Keen foreign interest in acquisition of Mannar, Cauvery basins’ data

Highest priority for exploration and development:

|

Director General, PRDS, Saliya Wickramasuriya

Picture: Shan Rupass ara |

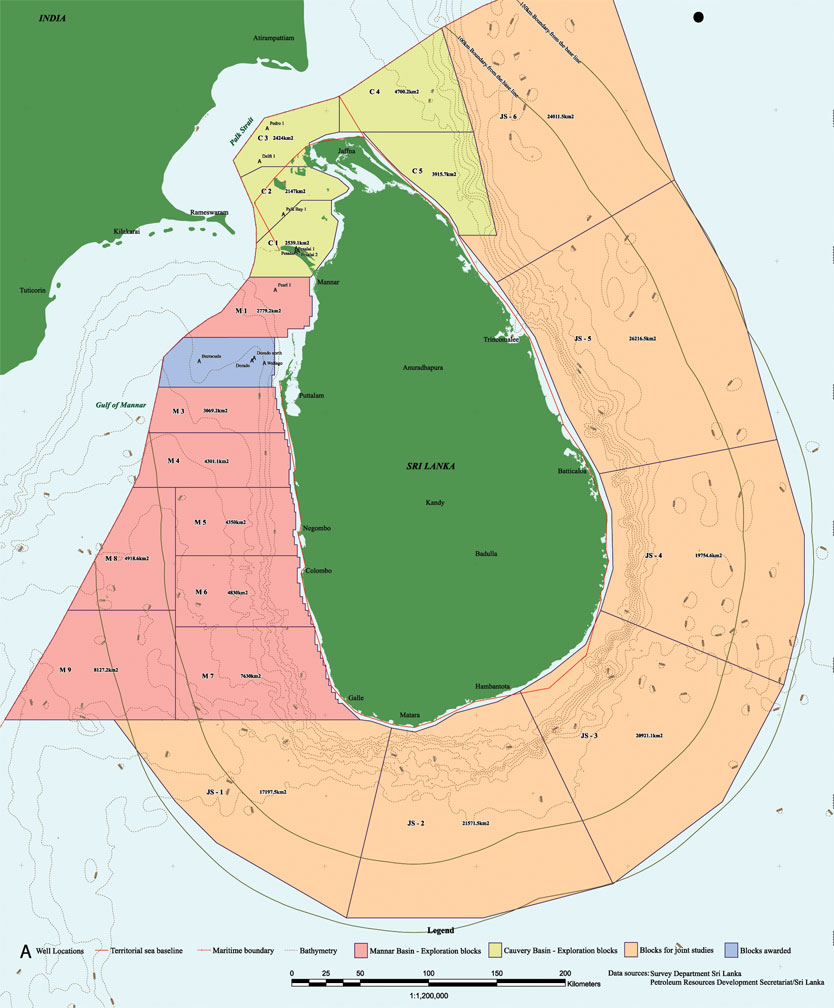

Exploration for offshore petroleum deposits will start in the Cauvery

Basin this year while the government is giving highest priority to

continue exploration and development of the Mannar Basin block where

Cairn found natural gas.

Surveys to acquire more data, without which it would be difficult to

attract oil majors, will also start this year. Petroleum Resources

Development Secretariat Director General Saliya Wickramasuriya explains

the latest position in the search for offshore petroleum in this

interview:

Q: What does the government intend doing with the Natural Gas

(NG) reserves that Cairn India discovered and abandoned in the Mannar

Basin?

A: The Cabinet Committee on Economic Management decided on May

9, 2016 that the Ministry of Petroleum Resources Development should call

for Expressions of Interest to further explore and develop Mannar Basin

gas reserves, so this puts into sharp focus our efforts over the next

few weeks. The primary benefit Sri Lanka has enjoyed from Cairn’s

investment in block M2 is the de-risking of the block (and therefore the

basin) by proving the existence of multiple petroleum systems following

a comprehensive data acquisition program spanning several years. The

monetary value of their operations was around USD 240 million, and while

none of this remains in cash, their relinquishment has sheltered this

amount from future cost recovery, delivering it to us effectively as our

equity in the block. It therefore has tangible value when negotiating

future partnerships, and has added significant technical value to our

interpretation of the whole basin.

Q: What, in your opinion, are the main priorities for the

government at this time?

A: The number one priority, due to the opportunity cost

involved in delay, is to establish continuity in developing Mannar Basin

block M2. To this end the Ministry and PRDC (Petroleum Resources

Development Committee) have given us a clear mandate to take steps to

globally solicit credible industry partners on this block. Let me split

the remaining part of my answer into two; below ground and above ground.

