Cracking the Panama trove

Lankan authorities seek reinvestment in the country and immediate declaration of

assets :

By Dilrukshi Handunnetti

The Exchange Control Unit of the Ministry of Finance together with the Central

Bank have commenced investigations into the Sri Lankan nationals named in the

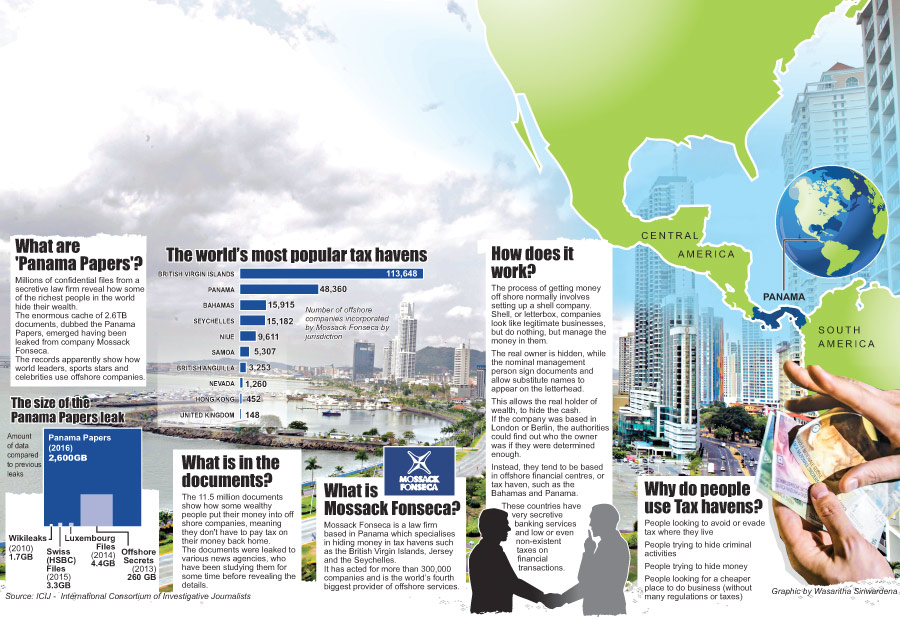

Panama Papers, a comprehensive probe by the US-based International Consortium of

Investigative Journalists (ICIJ) on offshore accounts held by companies and

individuals.

A top Finance Ministry source confirmed that letters have been sent to those

named in the Panama Papers, requesting full disclosure of their financial

status. The period of authentication is two weeks – within which the listed

parties –be they officers, beneficial owners or nominees – are required to offer

a legal explanation on offshore company engagement.

“The letter requests them to voluntarily declare their offshore assets and an

invitation to reinvest in Sri Lanka by following domestic financial

regulations,” the source said. The letters have already been dispatched.

Cracking the whip

Meanwhile, the Financial Corruption Investigations Department (FCID) has

commenced inquiries, independent to the process driven by the finance

authorities. An FCID insider said the authorities were keen to verify the data

dossier on Sri Lankans, due to the possibility of serious tax evasions and

non-disclosure of wealth using offshore companies set up in countries with lax

financial regulations.

Responding to the revelation of names, Finance Minister Ravi Karunanayake, said

every attempt will be made to discover any tax evasions by those listed and

accused the former government of being complicit in aiding financial fraud by

not conducting investigations against Sri Lankans listed in the 2013 ‘offshore

leaks’ by the ICIJ.

He said senior Ministry officials, including representatives from the Department

of Inland Revenue and the Department of Exchange Control ‘will probe the matter

to an end.’ The inquiry team is mandated to access banking details of those

listed and study their wealth as well as savings.

Among those listed was Yapa Hettipathirannahalage Nissanka Yapa Senadhipathi, a

close associate of former defence secretary and presidential sibling, Gotabhaya

Rajapaksa. His company, Avant Garde Pte Ltd was among the listed entities,

though Senadhipathy’s lawyers have promptly rejected any offshore operations as

being yet another ‘baseless allegation.’

Senadhipathi’s Avant Garde is a massive security operation with companies in

Panama and Cyprus. In 2015, a Navy raid of one of the company’s vessels, MT

Avant Garde, in the Galle Harbour led to the recovery of undisclosed weapons

with documents that underestimated the weapons on board.

Meanwhile, sources also said, both the US Financial Investigations Unit and the

Federal Bureau of Information have been contacted well before the Panama Papers

disclosure, requesting information and assistance to trace monies stashed away

in tax havens by Sri Lankans. Key figures of the previous administration have

faced allegations of amassing wealth and stashing the proceeds in tax havens to

avoid criminal action as well as heavy taxes.

