.

The banking solution can be used to deliver banking services to rural

areas using the country’s advantages including the extremely high

telephone penetration and the high literacy of the people.

Today the majority of the population has no direct access to the

formal financial system though they need financial services.

However, most people still save money in tills and this dead money

does not come into the financial system.

Only 30 per cent of the population, especially those who live in

urban and suburban have easy access to bank branches and alternative

channels.

Their financial literacy level is very high.

The 70 per cent population living in rural areas are under banked or

unbanked and have no access to bank branches or alternative channels

while their financial literacy is very low.

Market segment

Most of the private sector companies have recognised the value of

this market segment. For instance, companies selling FMCG soap, shampoo

and food items use “Sachet Marketing” to sell their products to the

rural masses. Telco companies too have focused on this market by

introducing Rs. 20 and 50 reload packages and cards. The banks have

tremendous opportunities to tap this market and banking via telephone is

the ideal way forward.

The new M-banking model will give secure and quick banking service to

millions of people, Kodituwakku said.

Kodituwakku explained the operation of the model. The bank service is

delivered through agents and even small boutiques can act as bank

branches that accept deposits and people can also withdraw money.

This is similar to telco companies selling their services through

reload packages or phone cards.

The agents should have an account with the partner bank and maintain

a pre agreed minimum balance daily.

When a customer needs to deposit money in his account in the bank he

can visit an agent (A boutique in the village) and give money to the

trader and the trader transfers the money from his account to the

customer’s account.

The transaction will be complete within seconds and the customer and

the trader receive messages on their phones informing them that the

transaction was successful. The transaction will be complete within seconds and the customer and

the trader receive messages on their phones informing them that the

transaction was successful.

The system can be used for deposits, fund transfers, cash

withdrawals, micro finance operations, payment of utility bills, credit

card payments payment for goods and services and many more, he said.

This system is important in many ways. According to traditional

banking system in the country today people have to visit a bank or bank

branch to get the service. To reach a Teller machine too they have to go

to a town or a suburb.

We did some research in Kurunegala, Anuradhapura and the Nuwara Eliya

districts and found that most of the people who are excluded by the

formal banking system live in areas that are far from bank branches.

Most of them wish to save money and use other financial services.

However, the opportunity cost of one bank transaction is their daily

wage/earning from their economic activities in addition to transport and

other costs.

Internet banking

Internet banking is available but access is very limited and only a

few privileged people have broad band access. Several models introduced

previously such as palm top banking, banking at a post office and

doorstep banking have failed due to many limitations in technology or

other practical difficulties. SMS banking is the most insecure banking

system, he said.

Kodituwakku said that there are many advantages in this kind of

banking system. It will enable banks to reach the majority of the

population and attract the money that is circulating outside the banking

system.

It will increase the GDP in the long run as the people need not stop

their usual work to go to a bank.

People can access the formal financial system easily and reduce the

risk of their savings.

The people’s financial literacy will also increase.

The system will help poverty reduction and enhance the lifestyle of

poor people.

On the other hand banks could cut costs. Today the cost of a bank

transaction is around Rs. 50 if all the costs associated in a bank

operation.

For instance in Pakistan setting up a “agent location” is 1/30th of

the costs of setting up a branch and the running cost is cheaper as

1/100th of the running cost of a branch.

Kodituwakku has studied similar banking systems which have been

successfully implemented in many countries. Eko in India, Gcash

introduced by the Rural Bank Association of Philippines, Wizzit of Bank

of Athens, Africa and WING introduced by Standard Charted Bank, Cambodia

and Mcheck in Pakistan are some of the success stories. In India and the

Philippines bank transactions can be done through an agent or a small

village boutique. In India, the customer can even open an account

through an agent.

Ekash solution

To make this kind of banking solution a success there should be the

right approach, correct technology platform and appropriate marketing

strategies.

Customers should be able to access via any phone, the mobile or land

phone of any operator.