Below ground, we need to capitalise on the interest of oil and service

companies in acquiring Sri Lankan data to enrich our data catalogue. Any

decision to invest in long-term exploration and production requires a

minimum quantity of data with which to make meaningful economic

projections, and most of our blocks fall short of that. We need to keep

in mind that the market down-turn acts in our favour in this regard, for

as soon as oil prices start to go up and petroleum operations increase,

most of these service companies will lose their spare capacity. Above

ground refers to legal, fiscal, regulatory and market conditions - those

conditions that convert oil and gas into cash. Clearly, in an unproven

province like Sri Lanka, this needs careful attention. As such, we are

working on getting our new Act and Regulations passed, creating local

demand for natural gas via a National Gas Policy, and assessing our

legal fiscal regimes against competition on an ongoing basis. All this

does not need to be done in sequence – we are coordinating with all our

stakeholders to reach major milestones in time for our Minister to

launch an international bid round later this year.

Q: What is the status of the agreement with Total SA for a

joint study in two blocks off the east coast?

A: Total SA have submitted three Monthly Progress Reports to

the PRDS since the agreement was signed in February, indicating the

progress in their plans to launch explorations in East Coast blocks JS5

and JS6. They are in discussion with the top two seismic service

providers who responded to their RFP (request for proposals), and are

planning to commence a deep water 2 D seismic survey in the third or

fourth quarter of this year.

Q: The PRDS has called for Expressions of Interest for gravity

and magnetic surveys in the offshore Mannar and Cauvery basins. Could

you explain what this work involves and the expected outcome?

A: This scope of work was first tendered in 2012, with a view

to obtaining data on gravitational and magnetic field variations over

the Mannar and Cauvery basins in time for the 2013 Licensing Round.

Delays in getting the approvals for this data acquisition program led to

the data being unavailable during the bid round, and the proposed survey

was finally approved by Cabinet only in 2015. By this time, the company

that had been competitively selected for the work had gone into

receivership as a result of the downturn in the oil and gas industry,

necessitating another RFP being issued for the same scope of work in the

same business model recently.

Q: Do you have any plans for additional data acquisition

before the next bid round?

A: Yes we do, as without new data, a third bid round would

raise little interest. In addition to the seismic data Total will

acquire off the East coast, we have received several proposals from well

known specialist companies to conduct various types of data acquisition

in both the Mannar and Cauvery basins. In particular, one broad proposal

from a leading global company contains substantial training for

Government officials in various Ministries in addition to the various

acquisition programs in “sweet spots” of the basin, and the PRDC

Chairperson and Ministry Secretary has set up a technical committee to

evaluate them all and submit appropriate recommendations.

Q: Were these proposals tendered for and who is going to pay

for them?

A: One of them was, since it was a very specific requirement

for airborne gravity and magnetic data. The others have been received

from various reputed companies over the past few months, each of them

for a different scope of work in line with the proposing company’s

available time, resources and technical capabilities. Sri Lanka will not

need to pay for any of these services, but will license the provider to

acquire the data, give us our copy, and then sell sets to multiple

interested oil companies. Proceeds from the sales will go towards

recovering the cost of the survey, and any surplus will be profit, in

most cases shared with the government. This business model is therefore

called ‘multi-client’, and is very common worldwide. It is typically a

win-win arrangement, as the service companies utilise spare capacity to

strengthen their commercial data library and therefore generate

long-term revenue potential, host countries obtain data in sometimes

marginal areas at no cost, and oil companies who underwrite the initial

cost of the surveys receive a decent discount. Of course, service

companies expect host countries to create market opportunities like bid

rounds, etc, to stimulate interest in data sales.

Q: What are the other offshore blocks that will next be bid

out for exploration and when?

A: The highest priority is to continue exploration and

development of Mannar Basin block M2, in which the Cairn gas discoveries

were made. The airborne gravity/magnetic and seismic data we hope to

start acquiring this year, along with the new Petroleum Bill and Natural

Gas section of the new National Energy Policy, will need to be in place

before we announce a new Licensing Round.

Q: What is the status of the last bid round, especially the

blocks given in the Mannar and Cauvery basins?

A: We received three bids during the last round. One was for

Mannar Basin block M5, a deep water block, submitted by Cairn, who at

that time were seeking to expand their operations in Sri Lanka. This bid

has now lapsed, since Cairn have relinquished their acreage in full. The

other two bids were received from Bona Vista from Singapore, who have

committed to maintain their original work programs, and the evaluation

process of their submitted bids and documentation is nearing

finalisation. Assuming no unexpected delays, we now expect activity in

the Cauvery Basin to also start within this year.

Q: Sri Lanka is seeking to replace the proposed coal plant in

Sampur, Trincomalee with a Liquefied Natural Gas (LNG) plant. Isn’t

there a danger of another ‘power crisis’ in future by stopping the

Sampur project on which much preparatory work is over, delaying planned

addition of capacity, just like when the Lakvijaya plant at Norochcholai

was delayed?

