Mini Budget 2016 and VAT

by P. Guruge

The finalised amended proposals for ‘Budget - 2016’ are yet to be

presented in Parliament. However, of the two main proposals, the

proposal regarding the increase of miscellaneous income tax rate from

the originally proposed 15% to 17.5%, for the year of assessment

2016/17, may not produce any additional revenue, this year as explained,

in my previous article titled ‘Mini Budget 2016 and its modifications’.

(Sunday Observer Business - 24.4.2016)

As a result, the entire additional revenue needed may have to be

extracted through the Value Added Tax (VAT). As a result, the entire additional revenue needed may have to be

extracted through the Value Added Tax (VAT).

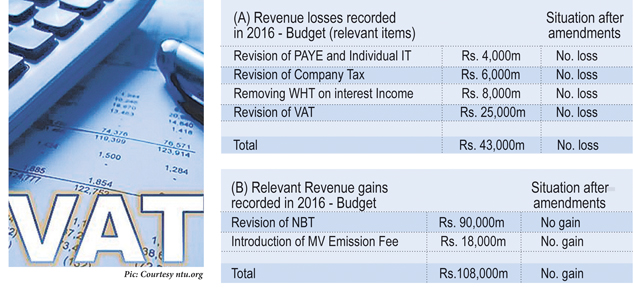

The illustration, using the statistics from Annexure-I to the

original 2016-Budget shows the importance of the additional VAT revenue

to bridge the Budget gap.

Accordingly, to maintain the original Budget deficit there is a need

to mobilise around Rs. 65,000 million (108,000 less 43,000) in

additional revenue, subject to any other changes in the original

estimates.

On the basis of a calculation made taking VAT revenue for 2015 (as

explained in my previous article), the VAT rate increase from 11% to

15%, from May 2016 to December 2016, may generate additional VAT revenue

of around Rs. 49 billion.

But the amount needed may be around Rs. 65 billion. The proposed

removal of exemptions may not generate additional revenue sufficient to

cover the deficit and if any other additional revenue is not be

generated then the original Budget deficit may not be maintained.

Amendments

Recent amendments to the VAT Act have drastically eroded the VAT

base:

Certain amendments effected by the Amendment Act No. 11 of 2015, have

greatly reduced the VAT revenue and made it difficult to implement the

proposed VAT rate increase in the relevant areas. As a result of this

amendment, there is no VAT liability on motor vehicles, cigarettes,

liquor and ethyl alcohol.

The relevant amendments are given below -

The VAT liability on certain motor vehicles imported and locally

manufactured has been removed from October 25, 2014.

The VAT liability on cigarettes was removed from October 25, 2014.

The VAT liability on liquor imported and locally manufactured was

removed from October 25, 2014.

The VAT liability on ethyl alcohol imported or manufactured and supply

was removed from January 1, 2015.

As a result of these exemptions, the VAT revenue which was Rs. 102

billion on imports in 2014, dropped to Rs. 75 billion in 2015.

The removal of these items from the VAT was a part of the grand plan

of ‘the previous financial authorities’ to dilute the importance of VAT

in our fiscal system.

Strange

However, it is very strange that the government did not reconsider

these matters before incorporating the relevant provisions in the

amended legislation which was certified on October 30, 2015.

Now, the question is whether the proposed VAT rate increase will be

applicable to the above items as well and if not why? Irrespective of

the formula adopted to arrive at the tax base of the above items, it

should be revised to include this increase in the VAT rate.

It was not clear how these ‘all inclusive tax bases’ for the above

items were revised to accommodate the Customs Duty increase and PAL

increase proposed in Budget - 2016.

Exemption relating to leasing activities –

The finance leasing facilities and operating leasing facilities which

were liable to normal VAT have been classified as items liable to

Financial VAT, from October 25, 2014, under the same amendment.

By this change, the VAT revenue collectible by the IRD may have been

greatly reduced and it may be appropriate to make a proper inquiry on

this matter and make changes to ensure increased VAT revenue collection

from this sector.

This is important because the taxable VAT base of leasing

transactions under the normal VAT system was always higher than that of

the financial VAT system. Although the rate increase will be applicable

to both, (Normal VAT and Financial VAT) the difference in the taxable

base will give less revenue under the financial VAT system.

Unimpressive revenue collection

For example, in 1978 the tax revenue was 24.2% of the GDP. But, after

30 years, in 2008 with a much higher level of development, the tax

revenue had dropped to 14% of the GDP and the country experienced the

lowest rate of tax revenue in 2014 which was10.7% of the GDP. This is

how the ‘previous regime’ achieved their fiscal consolidation.

Inadequate revenue collection in all areas of taxation in Sri Lanka

is mainly due to the inadequate political support to set up a suitable

tax system which generates adequate revenue.

As a result, an unbelievable level of exemptions has crept into the

tax system. For example, under the VAT, the tax base is the consumption

expenditure within Sri Lanka.

Of the total consumption, it was estimated that over 60% had been

exempted. Even in income taxation, a major portion of economic

activities has been exempted either fully or partly. It is natural that

a higher rate of tax should be applied when the relevant tax base has

been narrowed, to collect the revenue needed. If the tax base can be

expanded then the rates can be lowered.

In Sri Lanka, the highest VAT of 20% was applied at the inception of

the VAT on August 1, 2002, along with 10% for certain supplies. However,

this was reduced to 15% on January 1, 2004.

Ad-hoc basis

Again from January 1, 2005, the 18% was introduced along with 5% for

certain supplies. On January 1, 2009, 12% was introduced. All these

changes in the VAT rate were implemented on an ad-hoc basis without any

systematic analysis of the VAT base and revenue needs.

Although, there were fluctuations in the relevant VAT rates, no steps

taken to arrest the ever increasing exemptions in Sri Lanka’s VAT

system.

Setting up an ideal fiscal policy for the country is a major

responsibility of the Yahapalana government.

Without adequate revenue to meet expenditure, in a country where the

revenue collection is barely sufficient to pay salaries and wages to

public sector employees, massive interest payments, and other subsidies

and grants to State-owned enterprises to cover their recurring losses,

the economic prosperity may be another distant dawn.

Another, important area is the tax administration. Any well drafted

legal framework may not produce results, if the administration is weak.

The VAT administration should be handled by well trained and efficient

officials, else it will produce revenue losses.

The VAT fraud in our VAT administration was a good example. This

should have been an eye-opener to the officials and policy makers. The

steps taken following this massive fraud has further weakened our VAT

system. Even the Paranagama Commission Report which dealt with this VAT

fraud was not published.

Procedural aspects of the VAT administration need to be improved. For

example, let us consider the VAT payment system applicable to

non-manufacturers now. They should pay VAT twice a month. But many VAT

registered persons do not follow this payment system. Even the officials

ignore this need.

It is doubtful whether lethargic tax administration will implement

this VAT rate increase in a proper manner, to collect the anticipated

additional tax for the government. There should be extraordinary

supervision of payments at least for the first three months and proper

monitoring thereafter.

The writer is a Senior Tax and Investment Consultant

|