It should be a banking solution where the banks are responsible for

all transactions.

A proven security system, compliance to banking regulations and

Central Bank guidelines are essential.

The transaction should be as easy as making a telephone call.

Messages and instructions should be available in any language and the

people’s literacy should not be a barrier.

Kodituwakku assured that the Ekash solution that he has developed has

all these features.

He seeks the support of the Central Bank, Banks and telco operators

to implement the system in Sri Lanka.

JKH scholorships for Moratuwa varsity students

|

|

JKH Transportation Group President

Romesh David presents a scholarship to an undergraduate of

the Transport and Logistics Management Department at the

awards ceremony of the English Language Scholarship and

Mentoring Programs sponsored by JKH for undergraduates

reading for the Bachelor of Science degree in Transport and

Logistics Management (BSc T&LM Hons.) at the University of

Moratuwa. |

JKH’s Transportation Sector recently awarded 26 university

scholarships as part of its four year partnership with the Transport and

Logistics Management Faculty of the University of Moratuwa. The

scholarship awards coincided with the certificate distribution ceremony

of the English Language Scholarship Program and the Mentoring Program

which are also sponsored by John Keells Group for undergraduates reading

for the Bachelor of Science Degree in Transport and Logistics Management

(BSc. T&LM Hons.) at the University of Moratuwa.

The event was held on June 21, 2010 at the Cinnamon Grand Colombo. A

total of 26 university scholarships were awarded to the students: 21

merit scholarships to second, third and fourth year students, and five

need based scholarships for first year students. The merit based

scholarships reward academic excellence while the need based

scholarships help first year students reach their potential. JKH PLC has

awarded over 54 scholarships since the inception of this degree program

4 years ago.

The English Language Scholarship Program and the Mentoring Program

are aimed at enhancing the general capabilities and soft skills of the

students. Over 200 students were awarded certificates at the ceremony

which marks their first step as professionals in their chosen field.

Certificates of completion of the mentoring program were also awarded

at this event. This program involves the mentoring of students by senior

professionals in the transportation and logistics field.

The English Language Scholarship Program is sponsored by the John

Keells Social Responsibility Foundation. This program is attended by all

first year students and is of benefit to the students since the degree

program is also conducted in English.

Euromoney picks HNB as best Lankan bank

Hatton National Bank (HNB) was recognised as the ‘Best Bank in Sri

Lanka’ by the international Euromoney finance magazine for the second

time at the Euromoney Awards for Excellence 2010 Dinner held last week

in London.

Recognizing HNB as the Best Bank in Sri Lanka, Euromoney stated that

crucial to Sri Lanka’s economic future is a solid banking system, and no

lender has proved itself more capable over the past year than HNB.

Euromoney further stated that the privately run Colombo-based lender,

which recently celebrated its 120th birthday, posted pre-tax earnings of

Rs. 5.9 billion ($52 million) for the year 2009, up 24 per cent year on

year, on income of Rs. 39.4 billion.

Managing Director/CEO, HNB, Rajendra Theagarajah stated “It is truly

an honour to be adjudged the Best Bank in Sri Lanka by the prestigious

Euromoney finance magazine for the second consecutive time.

Our strong commitment towards delivering an unparalleled service to

customers, consistent growth recorded and continuous focus on enhancing

shareholder value are the cornerstones of our achievement”.

Since 1992, Euromoney, the world’s leading financial markets

magazine, has singled out outstanding institutions in finance.

Awards for Excellence have evolved with the markets they cover.

They now incorporate 25 global awards for banking and capital markets

and awards for the best banks and securities houses in almost 100

countries around the world.

The awards have one central theme - to recognise institutions and

individuals that demonstrate leadership, innovation, and momentum in the

markets in which they excel.

At the awards ceremony, Credit Suisse was adjudged the best global

bank and Deutsche Bank, the best global investment bank. CEO, Citigroup,

Vikram Pandit was recognised as Euromoney’s banker of the year.

