Amalgamation of EPF

and ETF:

Points to ponder

by Sunil G. Wijesingha

The proposal to amalgamate the EPF and the ETF has stirred a hornet's

nest. It is a popular topic of discussion too, particularly among

beneficiaries (members) of the EPF and ETF. However, it is appalling to

find that most people who have an opinion on the topic are ignorant of

some of the basic facts about the funds, and even worse have a

completely wrong notion of the two funds.

Having been a former Chairman of the Employees' Trust Fund Board, I

though it is perhaps not out of place to share my knowledge with the

public, so that their arguments for or against the proposals could be

based on a proper understanding of the two funds.

This is certainly not the first time such an amalgamation has been

proposed, but all previous attempts simply fizzled out. At present, I do

not have any strong views either for or against the proposal since I am

not aware of the final proposal.

However, I believe that the proponents of the amalgamation have done

their homework well and seem to be serious about it this time. First, it

is important to understand the two funds, its similarities, differences

and objectives.

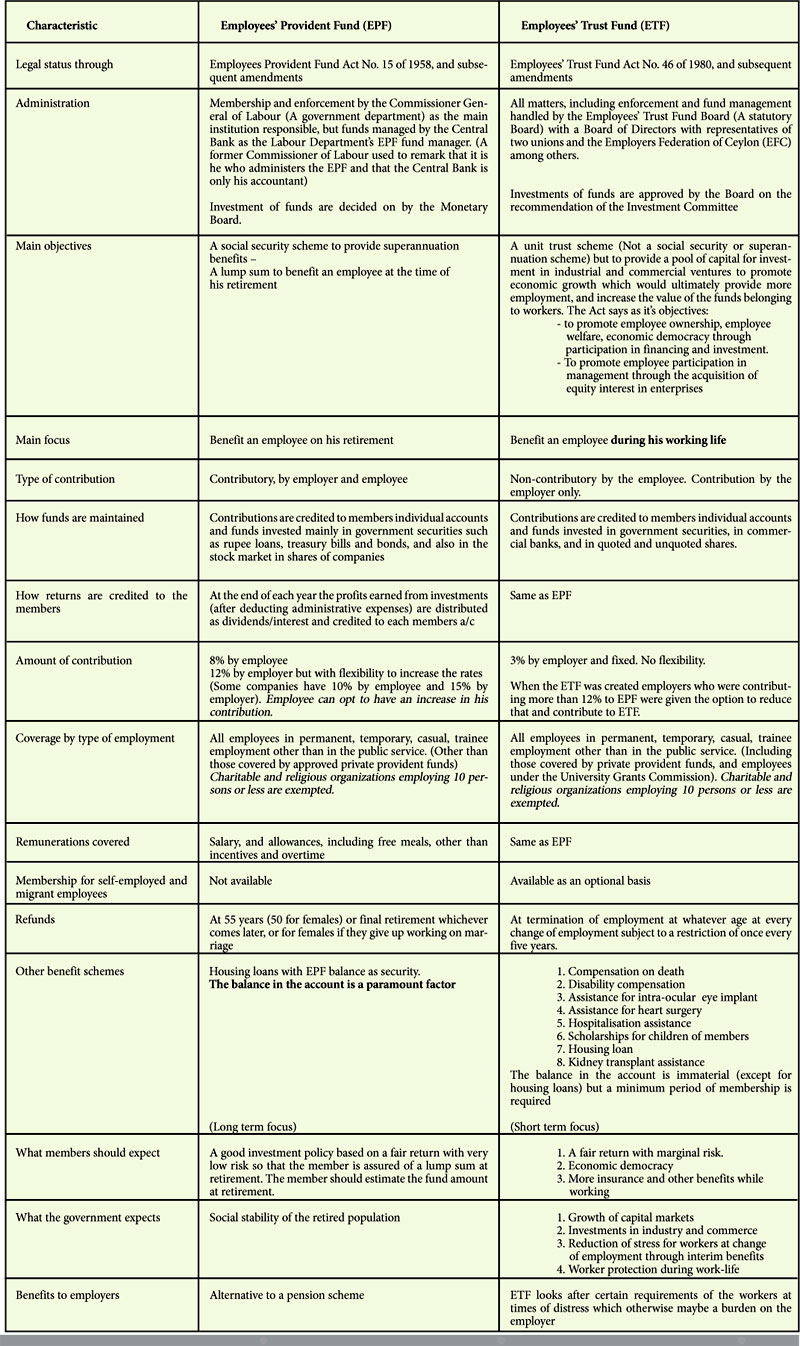

The table summarises the details. It is useful to evaluate how the

funds have performed in terms of dividends and interest declared to the

members. In evaluating the two funds it must be borne in mind that the

EPF makes refunds only once in the lifetime of the member while the ETF

may make refunds several times during the lifetime of a member.

