Double digit growth rate possible - Economy analysts

By Gamini WARUSHAMANA

A double digit economic growth rate will only be realistic if the

Government implements essential policy reforms on time, economy analysts

said.

|

|

| Dr. Ranjith Bandara

|

Dr. Sirimal Aberathne

|

Senior Lecturer, Department of Economics, University of Colombo Dr.

Sirimal Aberathne said “The annual average economic growth rate is

around 5 percent and this growth is led by the policy reforms introduced

in 1977. A double digit growth rate means that we have to double

economic growth and achieve an over 10 percent growth rate. Also the

Government has targets to double the percapita GDP to $4,000. These

targets are difficult to achieve, with only a few countries achieving

them. Considering the situation in Sri Lanka, they can be achieved”.

To achieve high economic growth we have to invest more. If we want to

double the growth by simple calculations we can say we have to double

our investment. Today our investment is around 26 percent of the GDP and

therefore at least we have to increase our investment to 40 percent of

the GDP. This can be seen in the fast growing economies such as China

where they maintain investment at 35-40 percent.

Who will invest?

If we break down our investment figures, private sector investments

accounts for 20 percent of GDP while government investment is only 6

percent. Government cannot increase investment because it has already

invested by borrowing money at high interest rates. Also there is a

current account deficit at the moment.

Our private sector too is not big to pour the required investment

into the economy. Then who will invest? Dr. Aberathne said that

investments should come from foreign investors but attracting foreign

investment is not easy as there are rivals in all parts of the world.

Therefore Sri Lanka has to go for its next policy reform to cater to

the needs of the domestic private sector as well as foreign investors.

In 1977, reforms were targeted to attract investors for labour intensive

manufacturing industries because we had cheap labour. However, today the

FDI does not flow to cheap labour destinations and it is only a minor

factor. If you look at FDI flows, investments now flow to high labour

cost destinations where the business environment is better. Therefore

policy reforms and reforms in the regulatory framework are essential at

this moment. Long term policies are needed to ensure policy stability

and predictability, he said.

Dr. Aberathne said that under these circumstances, the forthcoming

budget is crucial. Last year the budget was aggravated by internal and

external factors.

The Government has declared its vision for economic development and

therefore the budget should reflect it and cater to medium term growth.

Explaining the high economic growth rate achieved up to the second

quarter of the year, he said that it is a combination of two factors,

policy reforms after 1977 that did not reap full potential and peace.

This growth will not be sustainable unless we implement necessary

structural reforms.

|

|

In 1977, reforms were targeted to

attract investors for labour intensive manufacturing

industries |

Peace contributed in many ways including utilisation of abandoned

resources, reconstruction and other economic activities. In 2009 this

capacity was under utilised.

Competition for FDI is so high and there are many choices such as

China, Vietnam and India. We are not doing that good.

In many indices we have been ranked at the lower end.

Some economists argue that a robust growth of the Sri Lankan economy

will be realistic and is reflected in all indicators at the moment.

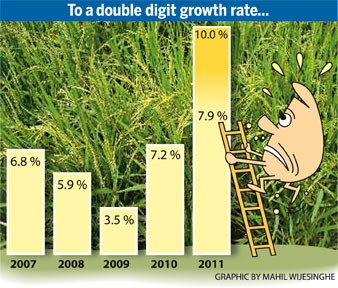

According to the most recent report released by the research division of

C.T.Smith Stockbrokers, growth forecasts for 2010 and 2011 in all three

sectors are higher compared to last year.

According to the report, indicators such as private sector demand for

credit, tourist arrivals, building material volume index, cement volume

index, Colombo port TEUs handling volume index, Monthly rubber

production, tea production and fish production are increasing with a

significantly higher rate compared to 2009.

Analysts also said that the favourable weather condition that

prevailed during the year will contribute to the growth this year mainly

in the agricultural sector and in power generation.

Since many power plants have been commissioned and some are almost

completed even under adverse weather conditions, growth will not be

hampered in the coming years.

The lowest economic growth has been reported in the years that severe

droughts were reported because it affected the agricultural sector as

well as the industrial sector as a result of over dependency on hydro

power and high cost thermal power.

Simultaneously with the ending of the conflict the country has

addressed a crisis that prevailed in the power sector.

Some economists argue that Sri Lanka should study and follow lessons

in post conflict development from countries like Ireland.

Ireland’s economy is fast growing and attracting investments for high

tech industries, knowledge industries such as software development and

nanao technology.

