Confusion reigns: VAT sits on the mat

by Rukshana Rizwie and Isuri Kaviratne

The increase in Value Added Tax (VAT) from 11% to 15% which was

scheduled to be implemented on May 2 cannot take effect because tax

reforms need to be sanctioned by a vote in Parliament and gazetted,

officials at the Inland Revenue Department told the Sunday Observer.

|

|

Telecom service providers

still clueless over how the increase in VAT will affect services |

“The specific sectors which are to be taxed starting this week is

still a grey area even for officials at the Inland Revenue Department (IRD),”

a senior official at the IRD who did not wish to be identified, said.

“There has been no clear decision over the country’s fiscal policy ,so

the confusion among the general public is to be expected.”

Last week, the Ministry of Finance rolled out an ambitious overhaul

of the country’s indirect taxation system.

Amendments were made to the VAT which was raised from 11% to 15%

starting from May 2. A notice advising the public and businesses, of the

increase was published in newspapers on Wednesday (4) , though it is not

clear when the tax increase will be implemented.

The confusion regarding the government’s principal source of revenue

has raised concerns from several stakeholders.

“I agree there has been some confusion regarding the specific sectors

which are now liable to pay VAT, but as with every other budget this

country has passed, the changes in VAT and Nation Building Tax (NBT)

will be implemented and adopted accordingly,” the Deputy Secretary to

the Treasury, S.R. Attygalle told the Sunday Observer.

“The newspaper notice is in accordance with parliamentary approval

and comes into effect on the prescribed date.

Confusion

In the past once the budget has been passed, the changes would

ordinarily come into effect from the beginning of the financial year.”

Attygalle added that the increase in taxes have been mired in confusion

primarily due to the many changes and contradictory remarks that have

been made. “I understand the reason why consumers are concerned or

confused, but it need not be the case.

The

IRD has posted the changes in VAT and NBT and its in the public domain,”

he said. The

IRD has posted the changes in VAT and NBT and its in the public domain,”

he said.

Many previously exempted sectors are now liable to pay the 15% VAT.

This includes the supply of telecommunication and healthcare services

which were previously exempted.

The other sectors include, the supply of telecom equipment or

machinery including copper cables, issuance of licence to local telecom

operators by the Telecommunication Regulatory Commission, and supply of

goods and services to projects other than housing projects. Finance

Minister Ravi Karunanayake announced that bread, wheat flour, milk,

spices, pharmaceuticals, electricity, public transport, and private

education would be exempted.

“We are aware that healthcare services are exempted but we’ve been

asked by private hospitals whether they should tax the meals provided

for the in-patients,” said Senior Deputy Commissioner General of Tax

Policy at the IRD M.G. Somachandra.

Some sections of business have threatened to take the matter of VAT

and its implementation to court.

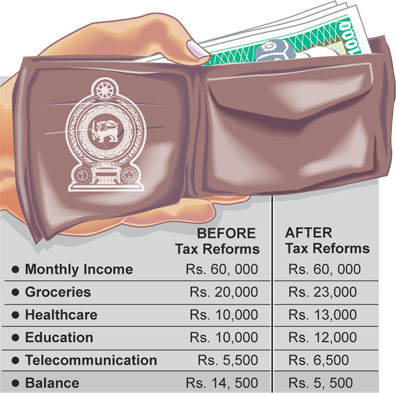

The increase in Value Added Tax (VAT) on a range of goods and

services will affect several sectors of the economy including retail

trade, vehicles, hospitality, private healthcare and private education.

The Sunday Observer spoke to a range of people from sectors said to

be impacted by VAT increases to get their opinion on how the rising tax

burden would affect their businesses.

Price of bread stays same

The price of bakery products except for bread is to increase by Rs.10

from May 2nd due to the increase in VAT from 11% to 15%, the All Ceylon

Bakery Owners’ Association Chairman N.K. Jayewardene told the Sunday

Observer.

“Except for locally produced flour, the increase in VAT on all

ingredients will result in the price of bakery items rising in the range

of Rs.5 to Rs.10,” he said. He explained that many of the ingredients

are imported and hence the combination of the VAT increase and a weak

Sri Lankan rupee will likely cause more price increases.

He said that the All Ceylon Bakery Owners’ Association met earlier

this week and decided collectively not to increase the price of bread.

This year the price of bread has already been increased twice. The price

of a loaf of 450g bread was increased by Rs.1 to be Rs. 55 due to the

increase in the NBT imposed by the budget.

In March this year it was increased by another Rs.4 due to a global

increase in wheat and flour prices. The price of a standard loaf of

bread now stands at Rs. 58.

Private Hospitals

|

Private sector hospital charges are expected to rise following

the VAT increase |

Wijay Ransi, Secretary of the Association of Private Hospitals and

Nursing Homes told the Sunday Observer, the implementation of the

proposed VAT will directly affect hospital services charges.

According to the new tax reforms, the charges for hospital services

will be increased by 15% but the prices of medicine is to remain

unchanged.

Ransi said the private hospitals, along with the doctors, already

have mechanisms to make their services at concessionary rates to people

with lower incomes.

“Doctors cancel their charges and deduct lab charges from the total

bill, but if the VAT is increased, this becomes counterproductive,” he

said.

The Association predicted a drop in patients as a result of the new

taxes, with those struggling to afford private care turning to the state

medical system, thus driving up the cost of healthcare borne by the

government.

Telecom

Chief Operating Officer of Mobitel, Nalin Perera said the increase in

the telecommunication bill will be negligible after the tax reforms, as

it will not have a significant impact.

An official at another of Sri Lanka’s large telecommunications

service providers told the Sunday Observer that the company was

‘clueless’ over how the increase in VAT was to affect telecommunication

services.

“Despite a notice by the Treasury that VAT would be increased to 15%

it is still a grey area for telecoms that are scrambling to make sense

of this directive,” he said. “We are still waiting for word on how the

payment structures will need to be changed.” |