Nature of probe

A top Finance Ministry source said, once the authentication process concludes,

the authorities, based on primary information, would initiate criminal

investigations into possible money laundering and tax evasions.

The source, explaining the mandate said: “The new committee is not confined to

probe information from Panama Papers leaks only. It will look into the 2013

‘Offshore Leaks’ as well. If they declare their actual wealth during this period

of two weeks, authorities may consider different options. It would be wise for

them to reinvest and that’s the way to avoid legal action, if found guilty of

evading taxes.”

Explaining further, the source said, while it was not illegal for Sri Lankans to

hold offshore accounts, he said it was mandatory to declare it under the

financial regulations.

“Sri Lankan citizens can invest their wealth in offshore entities but the

incorporation should be disclosed and registered with the Inland Revenue

Department. The balance sheets should be submitted periodically to the Exchange

Control Department to ensure the dividends return home. Non-registration is a

violation of the law.

They need twin registration – with the Department of Inland Revenue and the

Exchange Controls Department of the Central Bank.

In this backdrop, President Maithripala Sirisena has called for global support

to recover hidden Sri Lankan assets.

British Prime Minister David Cameron announced the Global Forum for Assets

Recovery at the global Anti-Corruption Summit in London recently which seeks to

bring together governments and law enforcement agencies on the possibilities of

returning stashed away assets to several countries including Sri Lanka.

Back home, the Presidential Taskforce for the Recovery of State Assets and

Proceeds of Crime, an initiative by President Sirisena in 2015, is now poised to

inquire into the Panama Papers.

The Task Force is chaired by well known anticorruption campaigner and senior

lawyer J.C. Weliamuna. Additional Solicitor General Yasantha Kodagoda PC serves

as the Secretary General.

The team is tasked to locate proceeds of crime and State assets which may be in

foreign countries and take measures to have such proceeds returned to the

island.

On May 9, ICIJ made public a tranche of the Panama Papers database, releasing a

2.6 terabyte of data of over 11.5 million financial and legal records currently

in the possession of the International Consortium of Investigative Journalists (ICIJ).

The ICIJ’s searchable

database published on May 9 revealed 22 offshore accounts related to 19 Sri

Lanka domiciled individuals.

Sri Lankan names

1. KENNETH JOHN PENDIGRAST, Scatola Finance Ltd, C/O 28/F.; Seabright Plaza;

9-23 Shell Street; North Point; Hong Kong

2. YAPA HETTI PATHIRANNAHALAGE NISSANKA YAPA SENADHIPATHI, Avant Garde Pte Ltd,

Cantidad Complete 25.3736

3. MOHAMED SIDDEEK MOHAMED ALI, Kalin International Company Limited, Charter

Place; 23/27 Seaton Place; St. Helier; Jersey; Channel Islands JE1 1JY

4. MOHAMED SIDDEEK MOHAMED ALI, KAT Minerals and Metals Ltd., Charter Place;

23/27 Seaton Place; St Helier; Jersey; Channel Islands

5. SENERATH BANDARA DISSANAYAKE, Avant Garde Pte Ltd, Est. Rhodia da CD Resd

Colina; 5151; CA 22; DT de Barao Geraldo. CEP 13084-000; Campinas-SP; Brazil

6. MIN XUAN, Lenzski International Ltd., Chkalova Str.; bld. 27; Apt. 57;

Zhukovskiy City; Moscow Region; Russia

7. Jayakody Arachchige Dona Marian Srini Pamela Jayakody, Grand Rise Industry

Ltd, Flat M; 9/F; Bloc 1 Grandway Garden; Tai Wai; Shatin; New Territories; Hong

Kong

8. PALAVINNEGE SUMITH CUMARANATUNGA, EMPIRE STAR HOLDINGS LTD.G/F.; 38 Oxford

Road; Kowloon)

9. KENNETH JOHN PENDIGRAST, Paskeville Trading Ltd., Flat G; 17Th Floor; Two

Robinson Place; 70 Robinson Road; Hong Kong.

