Lanka achieves record export performance

By Rohantha Athukorala

Even with all the issues that Geneva has brought on to the country,

the World Bank and ADB has forecast economic growth of around 7.5% for

2014 and 2015 while Cofarce has ranked Sri Lanka as a top growth economy

globally last month.

In this background, Sri Lanka has demonstrated its vibrancy with a

brilliant performance in March which was an all time record where

exports crossed the 1.06 billion dollar mark that has shown the world

the love of the global consumer for Sri Lankan merchandise.

Record exports in Q1, 2014: The performance in the first quarter of

2014 was powered by US and UK driving growth at 20.4% and 10.7% over

last year demonstrates the preference of the American and British

consumer to Sri Lankan products. Record exports in Q1, 2014: The performance in the first quarter of

2014 was powered by US and UK driving growth at 20.4% and 10.7% over

last year demonstrates the preference of the American and British

consumer to Sri Lankan products.

A point to note is that 35% of the export proceeds to Sri Lanka in

the first quarter of 2014 came from the US and UK which happen to be

countries that pioneered the resolution against Sri Lanka in the UN.

Some research is necessary to understand why markets like Belgium,

Iran, South Korea and Syria did not demonstrate the growth momentum that

the other key markets have shown so that corrective action can be

initiated from this end.

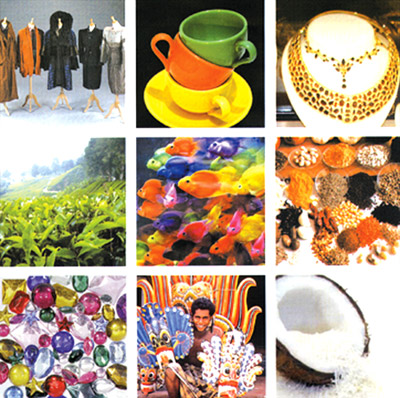

The product categories that have performed exceptionally well are

agricultural exports at 22.6%, tea by 13.6% and industrial products with

a staggering growth of 74.4% which was essentially driven by textile and

garments at 44.8% which is interesting.

This can be attributed to the upturn in the US and UK economy that we

have seen in the last quarter that has increased the purchasing power of

consumers. Research reveals that demand for lingerie related products

tend to increase even in economies that have a down turn, which Sri

Lanka experienced when the US economy was reeling around five years ago.

US $20 billion in exports

While the export performance of Sri Lanka was positive in the first

quarter of 2014 a point that needs to be kept in mind is that way back

in 1990, Sri Lanka, Bangladesh and Vietnam were all at the $2 billion

export mark. However, today, Vietnam has crossed the hundred billion

dollar mark while Bangladesh is touching fifty billion dollars.

Sri Lanka is targeting over US $ 11 billion by the end this year

which demonstrates the challenges that we are up against. The debate

right now is, was it the FTAs that was the driver or was it innovation.

Be that it may, we have a lot of work to do on both fronts.

Next step

While the next wave of growth for the export business can be the FTA

with China, there are many other areas within our control that need to

be managed in a private-public partnership approach. Let me share a few:

Get present FTAs to work. Even though quarter one exports are a

record performance, the two FTAs are not growing at the rate that Sri

Lankan exporters want it to grow. The key issue being the non tariff

barriers that Sri Lankan exporters are up against in India.

As at end February exports to India was at -27.7% and Pakistan at

-6.3%. Though the Indian market rebounded in March to end at a positive

trajectory, the fact of the matter is that the FTA is not driving the

Sri Lanka's agenda on the export front. This must be addressed with a

joint trade commission given that a new government has taken office.

Clear VAT refund issue - it builds positivity. One of the key cries

of the private sector is to clear the backlog and reduce the time lag on

VAT refunds. Many exporters say that they do not need any handouts but

getting the VAT refunds due to them can ease out working capital issues.

EDRS Scheme - to support winners . While this scheme was discontinued

in 2009, there were payments due to exporters before discontinuation of

the scheme. If this can be addressed we will be in line with the South

Korea export model where winners were selected and supported by the

government than a blanket approach of financial schemes.

Streamlining the TIEPS scheme. There were many claims and counter

claims on gaps in procedure that is making the TIEPS scheme a hassle

than an enabler.

Given that technology is developing rapidly there is no option but

move this online. It will bring in a positive vibe given that it will

have to anyway be paid on a later date. The question is, will there be a

cash flow to make the online strategy feasible.

Industrial Zone links. Given that almost 73% of the exporters are SMEs a point highlighted was that all trade fair participation and any

technology transfer training to be notified to the Industrial Zone

coordinators in the country. Apparently there are 47 industrial estates

in the country that house around 18-20 SMEs. May be the business

chambers can play the bridging role.

Ceylon Tea campaign. With the Tea sector closing on to the US $2

billion dollar mark, a key strategy called for by the exporter is the

launch of the Ceylon Tea Campaign. The good news is that with all the

bureaucratic issues of a government institution, the Sri Lanka Tea Board

partnering Dialog in sponsoring Sri Lanka Cricket is a big win.

The Ceylon Tea Moments restaurant that has brought in a new dimension

to the tea experience has the potential to be franchised globally. But

the launch of the Ceylon Tea campaign is a must given that it can have a

positive rub off on Brand Sri Lanka too. The process followed can then

be replicated by the rubber, cinnamon and Ceylon sapphire business.

Drive ICT growth. More focus must be made on the ICT sector given

that it is growing strongly. This includes software development, network

management, web application, the BPO business, designing and quality

checking, data mining, embedded system designing, e-publication, ICT

consultancy, KPO, customer care and call centre support. There is a

strong private-public partnership approach in developing the industry

which is encouraging. I guess we must make this business a US $ 1

billion dollar industry in the future.

Export Bank. Having a dedicated export industry-led bank that can

channel development finance targeting the SME sector might be a good

idea.

This can also drive strategies like the Export Oriented Investment

Support system (EOISS) which will be based on incremental export

earnings.

This mechanism can also ensure that the export trade brings in the

money earned, into the country. Interesting thought, though it may not

be popular.

We have to make the export business the key agenda of Sri Lanka. If

we can make this business around 30% of GDP by 2020, the objective of

Sri Lanka crossing the US $ 4,000 per capita income will happen

naturally given that 73% of exporters in Sri Lanka are SMEs. Hence this

will demand a micro perspective like the points discussed and a more

macro perspective on innovation and trade agreements with nations.

The writer is a marketeer by profession. He serves on many private

and public sector boards as a Director. The views expressed are strictly

personal. |