|

Point of view:

Tea industry is not without challenges

The theme selected for this year's Tea Convention was “ExclusiviTEA”.

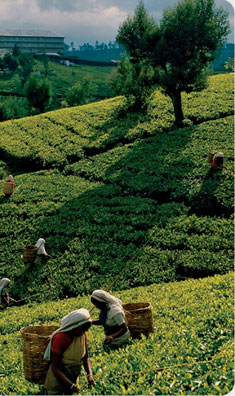

The rationale for this is that Ceylon Tea is an exclusive and unique

product. Being a speciality, it caters primarily to niche markets.

It represents the main source of orthodox Black Tea to the world.

Ceylon tea is grown and produced in seven major agro-climatic regions.

The seven major agro-climatic regions are further divided into 38

sub-regions, each with its own distinctive characteristics.

These are spread over three broad elevational classifications, with

varying soil types, a range of cultivatiom areas contrasting rainfall

patterns, temperatures and hygrometric gradations, There are over seven

- hundred factories manufacturing tea. Each one is unique in location,

elevation, climatic conditions, soil types and production processes, and

with twenty five different grades. These are spread over three broad elevational classifications, with

varying soil types, a range of cultivatiom areas contrasting rainfall

patterns, temperatures and hygrometric gradations, There are over seven

- hundred factories manufacturing tea. Each one is unique in location,

elevation, climatic conditions, soil types and production processes, and

with twenty five different grades.

Ceylon Tea and the names of the seven major agro-climatic regions

have been registered in Sri Lanka as Geographical Indications, with logo

designs as identification symbols. Over time these eight Geographical

Indications will be registered in all major consumer markets, as

protection against counterfeiting.

Ceylon tea is also acclaimed as the cleanest tea in the world. It is

the only country officially recognised as a producer of Ozone Friendly

Tea. It has been permitted, under the management of the Sri Lanka Tea

Board, to use the “Ozone Friendly Pure Ceylon Tea” logo, which has been

incorporated into an “Ozone Friendly” sticker that may be attached to

all retail tea packs of Ceylon tea exported from origin.

The International Tea Conventions held in Colombo are renowned for

their innovative content and stimulating deliberations, in addition to

providing opportunities for networking.

The Convention was conducted over five sessions, dealing with

different aspects relating to the main theme - 'ExclusiviTEA'.

Each session comprised five to eight presentations made by reputed

experts in their respective subjects.

The subjects ranged from the 'Uniqueness' of Ceylon Tea, to its

adherence to a wide spectrum of hygiene, food safety, ethical and

environmental codes, conformity to international quality parameters,

international compliance regimes, product quality and process practices

and labour standards, supported by developed scientific and research

facilities in Biotechnology, integrated pest management, conservation

and sustainability strategies and eco-friendliness and carbon balance;

the availability of state-of-the-art facilities in printing, packaging,

processing, value addition and quality control to having access to the

advantage of enhanced value of logos and upgraded regulations to control

counterfeiting.

Arising from this, constituting an all encompassing, dedicated

industry standard for Ceylon tea, to establish its distinct identity,

and resolutely promoting its acceptance and recognition internationally

was identified as the 'Key Take-away' of the Convention and has been

determined as the primary objective of the Industry.

Notwithstanding an overwhelmingly successful Convention, the tea

industry is not without very serious challenges. A general trend of

declining prices and demand has been experienced at the auctions over

the past many months and is likely to continue in the foreseeable

future.

This is mainly the outcome of the prolonged political turmoil in the

West Asian and North African regions, international trade sanctions

imposed on certain countries and the economic dilemma faced by many

countries worldwide.

The lack of optimism in the future and dearth of export orders have

resulted in a progressively increasing volume of teas offered at the

weekly tea auctions remaining unsold.

For producers, this has created serious cash flow problems, which

have been compounded by the significant increase in costs on account of

the revised wage package, excluding any linkage to productivity, for

plantation workers negotiated in July last year and the sharp

appreciation in electricity, fuel and various other charges,

particularly the most recent.

