Budget 2016: From promise to compromise

By Uditha Kumarasinghe

The Third Reading of Budget 2016 was passed after 16 of its revenue

proposals were amended in compliance with the call made by Opposition

political parties and trade unions. This would go down in the annals of

the country as the first time a government had bowed to the wishes of

the people signaling its strong affinity and commitment towards

upholding democratic norms.

Winding up of the Third Reading of the Budget debate, Finance

Minister Ravi Karunanayake said government expenditure for next year

could exceed Rs. 35.5 billion as a result of the amendments.

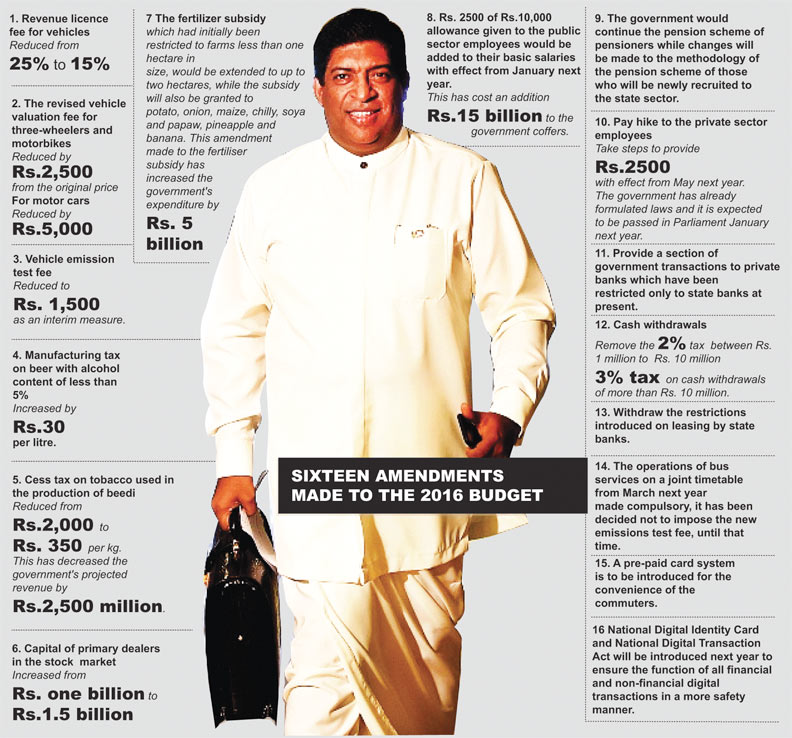

The sixteen amendments to the Budget are:

1. Revenue licence fee for vehicles reduced from 25 percent to 15

percent.

2. Revised vehicle valuation fee for three-wheelers and motorbikes

reduced by Rs.2, 500, while the valuation fee for motor cars has been

reduced by Rs.5,000.

3. Vehicle emission test fee reduced to Rs. 1,500 as an interim

measure.

4. Manufacturing tax on beer with an alcohol content of less than

five percent has been increased by Rs.30 rupees per litre.

5. Cess on tobacco used in the production of beedi has been decreased

from Rs.2,000 to Rs. 350 per kg. This has decreased the government's

projected revenue by Rs.2,500 million.

6. The capital requirements of primary dealers in the stock market

has been increased from Rs. one billion to Rs.1.5 billion.

7. The fertilizer subsidy, which had initially been restricted to

farms less than one hectare in size, will be extended to up to two

hectares, while the subsidy will also be granted to potato, onion,

maize, chilly, soya and papaw, pineapple and banana growers. This

amendment to the fertilizer subsidy has increased government expenditure

by Rs. 5 billion.

8. Rs. 2,500 of the Rs.10,000 allowance to public sector employees

will be added to their basic salaries from January. This has cost the

government an additional Rs.15 billion.

9. The government would continue the pension scheme for pensioners

while changes will be made to the methodology of the pension scheme for

those newly recruited to the State sector.

10. Steps will be taken to provide a Rs.2,500 pay hike to private

sector employees from May next year. The government has already

formulated laws and it is expected to be passed in Parliament in

January.

11. Provide a part of government transactions to private banks which

has been restricted only to State banks at present.

12. Remove the 2 percent tax on cash withdrawals between Rs. 1-10

million and 3 percent tax on cash withdrawals of more than Rs. 10

million.

13. Withdraw the restrictions introduced on leasing by State banks.

14. Operations of bus services on a joint timetable from March next

year has been made compulsory and the new emission test fee will not be

imposed until such time.

15. A pre-paid card system will be introduced for the convenience of

commuters.

16. The National Digital Identity Card and National Digital

Transaction Act will be introduced next year to ensure the function of

all financial and non-financial digital transactions safely.

Finance Minister Karunanayake said before making these 16 amendments,

the government's projected revenue for next year was Rs.2,005 billion

and total expenditure was Rs. 3,389 billion while the Budget deficit was

Rs. 649 billion.

However, the amendments made to the Budget have increased the

government's expenditure by Rs.35.5 billion. The government hopes to

minimize the expenditure by bridging the gap between savings and

revenue. Rs. 4 billion is expected to be saved through the management of

fuel and transport expenditure while the money allocated to expedite the

digitalization program has been suspended saving Rs. 3,000 million.

“We are trying to capitalize undercapitalized banks. Through the

increase of manufacturing tax on beer the government hopes to raise

Rs.500 million,” the Finance Minister said.

Meanwhile, Finance Ministry Secretary Dr. R.H.S. Samaratunga told the

Sunday Observer that the government will not slash any of the projects

due to the additional expenditure of Rs.35.5 billion as a result of the

amendments.

Usually projects start on the first of January each year. Each

project has to show progress. Some work goes on as scheduled while some

work may be delayed. These things may happen when a development project

is implemented. However, the Finance Ministry is able to manage these

things.

Dr. Samaratunga said it would not be difficult to adjust money as

some of the projects would naturally not progress at the expected rate.

It would only be a reallocation of funds. Sometimes, the completion of

the projects may get delayed. However, there are some savings in certain

areas. The Ministry is aware about the projects which are slow.

The vote on the Third Reading of the maiden Budget of the National

Unity Government was passed by a majority of 109 votes in Parliament on

December 19 and 160 MPs voted in favour of the Budget while 51 voted

against.

Thirteen MPs including former President Mahinda Rajapaksa were absent

at the time of voting. The JVP and the UPFA rebel MPs who call

themselves the ‘Joint Opposition’ voted against while the UNP, TNA, UPFA

members in the Government, SLMC, CWC and EPDP voted for the Budget.

|