Investments

The returns also do not quantify the value of the benefits provided

by the ETF. Therefore, the ETF return to members is slightly more than

what is shown as dividend plus interest. The ETF paid 10% and EPF paid

10.5% during the past two years.

The lower figure of ETF is surprising since ETF returns were usually

higher than EPF many years ago. One reason may be the high

administration cost of ETF of around 5% of income. This is a good

argument for amalgamation. In the case of ETF this includes the costs of

enforcement but whether the Labour Department's enforcement cost is

recovered from the EPF is not known.

The 2012 portfolio of both funds indicates that over 90% of its

investments are in Government Bonds, Treasury Bills and Rupee Loans. The

investment in the stock market is only around 5%. Therefore, members

need not fear about the security of their money.

Even if the stock market crashes to zero the loss will be negligible.

In good years, the gains from the stock market will be very useful. In

fact during the 1990s we claimed that 1% of the ETF dividends to members

that year came from the realised gains from the stock market. At that

time there was no 'mark to market' mechanism, but only a provision for

diminution of value based on market price. Otherwise with unrealised

gains the benefit would have been even greater.

Although small, the investment in the stock market must be purely in

the interest of the members and should not be used by the Government to

control companies. In fact, in the 1990s the ETF had a policy of not

taking up more than 10% of the issued capital of any company and not

using its proxies for voting for or against any resolutions that would

not be in the interest of its members.

The ETF Board of Directors, in the case of the ETF, and the Monetary

Board, in the case of the EPF, are trustees of the funds; they don't own

the funds. I understand that at one time the Investment Policy was

thrown out at the ETF and even 100% of the share capital was bought. The

EPF and ETF have Investment Policies now and Investment Committees which

take responsibility for investment decisions.

Architect of the ETF

In the early 1990s, the ETF was under immense pressure to invest in a

low interest debentures significantly lower than the prevailing Treasury

Bill yield rate. The Board refused, resulting in the Chairman (myself)

being asked to resign and the Board being given a 'telling off'. Later

when the President realised that the Board acted in the best interests

of the fund, I was re-instated.

The architect of the ETF is considered to be Lalith Athulathmudali

who realised that 3% from the entire working population in the private

and State corporation sector would be significant and could create large

organisations, particularly for infrastructure, which needs large

capital bases.

Colombo Drydocks Ltd (now Colombo Dockyard) and Lanka Cement were

beneficiaries then. At that time, the market could not raise sufficient

funds from the public for such large projects. Today, the situation is

different and the ETF's role in contributing to capital is less

significant.

Another declared objective of the ETF was "to promote employee

participation in management through the acquisition of equity interest

in enterprises". This caused a lot of anxiety in the private sector at

that time and it was thought best to ignore this objective.

The reason for its inclusion was that employee participation at

management and Board level was popular in some countries at the time.

This concept is no longer in vogue. Therefore, another objective of the

ETF is no longer relevant.

Whatever the new mechanism is, it should have a strong Board with

representation by unions and the Employers Federation of Ceylon. It

should resist unlawful directions from the Government. It should not be

considered as a captive source of funds.

Once when I received a demand for funds from the Superintendent of

Public Debt referring to the ETF as a captive source, I asked him to

define a Captive Source. He answered, perhaps in lighter vein, saying a

captive source is one where the Chairman would not dare to resist a

direction from the Government.

Many years later I came to understand that the Government kept asking

for funds at low interest and then asks the Board why the dividend is so

low! Once the Minister in charge informed us that under a particular

section he could give the Board special directions about investments. We

consulted legal opinion and informed the Minister that what is meant by

that section is not special directions about investments. Many years

later the ETF was brought under the Ministry of Finance, and now under

the Prime Minister.

The purpose of this article is to enable those who express opinions

on the proposed amalgamation to do so with greater information. It is a

pity that the latest published Annual Reports of the funds are still

only of 2012. Annual reports must be published in time and must also be

submitted to the National Labour Advisory Council.

The writer was Chairman of the Employees' Trust Fund Board from 1989

to 1994, and was later appointed to the Board by the Finance Ministry.

He also served two terms as the Employers' Federation of Ceylon

representative on the Board.

|