Chairman of the Sri Lanka Foundation Institute Dr. Ranjith Bandara

said that a double digit growth rate is not a difficult task. Today the

country has cleared all possible obstacles in economic and non economic

fronts.

Now we have peace and political stability that is crucial to

attracting investments. Government has a ten year development plan and

all these sectors have been considered.

Service hub

Dr.Bandara said that the service sector of the economy will grow

faster and education, health, ports and shipping and tourism sectors

will contribute greatly to the GDP in the next 3-4 years.

The Government has already invited reputed foreign universities to

set up their campuses here. Since there are a visa restrictions to

students in UK and Canada we have opportunity to develop Sri Lanka as an

alternative destination for higher education in the Asian region.

Sri Lanka’s friendly foreign relations with all Asian countries will

have advantage to attract students from all Asian countries.

China and India do not have this advantage due to many political

issues between the countries. Sri Lanka will be the education hub of the

region in the future.

The Health sector is also a potential area to attract investment and

businesses, he said.

The port sector was neglected in the past and already huge money has

been invested into this sector.

After completion of the ongoing mega port development projects Sri

Lanka will be the naval hub of the Asian region.

Already five leading shipping lines have agreed to venture into

Hambantota harbour.

Arrival of ships, TEUs handling and many other related services will

improve in the next 3-4 years, Dr. Bandara said. Arrival of ships, TEUs handling and many other related services will

improve in the next 3-4 years, Dr. Bandara said.

He said that without much marketing effort tourist arrivals have

increased 42 percent and therefore the 2.5 million tourist arrival

target is achievable.

Government has a clear plan to develop the sector considering all

aspects of the industry. Now investments are flowing into the industry

and new hotels are being constructed.

The Kalpitiya area will be developed as a special tourist zone

similar to what is in Malaysia.

Commenting on structural and policy reforms Dr. Bandara said that

today Sri Lanka is more flexible and we are moving forward in line with

what suits best for the country and not guided by the IMF or World Bank.

Reforms will take place according to the policy framework of the

Mahinda Chintanaya which was approved by the majority of the people.

Agriculture and land consolidation Economist Loyd Yapa said that

agriculture is a neglected sector in the economy and needs new direction

in post war Sri Lanka.

All advancing economies such as Japan, South Korea and Taiwan started

to march towards prosperity through manufacturing exports and

agricultural sector development via land reforms (land consolidation).

He said that land consolidation is important because small land plots

are too small to obtain economies of scale or improve productivity.

Subsistence agriculture has to be changed and issues such as lack of

credit to the agricultural sector has to be solved, he said.

Yapa said that FDI inflow to the country is very low compared to

other countries.

From 1995-2009 Sri Lanka has received only around US$4 billion FDI.

During the period Taiwan has attracted over US$ 40 billion and

Thailand and Malaysia over US$ 60 billion, he said.

|

C T

Smith Stockbrokers on the Sri Lankan economy

The government has taken a number of measures to increase domestic

consumption and encourage private sector participation in the economy.

Interest rates have declined sharply over the past year with the

Government repeatedly reducing policy rates while also looking oversease

to tap the Bond market.

Consumption initiatives include the reduction of import taxes on a

number of consumer durables, reducing levies by more than half.

Further incentives are expected following the recommendations of the

Presidential Tax Commission, which are expected to be incorporated into

the Government Budget for 2011. We expected growth to continue to remain

robust, though presently driven by Government investment in the economy.

Numerous opportunities have arisen in the fields of tourism, retail,

food & beverages, agriculture, transportation, financial services,

although sufficient investment is at present a limiting factor. To

address this issue the Government is looking to rationalise the

investment process and reduce the level of bureaucracy, which has been a

stumbling point for investment. Given better than expected GDP growth in

2Q 2010, we have revised upward our forecasts for overall GDP growth to

7.2 per cent in 2010 from 6.6 per cent and 7.9 per cent in 2011 from 7.4

per cent. Key sectors of growth include agriculture, construction,

wholesale and retail trade, banking and leisure segments with

significant (public and private) investment expected in these sectors.

Subsequent to the amendment in our expectations, nominal GDP is

forecast to rise to US$49.6 in 2010 and US$ 58.5 in 2011, resulting in

per capita GDP of US$ 2,398 in 2010 and US$ 2,795 in 2011 bolstered by

expectation of further appreciation of the Sri Lankan rupee Vs US

dollar. |

|