|

Exports earnings rise:

External sector stable in first seven months

With continued foreign currency inflows in the form of workers’

remittances, earnings from exports and tourism and inflows to the

financial account, Sri Lanka’s external sector remained stable during

the first seven months of 2013.

The external sector is expected to strengthen further with continued

inflows to commercial banks and the private sector and through projected

inflows in the form of tourist earnings and workers’ remittances during

the remaining months of 2013.

|

Tourists view wild elephants from a canoe |

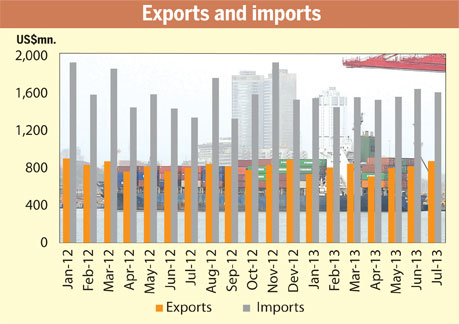

Exports also showed a positive growth in July for the second

consecutive month in 2013, leading to narrowing of the trade deficit.

Trade deficit

Earnings from exports and expenditure on imports recorded significant

growth on a year-on-year basis for the second consecutive month in July

2013, led by higher trade volumes.

In July 2013, earnings from exports grew by 8.0 percent to US $ 858

million, while expenditure on imports increased by 20.8 percent to US $

1,601 million compared to July 2012.

On a cumulative basis, earnings from exports during the first seven

months of 2013 declined by 2.7 percent, while expenditure on imports

declined by 2.6 percent compared to the corresponding period in 2012. As

a result, the cumulative trade deficit during the first seven months of

2013 declined by 2.5 percent to US $ 5,300 million, from US $ 5,435

million in the corresponding period of 2012.

Earnings from exports in July 2013 reached US $ 858 million, the

highest monthly value during the year, led by higher earnings from

agricultural exports followed by industrial exports.

Agricultural export

Agricultural export earnings which account for more than a quarter of

total exports, increased by 21.6 percent in July 2013 on a year-on-year

basis, mainly due to higher exports of tea and spices. Earnings on tea

exports increased by 20.2 percent in July 2013 due to a combination of

an increase in export volumes by 12.6 percent and an increase in the

average export price by 6.7 percent.

Earnings from spice exports increased by 50.6 percent propelled by

improved performance of commodities such as cinnamon, pepper and cloves.

Export earnings from kernel products of coconut and minor agricultural

products also increased significantly due to higher volumes exported.

However, export earnings from rubber and sea food declined in July

2013 reflecting reductions in export volumes and prices. Meanwhile,

industrial exports increased by 3.7 percent in July 2013 mainly due to

an increase in export earnings from textiles and garments. Earnings from

the export of textiles and garments, which account for more than 40

percent of total exports, increased by 13.5 percent, contributing 70

percent to the total increase in exports. However, export earnings from rubber and sea food declined in July

2013 reflecting reductions in export volumes and prices. Meanwhile,

industrial exports increased by 3.7 percent in July 2013 mainly due to

an increase in export earnings from textiles and garments. Earnings from

the export of textiles and garments, which account for more than 40

percent of total exports, increased by 13.5 percent, contributing 70

percent to the total increase in exports.

Textiles

During the month, earnings from export of textiles and garments to

the USA and to the EU increased by 26.9 percent and 1.6 percent,

reflecting a gradual recovery in those regions. Earnings from the export

of machinery and mechanical appliances, chemical products, and leather

products also contributed significantly to the growth in exports of

industrial products.

Meanwhile, gems, diamonds and jewellery, petroleum products, food,

beverages and animal fodder declined in July 2013.

Expenditure on imports increased by 20.8 percent to US $ 1,601

million in July 2013, with increases in all major categories of imports.

Expenditure on consumer goods imports increased by 30 percent,

year-on-year, in July 2013 with increases in food and non-food consumer

goods categories. Vehicle imports, which were declining on a

year-on-year since April 2012 began to increase from June 2013 with

growth accelerating further in July 2013, becoming the main contributor

to the increase in consumer goods imports. Increased imports of vehicles

could be mainly attributed to the sharp depreciation of several

currencies including the Indian rupee and the Japanese yen against the

US dollar.

Other food items such as lentils, onions and edible oils, which are

largely imported from India, also increased substantially in July 2013.

