Cents and sensibilities

Sri Lanka’s attempt to overcome economic woes:

by Smruti S. Pattanaik

|

|

The government’s problems

have been compounded as it faces a resurgent Mahinda Rajapaksa,

who is preparing for a comeback. |

Last year, soon after taking power as president of Sri Lanka,

Maithripala Sirisena requested a US$4 billion loan from the IMF to

restructure its debt repayments. The bailout package was rejected by the

IMF. It warned the government instead to rationalise the tax system and

arrest growing inflation.

Yet, despite the bleak economic situation, the government decided to

increase salaries and pensions for public servants, cut taxes for

farmers and increase subsidies. It is therefore unsurprising that the

government faced an imminent balance of payments crisis. The IMF finally

decided to provide a bailout package of US$1.5 billion — considerably

less than the US$4 billion initially requested by Sri Lanka — to boost

Sri Lanka’s falling foreign exchange reserves in March 2016.

What went wrong?

Following the end of the Sri Lankan civil war in 2009, the country

experienced persistent high growth of 8 per cent and a comfortable

foreign exchange reserve. But these all changed in late 2014. So what

went wrong?

Sri Lanka’s positive post-war economic growth was based on two

factors. First, in the postwar period Sri Lanka received massive

investment in infrastructure and other reconstruction activities. The

second factor is the sudden spurt in workers’ remittances, which

contributed to foreign exchange reserves. Peace also boosted investor

confidence.

Unfortunately, the government’s populist posture prevented it from

implementing any structural reforms to expand the tax base or end its

generous subsidy regime, resulting in a massive debt burden. Debt

servicing for projects that are not earning returns have further added

to Sri Lanka’s financial woes.

The country’s outstanding debt rose 12 per cent to 8.27 trillion

rupees (about US$57 billion) in the first nine months of 2015 and

foreign debt increased by around 5 per cent to 3.27 trillion rupees

(US$22 billion).

Fall in reserves

As the trade balance suffered, Sri Lanka’s macroeconomic indicators

faltered. The fluctuating rupee undermined investor confidence

contributing to capital flight, while foreign exchange reserves fell to

US$6.3 billion in January this year. The GDP growth rate reduced to 4.5

per cent in 2014 from a high of 9.1 per cent in 2012. Massive money

printing, which was intended to alleviate the budget deficit, only

exacerbated Sri Lanka’s economic woes and the budget deficit climbed to

7.2 per cent in 2015.

A

decrease in the growth of remittances from 9.5 per cent in 2014 to just

0.8 per cent in November 2015 only made matters worse. This was due to

the crash in oil prices and political turmoil in the Middle East, where

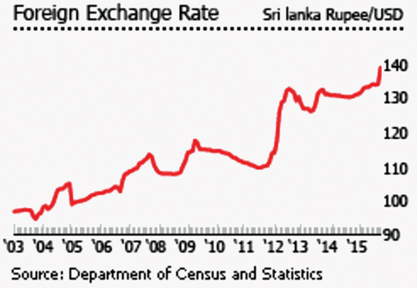

most overseas Sri Lankan workers are employed. The Sri Lankan rupee also

depreciated 8.8 per cent to the US dollar making imports costly. By

October 2015 the trade deficit had increased by 2.5 per cent to US$6.9

billion, mostly due to an increase in non-oil imports. A

decrease in the growth of remittances from 9.5 per cent in 2014 to just

0.8 per cent in November 2015 only made matters worse. This was due to

the crash in oil prices and political turmoil in the Middle East, where

most overseas Sri Lankan workers are employed. The Sri Lankan rupee also

depreciated 8.8 per cent to the US dollar making imports costly. By

October 2015 the trade deficit had increased by 2.5 per cent to US$6.9

billion, mostly due to an increase in non-oil imports.

The government tried several measures to overcome the impending

crisis. For example, Sri Lanka issued 10-year sovereign bonds worth

US$2.15 billion — US$1.7 billion from development bonds and US$1.5

billion from currency swaps with India. Sri Lanka’s central bank also

increased the statutory reserve ratio — that is, the proportion of

customer deposits that commercial banks must hold in reserve — to help

combat inflation. And it issued short-term bonds to overcome the revenue

deficit. This policy came under severe criticism by the opposition. For

its part, the government accused the previous Rajapaksa regime of being

responsible for the country’s 9.5 trillion rupee (US$65 billion) debt.

The government’s problems have been compounded as it faces a

resurgent Mahinda Rajapaksa, who is preparing for a comeback and still

enjoys considerable popularity. To survive, it has to keep both the

people and the party leaders happy. To this end, the government

increased the perks for the 225 members of parliament, creating an

additional financial burden to the tune of 39.4 million rupees per month

(US$270,000) and 472.8 million rupees (US$3.2 million) a year.

Currency swap

In July last year the Central Bank of Sri Lanka entered into an

agreement with the Reserve Bank of India (RBI) for a currency swap

agreement. As a result, Sri Lanka’s Central Bank was allowed to withdraw

up to US$1.1 billion for a maximum period of six months.

|

|

commons.wikimedia.org |

The deal is in addition to the existing RBI currency swap provision

that is available for all the South Asian Association for Regional

Cooperation (SAARC) countries under the 2012 ‘Framework on Currency Swap

Arrangement for SAARC Member Countries’. Currency swaps under the SAARC

agreement have a maximum ceiling of US$2 billion. To help Sri Lanka meet

the imminent balance of payment crisis, the Indian government also

approved an interim currency swap amounting to US$700 million.

India’s participation was partly motivated by a desire to strengthen

ties with Sri Lanka to counter possible Chinese influence. When

advocating the currency swaps to the Sri Lankan government, the RBI

argued that the deal would help to mitigate ‘possible currency

volatility in the spirit of strengthening India’s bilateral relations

and economic ties with Sri Lanka.’

But Sri Lanka needs to go beyond just currency swaps to revitalise

its flagging economy. In the recent past, Sri Lanka has taken steps to

increase taxes to raise revenue. The value-added tax, for example, was

increased by 15 per cent and the government removed tax concessions on

telecommunication services, private education and health services. But

it is yet to expand the tax base and reduce subsidies.

It appears that Sri Lanka is in for some tough negotiations with the

IMF. It has to address the structural issues, bring in financial reform

to expand the tax base, reduce unnecessary expenditure and address the

budget deficit. And it must do all these in a difficult political

climate. It will be difficult for the government to avoid giving in to

its populist impulses, especially when the opposition is waiting in the

wings.

(Dr Smruti S Pattanaik is a research fellow at the Institute for

Defence Studies and Analyses, New Delhi)

- East Asia Forum

|