A: Combined Cycle Gas Turbine (CCGT) units themselves are

relatively standard items unless of unusual specification, with a

lead-time of less than two years. Certainly, at the planning stage of a

power plant, the few extra months it may take to amend the design of the

plant will be completely worth it. The significantly lower cost of

natural gas derived power versus coal power will absorb any additional

expense within a matter of months. Do also remember that a coal power

plant requires a deep water jetty and extensive coal and fly ash

handling facilities, none of whose capital cost has been added to the

Sampur plant in any quantifiable manner. There are a few other things to

say here; NG is cheaper than coal in terms of plant capital cost, it has

almost a negligible environmental footprint, CCGT plants are more

efficient in terms of cooling (the Kerawalapitiya plant does not

continuously discharge hot water into the Negombo lagoon – it has a

cooling tower that requires flushing only once a month), space

requirement and feedstock delivery infrastructure. With the world now

moving to gas for power generation from coal, including India, the US

and many other coal-producing countries themselves, I can’t understand

how any professional energy planner can continue to recommend coal for

Sri Lanka. The ONLY argument in the past was non-availability of natural

gas at a competitive price versus coal, and that argument has evaporated

with world gas prices tumbling, an almost permanent oversupply predicted

when the huge East African and Australian reserves come on stream, and a

spot market at 30% and growing, giving rise to very flexible and

sustainable procurement models. Even LNG-handling infrastructure is

coming down in price globally with over-capacity and technology advances

making economies of scale a lot easier to attain. One last point is that

many people who participate in the Sampur coal versus gas debate have

never actually been to Sampur. I can assure you that if they do, the

right thing to do will become obvious – it is one of the most beautiful

places in Sri Lanka.

Q: A Japanese study says LNG is feasible in Sri Lanka only for

a plant with a minimum 1,000MW capacity. How have the costs of LNG and

LNG transportation and terminal infrastructure changed in recent years

to make LNG viable now?

A: As mentioned earlier, we are now in a new paradigm of LNG

price and availability, and would be foolish to ignore the potential of

this opportunity to convert most of our power generation to gas. In any

event, if you add the 630 MW of Kerawalapitiya, AES and Kelani Tissa to

the 500 of Sampur and 300 of the new CEB CCGT plant, you get 1430MW.

Also remember a huge point – we will always need to import coal, but we

do have indigenous natural gas. Already-discovered volumes are enough to

power that 1430 MW for the entire lifetime of the plants, and the cost

of production drops drastically after the capital cost of the deep water

infrastructure gets depreciated (5–10 years, depending on financing

methodology). So who is prepared to recommend that we forsake a cheap

domestic source of energy to commit to permanent import?

Q: Petronas and Mobil have expressed interest in oil

exploration in Sri Lanka while Japan and Korea have expressed interest

in Sri Lanka’s potential to develop a domestic gas industry. Could you

give details of these proposals?

A: As a pure Exploration and Production (E&P) opportunity – in

other words granting an investor the right to explore for, produce and

sell oil and gas in the open market - Sri Lankan deep-water fields are

not attractive in current industry conditions. The only way to ‘sweeten’

the deal is to include in the scope of work mid-stream (transport) and

down-stream (processing, manufacture) opportunities as well. This

implies that Sri Lanka may be more attractive to companies vertically

integrated in the whole natural gas value chain. KOGAS and Petronas are

two examples of such companies – the former is the world’s largest

importer of LNG, and the work they have done in gassifying South Korea

in a relatively short period of time is nothing short of remarkable, and

of course Petronas is a major LNG exporter, whose commercial and

technological successes have transformed the Malaysian economy.

Q: Why is the national gas policy delayed? What are its key

features?

A: This is delayed due to its scale and implications. First, it needs

to be holistic in nature, taking into account cross-cutting impact (for

example, petrochemical, fertiliser, ceramic, steel and transport are

sectors which are impacted, other than the obvious power), which

requires a broad consultative process, and second, it needs to be

embedded in a larger national energy policy rather than being a

stand-alone piece. A further essential element is that it must contain

monetisation, or commercialisation options for investors, with

appropriate investment protection, requiring, again, a broad consensus

between the Petroleum Resources Development Ministry, the Central Bank,

Ministries of Finance, Power and Renewable Energy, Economic Development

and National Planning, and all other institutions impacting and

analysing our economy. Finally, it must stand the test of international

competitiveness, as it will be one of the most influential documents on

foreign investment in the energy sector. The Ministry of Power and

Renewable Energy has taken the lead in revising the umbrella document –

the National Energy Policy, and a draft has recently been circulated by

the Secretary to the Ministry seeking preliminary input towards the next

stage. If you wish to understand more about the gas policy, you will see

on our website (www.prds-srilanka.com).

|