|

Economic Review:

Corporate governance, frauds and control measures

by Sunil KARUNANAYAKE

"The ten commandments or the Dhammapada alone cannot make a human

being complete. It is the true practise of the tenets by that individual

that would make him succeed.

It is thus the ethical behaviour of companies that can make the

difference. At the end of the day, the company, the stakeholders and the

society at large should be happy that the company is a clean house and

not a dirty one. In a nutshell these are golden rules to be followed by

any board, listed or otherwise"

(Duties of company Directors and corporate governance in Sri Lanka-

Dr Harsha Cabraal)

Corporate scandals in the developed world and its consequent effects

on investors and public have seen the emergence of new laws and

tightening of the regulatory regimes and formalising corporate

governance. Corporate scandals in the developed world and its consequent effects

on investors and public have seen the emergence of new laws and

tightening of the regulatory regimes and formalising corporate

governance.

Insider dealing or the "white collar crime" is one of the commonest

crimes committed in the stock market activities. In Sri Lanka

prohibition on insider dealing was first introduced by the companies Act

No 17 of 1982 but now it is imposed by the Securities Exchange

commission(SEC) Act. Insider dealing comprise a process of obtaining

price sensitive information by people who have access to such

information from the organisations. Those who possess such information

will be in an advantageous position in the ultimate situation in trading

in securities that is considered an offence.

It was not long ago, that Sri Lankan born Raj Rajaratnam, former head

of the multi billion dollar Galleon group hedge fund was sentenced to a

prison term of 11 years by the US High Court after having been found

guilty of " Insider dealing". Prosecutors has pushed for 25 year

sentence after convicting Rajartnam in the biggest insider trading

investigation ever conducted by US authorities.

Legal experts said that while prosecutors may have been disappointed

with the decision, the sentence was still the highest ever given for

insider dealing.

Prosecutors found that Rajaratnam had used a network of insiders to

gain illegal tips on some of the world's biggest companies including

Goldman Sachs,Google, and Hilton.The scandal also dragged a former

Director of Goldman Sachs, a Director and a former head of Mckinsey

management consultant group who are now said to be facing criminal

investigations.

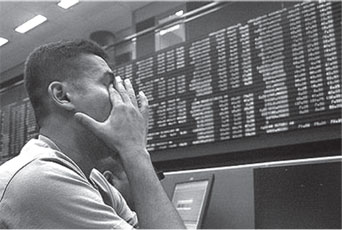

One of the key signs in the post war scenario was a booming a stock

market with many IPO's and new players entering the fray. In Sri Lanka,

recently there was much concern on stock market activities that prompted

the state agency Securities exchange commission (SEC) to move in for

punitive action. Consequently two eminent former- public servants were

among those who had to face charges for disclosure lapses and pay hefty

fines.

The SEC also had to warn some members of the broker fraternity for

misdemeanors.. But to date no prison sentences have been delivered. The

SEC was also forced to take action to ensure that just and equitable

schemes to ensure are in place and all applicants in public share issues

are given a fair deal depriving total dominance by few big players.

Risks

"Under the influence of delusion and greed, greater and greater risks

are taken by financial institutions and investors and investors to bring

in greater and greater profits in shorter and shorter time spans.

Thus, a financial institution or business which only functions for

the benefit of its Directors or shareholders, desiring to grant them

ever greater bonuses and dividends, and shirk responsibility to wider

society and the environment can turn out to be parasites". (Protest

against greed)

Corporate governance has been defined in many ways, it's recognised

as a set of mechanisms through which firms operate when ownership is

distinct from management.

Corporate governance is also identified as the manner in which

companies are directed, controlled and managed. It is the responsibility

of the board of directors to ensure that governance principles are

observed. It is also being reported that if a country's overall

governance systems are weak voluntary governance mechanisms could fail.

Corporate governance once confined to board rooms, academics and policy

forums has now become a buzz word in the corporate circles.