Expenditure on intermediate goods imports increased by 21.5 percent,

year-on-year, to US $ 943.4 million in July 2013, mainly due to the

higher import expenditure on refined petroleum products.

Fuel imports

Accordingly, in July 2013, the import volume of refined petroleum

increased by more than two-fold compared to July 2012. Notwithstanding

such increase, expenditure on fuel imports during the first seven months

of 2013 recorded an overall decline, over the corresponding period in

2012. Meanwhile, expenditure on non-fuel imports increased at a moderate

rate of 4.3 percent, year-on-year, to US $ 1,166 million in July 2013.

Import expenditure on fertiliser and plastic articles also increased

considerably during July 2013.

At the same time, expenditure on textiles and textile articles,

diamonds and precious stones, and wheat and maize, which are classified

under intermediate goods, declined in July 2013. Import of investment

goods increased by 12.8 percent to US $ 347.8 million in July 2013

mainly due to a significant increase in machinery and equipment, even

though transport equipment declined substantially.

Accordingly, the number of tourist arrivals during the first eight

months of the year increased by 14.3 percent, to 711,446 over the

corresponding period in 2012. Total earnings from tourism increased by

34.7 percent to US $ 110 million, year-on-year, in August 2013.

Cumulative earnings from tourism during the eight months of 2013

recorded a growth of 22.1 percent, to US $ 784 million, from US $ 642

million during the corresponding period in 2012.

Worker remittances

In July 2013, workers’ remittances increased by 17.0 percent, to US $

555.9 million from US $ 475.0 million in July 2012. Accordingly,

cumulative inflows of workers’ remittances during the first seven months

of 2013 amounted to US $ 3,763.5million, a rise of 10.1 percent from the

first seven months of 2012. The financial account of the BOP continued

to attract investment inflows at a moderate pace. The Colombo Stock

Exchange (CSE) recorded a net inflow of US $ 8.6 million in July 2013,

compared to a net inflow of US $ 18 million in July 2012.

On a cumulative basis, the CSE received net inflows of US $ 128.8

million during the first seven months of 2013. As of September 23, 2013,

net cumulative foreign inflows to the CSE amounted to US $ 150 million.

The net inflows to the government securities market was US $ 45.9

million in July 2013, compared to a net outflow of US $ 27.4 million in

June 2013.

As of September 20, 2013, cumulative net foreign inflows to the

government securities market amounted to US $ 493 million while the

outstanding foreign holdings of Treasury Bills and Bonds amounted to US

$ 3.6 billion, thereby moderately exceeding the threshold earmarked for

non-resident investors.

Long-term loans obtained by the government amounted to US $ 1,054.5

million during the first seven months of 2013, lower than the loans of

US $ 2,193.4 million obtained during the first seven months of 2012,

which included proceeds of the international sovereign bond of US $ 1

billion.

FDI inflows

FDI inflows, including foreign loans to BOI companies, amounted to US

$ 540 million during the first half of 2013, an increase of 20 percent,

compared to US $ 451 million during the first half of 2012.

Inflows to commercial banks during the first half of the year

amounted to US $ 664 million.

Sri Lanka’s gross official reserves stood at US $ 6.3 billion at end

July 2013 while total international reserves, which include foreign

assets of commercial banks, amounted to US $ 7.3 billion. Despite the

outflows on account of IMF Stand-by Arrangement (SBA) repayments,

foreign debt service payments and the impact of valuation changes, Sri

Lanka’s gross official reserves have been at a satisfactory level during

the first seven months of 2013 with gross official reserves and total

reserves of the country being equivalent to 4.0 months and 4.7 months of

imports.

The National Savings Bank (NSB) raised US $ 750 million by issuance

of an international bond in foreign capital markets in September 2013

with high market participation, reflecting increased and continued

investor confidence in the Sri Lankan economy.

With the receipt of US $ 750 million, the financial account of the

BOP strengthened further, and the gross official reserve position is

estimated to have surpassed US $ 7.0 billion by September 23.

Exchange rates

The Sri Lankan rupee has strengthened against several major

international currencies so far during the year. By September 23, the

rupee had appreciated against the Japanese yen by 11.1 percent, the

Indian rupee by 8.7 percent and the Australian dollar by 5.8 percent.

However, the Sri Lankan rupee depreciated against the US $ by 3.8

percent, the Pound Sterling by 3.2 percent, the euro by 6.1 percent and

the Chinese yuan by 5.5 percent by September 23. |