The arrears payable from April 2011, within the framework of the wage

package, and the granting of the subsequent customary Festival Advances

to the plantation workers have placed many regional plantation

companies, especially those with portfolios comprising either

exclusively or predominantly tea properties, in a virtually unenviable

position, financially.

The crop shortfall due to adverse weather conditions aggravated the

situation. Private factories, which are overwhelmingly the main buyers

of the green leaf harvested by the smallholder sector, have been

similarly affected by these circumstances, while the Smallholders, whose

returns have been sharply diminishing, find that their operations are

increasingly becoming financially unsustainable.

The Gross Sales Average in respect of the Corporate Plantation Sector

has declined from Rs.390 to Rs.325 over this period and the deficit

between the Cost of Production and the Net Sale Average is about Rs.75

to Rs.100 per kg, particularly in respect of teas from the higher

elevations.

As a consequence, low grown teas, which account for the bulk of the

country’s tea production, are now barely breaking even, as against

comfortable margins earned previously. High and mid grown teas, which

were not showing profits previously, are now recording significant

losses.

The National Gross Sales Average [NGSA] reflects an equally alarming

situation, although not to the same extent as in the case of those

applying to the Corporate Plantation Sector, which does not have the

advantage of a high percentage of low grown teas.

During May to September 2011, the NGSA had declined, from Rs.395 in

January/February 2011, to around Rs.340, whilst a comparison of prices

realised in January and February in 2011, against the same two months in

2012, show a less significant decline from Rs.395 to Rs.350. This slight

improvement is on account of the fact that two major producers, North

India and Vietnam, suspend harvesting during this period due to the

winter, creating an imbalance in supply and demand.

The prognosis for the next quarter is far less favourable. It is

usually a high cropping period and, on the basis of current weather

conditions, 2012 is expected to surpass the performance in 2011.

Also India and Vietnam will re-join the supply chain, after the

winter break, and, with the onset of summer, the consumption of tea in

the two regions that account for the highest imports of Ceylon Tea, the

Middle East and Russia/the CIS countries, customarily consume less of

this beverage. This does not portend well for prices.

Exporters faced inequitable competition in the global market place,

as a result of sharp currency devaluations in both consumer and other

producer countries, an unrealistic exchange rate being artificially

maintained for the Sri Lanka Rupee, till recently, and additional levies

being imposed on exports, such as the Promotion and Marketing Levy and

the supplementary Rs.6 Cess on bulk tea.

They were further disadvantaged as a consequence of the suspension of

some channels of procurement of teas which were available to them prior

to end 2008 and the stringent controls placed bythe State Regulatory

Authority on imports of tea from other origins for purposes of value

addition, also introduced during the last global financial crisis in

2008.

Trade sanctions imposed on countries such as Iran and Syria have

caused export restrictions and undue delays in the receipt of payment

against shipments.

With these sanctions expected to be more rigidly implemented in the

ensuing months, the situation cannot but be exacerbated.

The devaluation of the Sri Lanka Rupee in the budget was “too

little-too late”, whilst the subsequent depreciation in the value of the

rupee, following the 'free float', has had little impact on tea prices.

In the final analysis, the ensuing months reflect an ominous scenario

for the Tea Industry.

With the country’s population depending on this industry, the

negative outlook for tea could escalate into a national problem of

calamitous proportions, in regard to the economy vis-à-vis export

earnings, employment and the sustainability of the industry. State

authorities should view this as an overwhelming priority.

In these circumstances, it is imperative that the funds approved by

the Cabinet should be judiciously invested by the Promotion and

Marketing Committee of the Sri Lanka Tea Board, which is driven by the

private sector.

The s forum should steer towards using these resources to expand into

the largely untapped markets, such as China and India, which hold the

greatest potential for the creation of new marketing opportunities,

thereby shifting dependency from the volatile Middle Eastern region, the

financially challenged EU and US markets and the increasingly

protectionist policies of the Russian Federation, which are adversely

impacting the vital value added tea exports of the country.

The Colombo Tea Traders Association

|