Forerunner to the priority for corporate governance were the

financial crisis in Asia, Russia and Brazil in the late nineties that

was threatening the global financial stability equilibrium, then the

corporate scandals in USA and Europe in the new millennium further

aggravated the situation. This did create awareness for formalizing good

governance principles to minimise corporate scandals.

Recent global financial crisis too was attributed to poor governance

particularly in the financial sector. With the deregulation, growing

free trade, collapse of totalitarian regimes global integration has been

strengthened providing for investment and fund flows freely across the

barriers. This fact too was another reason for the emergence of

corporate governance

While in UK a committee headed by Sir Adrian Cadbury on financial

aspects of corporate governance proceeded to set up corporate governance

process, in the early nineties, in Sri Lanka Institute of Chartered

Accountants of Sri Lanka played the pioneering role in introducing the

first ever code in 1997. Later in 2005 together with the Securities

Exchange Commission (SEC) ICASL set up a process to revise the code.

Thereafter SEC and ICASL worked together in drafting the corporate

governance listing rules applicable to listed companies through the

Colombo stock exchange that became mandatory from 2008. ICASL has gone

further to give priority to compliance on corporate governance through

the Best annual report competition that that is being eagerly awaited by

the corporate sector.

It has been proved that companies practising good governance

principles benefit from access to financing. Low cost capital, more

favourable treatment to all stakeholders and public acceptability.

Historical evidence also proves that when a country's overall corporate

governance systems are weak voluntary corporate governance mechanisms

too deteriorate. It could also be argued that poverty and suffering is

less in countries that practise good governance principles Sri Lanka

came up with a new company legislation in 2007 that provided for

shareholder safeguard by ensuring adequate representation of non-

executive directors are appointed thus maintaining a proper board room

balance.

The corporate governance code defined the necessity for audit

committees and its composition. In addition provision was also made for

director's responsibility on duties of directors in insolvency and

serious loss of capital. To date, probably only one court case invoking

this section has been reported. Perhaps this reflects that directors

have not contravened the section 219; 220 of the Companies Act.

Developed countries have been moving swiftly on fraudsters with

appropriate legislation and have been able to prosecute them.

Investigators tasks are made difficult with the new breed storming in to

the IT areas.

Bribery

While white-collar crimes are in the increase organized crimes in

terrorism, bribery and corruption have not slowed down providing

enormous economic gains to criminals. Legal and prosecution machinery in

the third world are still behind times and the cost to the citizens of

these could be significant.

Sri Lanka in 2006 formalized legislation on terrorist financing and

Money laundering two areas where fraudulently earned money is channeled.

It is most common for criminals who engage in fraud to slip out of the

home country to escape prosecution.

It was not long ago that a VAT scam involving over RS 3 billion of

public funds hit the headlines and some of the suspects are said to have

escaped from the country.

Accord to research based information UK frauds cost the country over

14 billion pounds annually with the majority of the losses borne by the

public.

The UK government is taking a serious view of the alarming increase

in crime and particularly the IT related cases prompting the government

to introduce a Fraud Bill in the Parliament. A few years back there was

some euphoria when there was some speculation that Sri Lanka Government

was going to appoint an anti Corruption commission but this thought

never saw the light of the day.

The Permanent Commission for Bribery and Corruption, declaration of

Assets by Public officers and Parliamentary select committees for

Parliamentarians, Ombudsman are some of the existing checks in the Sri

Lankan system, unfortunately these instruments to date have failed to

meet the growing civil society demand and confidence for corrupt free

society.

In the developed west and the industrialised East Asia, corruption is

treated with all seriousness with prosecutions and punishment to the

guilty.

Countries in the region such as India (Central Vigilance Commission),

Hong Kong (Independent Commission against Corruption), Bangladesh

(Bureau of anti Corruption) and Singapore and other countries like

Australia (ICAC), UK, USA and even some of the African countries have

already enacted legislations to give strength to " Fight against

Corruption", a priority need.

|