CB makes substantial gains in reserve management

The attention of the Central Bank (CB) has been drawn to several

one-sided media reports which have alleged that the Bank has lost

heavily by investing in Greek Bonds.

Some reports have also claimed that the Central Bank was summoned to

the Committee on Public Enterprises (COPE) at the request of an

Opposition MP. While the examination of the Central Bank by COPE was a

routine assessment and not prompted by a request by an Opposition MP,

the Central Bank wishes to clarify the actual position vis-a-vis its

reserve management.

The Central Bank manages the foreign reserves in order to safeguard

and enhance the value of its overall reserves as well as generate a

reasonable income from its investments. The Central Bank manages the foreign reserves in order to safeguard

and enhance the value of its overall reserves as well as generate a

reasonable income from its investments.

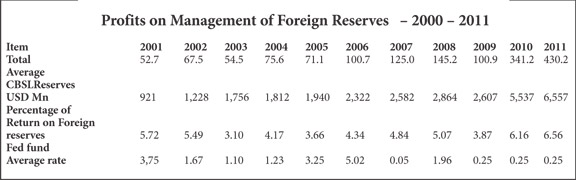

The track record of the investment activities over the past 10 years

is set out in table.

From such table it would be clear that the Returns generated by the

reserve management activities in the past two years had been well above

the benchmark of the US Fed Fund rate and had yielded US$ 430 million in

2011 and US$ 341 million in the year 2010.

The yield in 2011 has been after making provision for losses in Greek

Bonds as well, which clearly shows that the portfolio management has

been successful in enhancing the value of the total protfolio whilst

also providing for any losses that had been incurred in a highly

challenging and volatile global situation.

It may also be pertinent to state that the profits made by the

Central Bank from its investment of foreign reserves for the period 2006

to 2011 were US$ 1,243 million, which amount is substantially higher

than the profits made during the previous ten years.

With particular reference to Greek investments, the Central Bank

wishes to state, that at the time the Greek investments were being done,

Greece had the backing of the European Financial Stability Fund (EFSF)

which had a AAA rating and therefore, Greek Bonds were considered sound

even though the Greece rating itself was lower than the investment

rate.The investments in Greece Bonds were a small fraction of the

Central Bank total Europe portfolio and the loss of the Greek bonds was

comfortably offset by higher returns from other investments.

The Central bank also wishes to state that in a wide portfolio which

includes inter alia, US dollars, Euro, Japanese Yen, Australian Dollars,

Sterling Pounds and Gold as well as different types of instruments such

as fixed income, money market and treasuries, there are fluctuations

that occur in real-time.

Whilst such fluctuations pose significant challenges to all reserve

managers, the Central Bank has been able to deliver higher than average

returns and consistent enhancement of value of its reserves in the past

and it is confident that it can do so in the future as well, in keeping

with its policy guide lines.

In that context, the alarmist, and one side reports which were

obviously designed to discredit the Central Bank and generate feelings

of uncertainty within the economy are highly regrettable.

|