|

Understanding investment options:

Savings, a prelude to investing

by Dimantha Mathew

This article is a part of First Capital Holdings' Investor Education

series. The Investor Education Series aims at improving investment

education and financial literacy in Sri Lanka and enabling investors to

make informed decisions about investments and the financial market and

is not an endorsement of specific products.

It is a truth universally acknowledged that money does not grow on

trees. It is also, however, accepted that with prudent investment and a

modicum of financial planning, you can develop your finances.

Here are a few basic tenets of investing, for those already in the

know and those hoping to cautiously test the investment waters.

Whatís the difference between saving and investing? How do I start?

The terms saving and investing are often used interchangeably. While

there are similarities, there are also fundamental differences. Saving

is a prelude to investing and refers to the practice of keeping aside

money on a regular basis, to be accessed later. Whatís the difference between saving and investing? How do I start?

The terms saving and investing are often used interchangeably. While

there are similarities, there are also fundamental differences. Saving

is a prelude to investing and refers to the practice of keeping aside

money on a regular basis, to be accessed later.

While interest is accrued on savings, investment is a step further,

where one attempts to grow oneís money and build wealth. Investment is a

more active process than saving and varying investment tools contain

varying elements of risk.

Understanding risk

Unlike savings accounts, it is important to note that investment

earnings are not always guaranteed. Types of risk related to investment

include financial market movements, interest-rate risk, inflation risk,

currency risk and political risk.

As these can affect investments positively and adversely,

diversification of investments is important. Well thought out

diversification can reduce the risk profile of your investment

portfolio. As the age-old maxim goes, donít put all your eggs in one

basket.

Properly managed diversification can significantly lower risk while

maximising returns.

Investment goals

Hence it is important to arm yourself with the correct information

and identify your short-term and long-term financial goals before

embarking on your financial journey.

Before mapping out your investment plan, you need to identify your

funding capacity i.e. understanding your ability to allocate excess

funds for investment either as a lump sum or on a monthly basis.

Second, identify the investment time horizon that you have earmarked

for your investments. Before investing it is important to know when you

will need your funds. Each investorís financial goals and time horizon

may differ.

For example you may need a monthly income after retirement and a lump

sum to finance your childrenís university education or buy a new car.

Evaluate the acceptable risk level and embark on building a

diversified investment portfolio in line with your risk appetite and

expected return. One needs to understand that the higher the risk, the

higher the return and similarly the lower the risk, the lower the

return.

Regardless of which investment instruments you choose and time

horizon you invest for, be sure to meticulously evaluate the instruments

and companies with whom you intend to place your hard earned money and

donít be afraid to ask questions.

Investment instruments

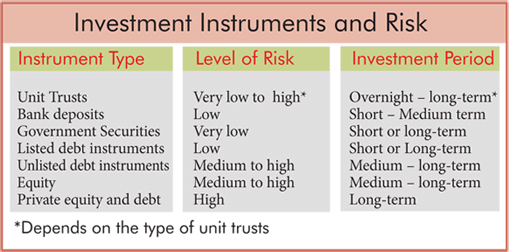

The choice of investment instrument will vary according to your

investment time horizon and individual risk appetite. In addition to

bank deposits, government securities, equity and debt listed on the

stock market, unlisted securities such as securitised papers and

commercial papers, unit trusts and private equity are some of the

options available for consideration.

The table outlines the element of risk and investment horizon for

different investment instruments.

Once you have considered your investment options and decided on your

investment time horizon, carefully examine your debt commitments. It is

strongly recommended that you seek professional advice before you

invest. While you may prefer to make your own investment decisions

through self-education, a qualified financial professional or investment

adviser might be better equipped to advise you on the investment

opportunities available to meet your goals and risk appetite.

Investment landscape

When vetting an investment adviser, be sure to understand the

services they offer, terms of compensation and track record. A perusal

of their affiliations, history and assets under management is also

recommended. Good communication, clear articulation of your financial

goals and mutual trust are essential when relying on the services of an

investment adviser.

A good investment adviser can guide you in matching financial tools

with your monetary goals and help you mitigate risk and regularly

monitor the performance of your investments. Investors can turn to

regulators such as the Central Bank, Securities and Exchange Commission

of Sri Lanka and the Colombo Stock Exchange for information or queries.

Dimantha Mathew, Manager, Research, First Capital Equities (Pvt) Ltd,

has over eight years of experience in the investment banking space in

Sri Lanka with extensive exposure in equity research, fund management,

corporate finance and advisory services. He holds an MBA from the

University of Wales and is an Associate Member of the Chartered

Institute of Management Accountants and Chartered Global Management

Accountants. He also holds a Bachelorsí of Law Degree from the

University of London and is an Attorney-at-Law in Sri Lanka. |