10. JAYAKODY ARACHCHIGE DONA MARIAN SRINI PAMELA JAYAKODY, Lucky Stone Indus

Ltd., Flat M-N; 24/F; Houston Building; 32-40 Wang Lung Street; Tsuen Wan; N.T.;

Hong Kong

11. PRASANNA ATHANASIUS SIRIMEVAN RAJARATNE, Avant Garde Pte Ltd, Khaqani Street

23; Apt 23 Azerbaijan; Baku

12. TRISTAN LAURENS BERNARD, Hotel IQ International Ltd., Landstrasse 97; P.O.

Box 17; 9494 Schaan; Liechtenstein

13. Nicola Dawn Hakansson, NETWORK LIMITED, Le Regina; 15 Boulevard des Moulins;

MC98000; Monaco

14. Michael Robert Nasmyth McPherson, Kachine Limited, No. 14; Yu Jia Qiao Nan

Li; Xia Shi Zhen; Hai Ning Shi; Zhe Jiang; China

15. Aroon Hirdaramani, Brown International Limited, Menthonis 11 1070 Nicosia

Cyprus

16. MONA HIRDARAMANI and AROON HIRDARAMANI as Joints tenants with Rights Of

Survivorship, Stonecroft Investments Inc., Menthonis 11 1070 Nicosia Cyprus

17. ARUN PRAKASH MAHTANI, Passion China Limited, N-90-01 Jelatek 2; Seri Maya;

Jalan Jelatek; 54200 Kuala Lumpar; Malaysia

18. Mukesh Khubchand, Advani Investments Limited, No. 26 Mengzhui Road; Chenghua

Sectin; Chengdu City Of Sichuan Procince; P.R. China

19. NG YIN PENG, Genius.Com Ltd., Rm 401; No. 2; Building 1; Bai Jing Fang Xin

Cun; Xia Cheng District; Hangzhou City; Zhejiang Province; P.R. China

20. SIMON FINCH, Best Cheers Limited, Room 202; No. 1; No. 29 Changbaishan

Village; Yangpu District; Shanghai; P.R. China

21. Y H P KITHSIRI MANJULA KUMARA YAPA, Avant Garde Pte Ltd, Villa 57; Delmon

Avenue; Manama 327; Bahrain

22. Christopher Rohan Martin, Trump Trading Limited, Villa 26/B26 Govt of Dubai

Villas Dubai

Glossary of terms

*Offshore Entity:

A company/ trust/ fund created in a low-tax, offshore jurisdiction by an agent

* Agent (registered agent/ offshore service provider):

Firm that provides services in an offshore jurisdiction to incorporate, register

and manage an offshore entity at a client’s request

*Officer:

A person/ company playing a role in an offshore entity

* Intermediary:

A go-between for someone seeking an offshore corporation and an offshore service

provider – usually a law-firm or a middleman – requesting an offshore service

provider to create an offshore firm for a client

* Beneficial owner (ultimate beneficial owner or beneficiary):

True owner of a company. In the offshore world, the identity of beneficial

owners is often kept secret.

* Bearer shares:

Whoever physically holds a certificate of shares is considered the owner of the

shares. ‘Bearer shares’ provide one of the deepest levels of secrecy. Many

countries have banned bearer shares because they are considered a facilitation

of tax evasion and money laundering. In the ICIJ database, bearer shares are

sometimes referred to in Spanish as “Portador.”

*Nominee:

A person/ company that acts on behalf of the beneficial owner of an entity to

provide an extra level of secrecy

* Nominee director:

Stand-in who controls a company on paper but exercises no real authority over

its activities

* Nominee shareholder:

A person listed as a shareholder on a company’s documents but has no real power

over the company or claim to its assets (used for hiding the identity of the

real owner)

* Power of attorney:

Authorization given to a person to represent an offshore company, including

general and specific powers

* Incorporation date:

The date an offshore entity was created

* Dormancy date:

The date an offshore entity became inactive

*Inactivation date:

The date when a client required the agent to deactivate an offshore entity. (The

actual deactivation can be on a later date.)

*Struck off date:

A company becomes ‘struck off’ when it fails to be in good standing.

This happens when it fails to pay license fees. In the offshore world, this is

equal to closing an entity, although it can be reactivated by subsequent payment

of fees.

*Sundry account:

An internal account created by the offshore services firm to record

miscellaneous charges of an officer or master client.

*Tax status:

In this database, the information that relates to the jurisdiction where an

entity may have fiscal duties

* Trust:

A legal arrangement in which an individual transfers assets owned by him/her to

a trustee

*Trustee:

A person who holds title to the assets in a trust and is responsible for

administering the assets on behalf of the beneficiaries of that trust

* Beneficiary:

A person entitled to certain financial benefits under a trust arrangement

* Protector:

An advisor to a trust settlor who oversees the work of a trustee

*Trust settlor:

A person who creates a trust or transfers assets to an already existing trust

– ICIJ

|