Role of private sector in driving economic growth

By Rohantha N. A. Athukorala

Last week at the launch of the Central Bank '2014 Road Map' my mind

went to the days when I used to travel in the C130 military aircraft

with soldiers to Jaffna during the last phase of terrorism and under

stringent convoy protection we used to travel from the Palaly airport to

the heart of Jaffna town on work. Last week at the launch of the Central Bank '2014 Road Map' my mind

went to the days when I used to travel in the C130 military aircraft

with soldiers to Jaffna during the last phase of terrorism and under

stringent convoy protection we used to travel from the Palaly airport to

the heart of Jaffna town on work.

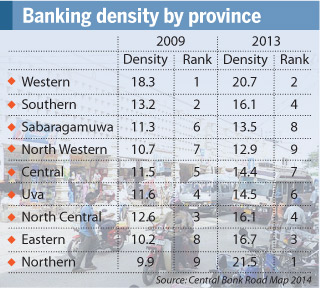

Banking density

Today, four years after the end of terrorism, the economy has

recorded an average growth of 6.7% with the hotels and restaurant sector

booming at 13.6%, the Eastern Province growing by 25% to 6.3% of the GDP

registering Rs 472 billion while the northern economy growing by 25.9%,

as a share of the GDP - 4%, registering Rs. 305 billion which is the

economic dividend of peace.

The banking density picking up from 9.9 in 2009 to become number one

at 21.5 in 2013 indicates the asset based growth in that part of the

country and the overall increase in economic activity. (Source : Central

Bank Road Map 2014)

Tourism

On the tourism front, way back in 2009 the income generated by

tourism was US $ 447 million and today this business has increased by a

billion to US $ 1.35 billion is an indication of the peace dividend. The

question of controlled sector tourism struggling to grow given that the

uncontrolled sector has captured this business, needs careful analysis

and may be a strategy to correct the situation. But the numbers are

encouraging from a macro basis. Tourism Performance - 2000 to 2013.

(Source : Central Bank Road Map 2014)

|

Rohantha N. A. Athukorala |

To take these macro economic numbers to private sector performance

let me give an example: Lion Brewery (Ceylon) PLC (LBC). The company was

incorporated in 1996 by Ceylon Beverage Holdings PLC (CBL), formerly

known as Ceylon Brewery PLC, at Biyagama and was commissioned in 1998.

Background

The local alcohol industry consists of 22 licensed producers that

accounted for alcohol production of approximately 153 million litres in

2010.

However, traditionally the illicit production of alcohol has also

been rampant in the country (kassippu being the common form of illicitly

distilled alcohol and the most frequently consumed illicit alcohol).

According to a study carried out by LBC, illicit alcohol dominates

the consumption of alcohol in the country with a consumption level of

50-60%. Of the legal alcohol consumption in 2010, spirits accounted for

a market share of 59% while beer accounted for 41%.

Based on data available in the public domain, the performance of the

organisation after the end of terrorism has been outstanding with the

brand value of 'Lion' in 2010 valued at Rs 2 billion ranking it as the

21st brand among the top Sri Lankan brands by LMD.

The brand value has changed by 47% compared to 2010 and the brand was

valued at Rs 3 billion in 2011. A remarkable increase of brand value by

128% in 2012 ranked the brand at the 9th position at Rs 6.8 billion.

This dramatic change was due to many reasons.

Government policy decisions such as Mathata Thitha and the

restriction on advertising alcoholic beverages creates a huge entry

barrier to new companies entering the economy of Sri Lanka. The end of

terrorism has created an expanded market especially in the North and the

East where new distribution channels are being opened.

Increase in the number of tourist arrivals impacted a lot on increase

of the soft liquor market. Increase in the number of tourist arrivals impacted a lot on increase

of the soft liquor market.

Expanding to new markets with different market segments eg. 'Machang'

Pub.

The Enterprise Value of the LBC also gone up with the brand value

from Rs 6 billion in 2010 to Rs 18 billion by 2012, a change of 211%.

The cumulative revenue of LBC has grown from Rs 8 billion to Rs 17.5

billion from 2010 to 2012 an increase of 223% which was the highest

revenue in LBC's history.

As per information made available through the Excise Department, the

annual production of beer increased during 2010, 2011 and 2012, as a

result of:

* Increased consumer spending due to higher disposable income -

economy growth was 8.3% during 2011 and the continuous pattern of

economy growth during 2012.

* Improved business confidence.

* Increased tourist arrivals - 46% increase in tourist arrivals and

hotel occupancies of over 70%; beer consumption is more favoured by

tourists compared to the local population.

* Focus on curtailing the production of illicit alcohol.

* The general 'feel good' factor in the country contributed to

improved consumer sentiment.

* Opening up of the Northern and the Eastern regions.

* Expansion of recreational and entertainment facilities.

Considering that the brands under Millers Brewery have for sometime

been out of the market, Millers will have to embark on a revitalisation

campaign to regain the lost market visibility. With the current

restrictions in advertising and distribution this might be a challenge.

With the idea moving close to the customer and moving further

downstream, CBL Retailers (Pvt) Ltd. was set up as a fully owned

subsidiary of Ceylon Beverage Holdings PLC, which runs a chain of wine

shops under its own name. CBL Retailers also operates a chain of pubs

styled 'Machan' to provide the consumer value for money experience and

also to facilitate a 'beer culture' in the country.

Being the third largest tax-payer to the government, LBC's

contributing Rs 42 million per day as government taxes and they pay 40%

as income tax being in the alcoholic industry whereas other companies

pay 28% as final tax. This explains the low profit margins of the

company.

During 2011 the MPS did not reflect the increase in EPS and Brand

Value whereas the MPS stood at Rs 200 in both years without any change.

The reason behind the issue is the decline of the stock market in Sri

Lanka.

The ASPI and Milanka price index fell by 25% and 29% in 2011 whereas

the LBC share price remained constant without making any capital losses

to shareholders.

However, the share price has shot up to more than Rs. 300. This

robustness gained mainly through its brand equity with the consumers and

investor confidence given the shareholder value that the company is

expected to generate.

The brand value of 'Lion' in 2010 was Rs 2 billion, ranking it as the

21st brand among the top Sri Lankan brands by LMD.

The brand value has changed by 47% compared to 2010 and the brand was

valued at Rs 3 billion in 2011.

The Enterprise Value of the LBC also gone up with the brand value and

the value of Rs 6 billion in 2010 has increased to Rs 18 billion by 2012

resulting in a change of 211%. Further analysis is necessary on the

basis of valuation to explain the higher rate of increase in enterprise

value compared to the increase in brand value.

One consideration will be the expansion initiated to increase

capacity which in turn increase the value of tangible assets. Brand

Finance uses enterprise value as a benchmark for their brand valuations,

since brand is one of the many assets that make up a business.

If all the assets in a business (tangible, such as buildings and

machines, and intangible, such as patents, airport landing slots, a

trained workforce, and also goodwill) are added up, it will give you the

enterprise value.

Other brands owned by the company may be another contributor to

increase in enterprise value.

Hence we see how macro performance of the economy can be seen with

the reality in the market place in the private sector.

The challenge is how we can drive the economy to the 8.5% growth

targeted for 2016 and how the private sector can take centre stage in

the development agenda given that in the 'Doing Business Index' we are

at 85th position in the world even though we are the best in South Asia. |