CDB gifts IT lab to school in Hambantota

|

|

Students at the

computer lab. |

Citizens Development Business Finance Ltd (CDB) recently donated a

much needed IT lab, fully equipped with computers, LCD monitors,

printers, scanners, and internet facilities to HM/Nedigamvila Kanishta

Vidyalaya in Tissamaharama, in the Hambantota district.

This state-of-the-art IT lab was ceremonially opened by CDB’s Chief

Executive Officer Mahesh Nanayakkara, together with senior officials of

CDB, the School Principal P.N.M Kumarasinghe, students and well-wishers.

Speaking on the occasion Nanayakkara said, the main objective of such

projects is to give less privileged schools in rural areas access to

information technology and thus enable them to launch into a future

shaped by technological innovation.

The CDB Technology Centre paves the way for students such as those at

Nedigamvila Kanishta Vidyalaya to zoom in on future opportunities in the

growing IT sector as well as to acquire a skill which is indispensable

in any area of specialisation.

The project is implemented under the CSR theme of CDB Pariganaka

Piyasa (CDB Technology Centre).

Intec demonstrates low-cost charging and billing performance

A leading provider of Business Support System (BSS) solutions,

announced the completion of another successful performance benchmark of

its award-winning charging, billing and customer care system Singl.eView

v7.0.

The performance results reaffirmed Intec’s commitment to providing

software that offers exceptional performance on platforms that are a

fraction of the cost of traditional UNIX servers.

It also demonstrated that Singl.eView, running on Intel® Xeon®

processor 7500 series, easily supports millions of convergent prepaid

and postpaid subscribers, executing real-world service and business

processes.

The benchmark, carried out by Intec on Intels latest Xeon® processor

7500 series, validated the performance of Singl.eView’s critical

functions:

* Real-time rating and balance management

* Batch post-event rating

* Bill cycle processing

Singl.eView is relied upon by many of the largest and most innovative

communications service providers (CSPs) worldwide. Singl.eViews

efficient, distributed architecture allows CSPs to lower their operating

costs by supporting all rating, balance management, charging and billing

tasks on a single platform, serving postpaid, prepaid and convergent

customers for all classes of product and service.

The Intel Xeon® processor 7500 series ushers in a new era in

performance and scalability within the fast growing x86 server market.

Singl.eView, running on the Intel Xeon platform, provides a powerful

and cost-effective solution for today’s service providers, allowing an

attractive price-performance ratio with more than adequate headroom to

support the growing volume of increasingly complex demands of modern

transaction processing.

EMEA Director of Intel Software and Services Group, Wolfgang Petersen

said the results of this benchmark prove that BSS customers need no

longer be dependent on expensive proprietary servers, and can be

confident that Intel-based affordable processing solutions powered by

the Xeon® 7500 series can easily manage highly-demanding workloads, and

deliver the real-time performance necessary for a modern, converged

communications service provider.

HP introduces energy-efficient laser printer for SMBs

HP launched its environmentally-responsible imaging and printing

products and solutions, including industry-first innovations for small

and midsize businesses (SMBs) to obtain more value from their IT

investments and to reduce energy and paper use, reduce costs and

environmental impact.

Senior Vice-President, Imaging and Printing Group, Hewlett-Packard

Asia Pacific and Japan. John Solomon said, “HP is a leader in

environmental sustainability.

It is in our DNA to deliver solutions that make it easy for customers

to reduce their environmental impact and save money.

This aligns with our goal to remain the partner of choice for SMBs in

Asia Pacific by providing a value equation that encompasses how we can

help SMBs go green for their bottom-line and accelerate their business

growth.

HP introduces the most energy-efficient laser printer in the world(1)

The affordable, HP LaserJet P1102 and P1102w printers help customers

affordabley increase efficiency.

In addition, with HP Smart Install, the HP LaserJet Pro1102w lets SMB

owners quickly connect and print on-the-go or from virtually anywhere in

the home or small office. |